Victoria Airport Authority Annual Report 2012

Victoria Airport Authority Annual Report 2012

Victoria Airport Authority Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(e) Beacon Avenue pedestrian overpass:<br />

The VAA has made a commitment to the Town of Sidney to contribute $100,000 to the construction<br />

of a pedestrian overpass at Beacon Avenue and Highway 17 . The agreement is contingent upon the<br />

Town securing sufficient funds to complete the project . Should the project proceed the Town of<br />

Sidney have agreed to release the VAA from its obligation related to the Beacon Avenue extension .<br />

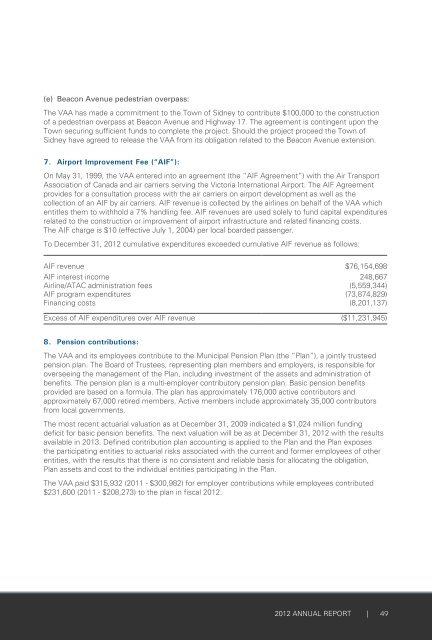

7. <strong>Airport</strong> Improvement Fee (“AIF”):<br />

On May 31, 1999, the VAA entered into an agreement (the “AIF Agreement”) with the Air Transport<br />

Association of Canada and air carriers serving the <strong>Victoria</strong> International <strong>Airport</strong> . The AIF Agreement<br />

provides for a consultation process with the air carriers on airport development as well as the<br />

collection of an AIF by air carriers . AIF revenue is collected by the airlines on behalf of the VAA which<br />

entitles them to withhold a 7% handling fee . AIF revenues are used solely to fund capital expenditures<br />

related to the construction or improvement of airport infrastructure and related financing costs .<br />

The AIF charge is $10 (effective July 1, 2004) per local boarded passenger .<br />

To December 31, <strong>2012</strong> cumulative expenditures exceeded cumulative AIF revenue as follows:<br />

AIF revenue $76,154,698<br />

AIF interest income 248,667<br />

Airline/ATAC administration fees (5,559,344)<br />

AIF program expenditures (73,874,829)<br />

Financing costs (8,201,137)<br />

Excess of AIF expenditures over AIF revenue ($11,231,945)<br />

8. Pension contributions:<br />

The VAA and its employees contribute to the Municipal Pension Plan (the “Plan”), a jointly trusteed<br />

pension plan . The Board of Trustees, representing plan members and employers, is responsible for<br />

overseeing the management of the Plan, including investment of the assets and administration of<br />

benefits . The pension plan is a multi-employer contributory pension plan . Basic pension benefits<br />

provided are based on a formula . The plan has approximately 176,000 active contributors and<br />

approximately 67,000 retired members . Active members include approximately 35,000 contributors<br />

from local governments .<br />

The most recent actuarial valuation as at December 31, 2009 indicated a $1,024 million funding<br />

deficit for basic pension benefits . The next valuation will be as at December 31, <strong>2012</strong> with the results<br />

available in 2013 . Defined contribution plan accounting is applied to the Plan and the Plan exposes<br />

the participating entities to actuarial risks associated with the current and former employees of other<br />

entities, with the results that there is no consistent and reliable basis for allocating the obligation,<br />

Plan assets and cost to the individual entities participating in the Plan .<br />

The VAA paid $315,932 (2011 - $300,982) for employer contributions while employees contributed<br />

$231,600 (2011 - $208,273) to the plan in fiscal <strong>2012</strong> .<br />

<strong>2012</strong> ANNUAL REPORT |<br />

49