Annual Report 2012

Annual Report 2012

Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

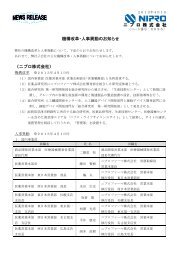

The aggregate annual maturities of long-term debt outstanding at March 31, <strong>2012</strong> are as follows:<br />

Millions of yen Thousands of U.S. dollars (Note 1)<br />

<strong>2012</strong> <strong>2012</strong><br />

<strong>2012</strong>········································································································ ¥ 50,874 $ 618,980<br />

2013········································································································ 32,961 401,034<br />

2014········································································································ 51,004 620,562<br />

2015 and thereafter ················································································· 105,415 1,282,577<br />

Total ································································································· ¥ 240,254 $ 2,923,153<br />

As is customary in Japan, long-term and short-term bank loans<br />

are made under general agreements which provide that additional<br />

securities and guarantees for present and future indebtedness will be<br />

given under certain circumstances at the request of the bank.<br />

11. Accrued Pension and Severance Liabilities<br />

In addition, the agreements provide that the bank has the right to<br />

offset cash deposits against any long-term and short-term bank loan<br />

that becomes due, and in case of default and certain other specified<br />

events, against all other loans payable to the bank.<br />

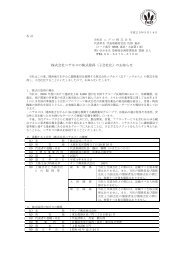

The Company and certain consolidated subsidiaries have defined benefit pension plans and unfunded retirement benefit plans, and defined<br />

contribution pension plan for employees. The following table sets forth the changes in projected benefit obligation, plan assets and funded status<br />

of the Company and its consolidated subsidiaries at March 31, <strong>2012</strong> and 2011.<br />

Millions of yen Thousands of U.S. dollars (Note 1)<br />

<strong>2012</strong> 2011 <strong>2012</strong><br />

1) Projected benefit obligation ······························································ ¥ (8,770) ¥ (8,799) $ (106,704)<br />

2) Fair value of plan assets ··································································· 6,141 6,182 74,717<br />

3) Projected benefit obligation in excess of plan assets 1)+2) ··············· (2,629) (2,617) (31,987)<br />

4) Unrecognized actuarial (gain) loss ···················································· 669 1,039 8,140<br />

5) Unrecognized past service obligation ··············································· (9) (12) (110)<br />

6) Total 3)+4)+5) ·················································································· (1,969) (1,590) (23,957)<br />

7) Prepaid pension cost ······································································ 19 26 231<br />

8) Accrued pension and severance liabilities 6)-7) ································ ¥ (1,988) ¥ (1,616) $ (24,188)<br />

The breakdown of net pension and severance costs for the years ended March 31, <strong>2012</strong> and 2011 were as follows:<br />

Millions of yen Thousands of U.S. dollars (Note 1)<br />

<strong>2012</strong> 2011 <strong>2012</strong><br />

Service cost ·························································································· ¥ 614 ¥ 698 $ 7,470<br />

Interest cost ························································································· 152 178 1,849<br />

Expected return on plan assets ···························································· (102) (117) (1,241)<br />

Amortization of actuarial gain ································································ 264 97 3,212<br />

Amortization of past service obligation ·················································· (3) (3) (37)<br />

Other ···································································································· 264 114 3,212<br />

Net pension and severance costs ························································· ¥ 1,189 ¥ 967 $ 14,465<br />

The assumptions used in the accounting for the above benefit plans were as follows:<br />

<strong>2012</strong> 2011<br />

Discount rate ························································································ Primarily 1.8% Primarily 1.8%<br />

Expected rate of return on plan assets·················································· Primarily 1.5% Primarily 1.5%<br />

Amortization period of past service obligation ······································· Primarily 5 years Primarily 5 years<br />

Amortization period of actuarial differences ··········································· Primarily 5 years Primarily 5 years<br />

12. Commitments and Contingent Liabilities<br />

The Company and its consolidated subsidiaries had the following commitments and contingent liabilities:<br />

Millions of yen Thousands of U.S. dollars (Note 1)<br />

<strong>2012</strong> 2011 <strong>2012</strong><br />

Export drafts discounted ······································································ ¥ 9 ¥ 78 $ 110<br />

Trade notes receivable discounted ························································ 10 30 122<br />

Total ······························································································· ¥ 19 ¥ 108 $ 232<br />

Nipro Corporation <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 42