Examples of how the GAAR applies to tax arrangements

Examples of how the GAAR applies to tax arrangements

Examples of how the GAAR applies to tax arrangements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

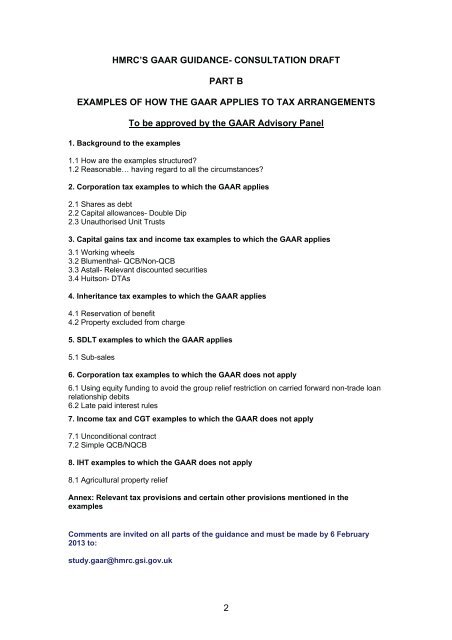

HMRC’S <strong>GAAR</strong> GUIDANCE- CONSULTATION DRAFT<br />

PART B<br />

EXAMPLES OF HOW THE <strong>GAAR</strong> APPLIES TO TAX ARRANGEMENTS<br />

1. Background <strong>to</strong> <strong>the</strong> examples<br />

To be approved by <strong>the</strong> <strong>GAAR</strong> Advisory Panel<br />

1.1 How are <strong>the</strong> examples structured?<br />

1.2 Reasonable… having regard <strong>to</strong> all <strong>the</strong> circumstances?<br />

2. Corporation <strong>tax</strong> examples <strong>to</strong> which <strong>the</strong> <strong>GAAR</strong> <strong>applies</strong><br />

2.1 Shares as debt<br />

2.2 Capital allowances- Double Dip<br />

2.3 Unauthorised Unit Trusts<br />

3. Capital gains <strong>tax</strong> and income <strong>tax</strong> examples <strong>to</strong> which <strong>the</strong> <strong>GAAR</strong> <strong>applies</strong><br />

3.1 Working wheels<br />

3.2 Blumenthal- QCB/Non-QCB<br />

3.3 Astall- Relevant discounted securities<br />

3.4 Huitson- DTAs<br />

4. Inheritance <strong>tax</strong> examples <strong>to</strong> which <strong>the</strong> <strong>GAAR</strong> <strong>applies</strong><br />

4.1 Reservation <strong>of</strong> benefit<br />

4.2 Property excluded from charge<br />

5. SDLT examples <strong>to</strong> which <strong>the</strong> <strong>GAAR</strong> <strong>applies</strong><br />

5.1 Sub-sales<br />

6. Corporation <strong>tax</strong> examples <strong>to</strong> which <strong>the</strong> <strong>GAAR</strong> does not apply<br />

6.1 Using equity funding <strong>to</strong> avoid <strong>the</strong> group relief restriction on carried forward non-trade loan<br />

relationship debits<br />

6.2 Late paid interest rules<br />

7. Income <strong>tax</strong> and CGT examples <strong>to</strong> which <strong>the</strong> <strong>GAAR</strong> does not apply<br />

7.1 Unconditional contract<br />

7.2 Simple QCB/NQCB<br />

8. IHT examples <strong>to</strong> which <strong>the</strong> <strong>GAAR</strong> does not apply<br />

8.1 Agricultural property relief<br />

Annex: Relevant <strong>tax</strong> provisions and certain o<strong>the</strong>r provisions mentioned in <strong>the</strong><br />

examples<br />

Comments are invited on all parts <strong>of</strong> <strong>the</strong> guidance and must be made by 6 February<br />

2013 <strong>to</strong>:<br />

study.gaar@hmrc.gsi.gov.uk<br />

2