schedule of investments fiscal year 2011 - State of Wisconsin ...

schedule of investments fiscal year 2011 - State of Wisconsin ...

schedule of investments fiscal year 2011 - State of Wisconsin ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

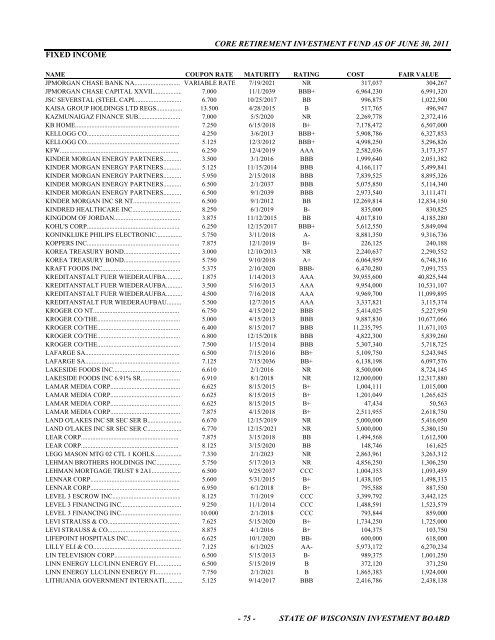

FIXED INCOME<br />

CORE RETIREMENT INVESTMENT FUND AS OF JUNE 30, <strong>2011</strong><br />

NAME COUPON RATE MATURITY RATING COST FAIR VALUE<br />

JPMORGAN CHASE BANK NA............................ VARIABLE RATE 7/19/2021 NR 317,037 304,267<br />

JPMORGAN CHASE CAPITAL XXVII.................. 7.000 11/1/2039 BBB+ 6,964,230 6,991,320<br />

JSC SEVERSTAL (STEEL CAPI............................. 6.700 10/25/2017 BB 996,875 1,022,500<br />

KAISA GROUP HOLDINGS LTD REGS................ 13.500 4/28/2015 B 517,765 496,947<br />

KAZMUNAIGAZ FINANCE SUB.......................... 7.000 5/5/2020 NR 2,269,778 2,372,416<br />

KB HOME................................................................ 7.250 6/15/2018 B+ 7,178,472 6,507,000<br />

KELLOGG CO......................................................... 4.250 3/6/2013 BBB+ 5,908,786 6,327,853<br />

KELLOGG CO......................................................... 5.125 12/3/2012 BBB+ 4,998,250 5,296,826<br />

KFW......................................................................... 6.250 12/4/2019 AAA 2,582,036 3,173,357<br />

KINDER MORGAN ENERGY PARTNERS........... 3.500 3/1/2016 BBB 1,999,640 2,051,382<br />

KINDER MORGAN ENERGY PARTNERS........... 5.125 11/15/2014 BBB 4,166,117 5,499,841<br />

KINDER MORGAN ENERGY PARTNERS........... 5.950 2/15/2018 BBB 7,839,525 8,895,326<br />

KINDER MORGAN ENERGY PARTNERS........... 6.500 2/1/2037 BBB 5,075,850 5,114,340<br />

KINDER MORGAN ENERGY PARTNERS........... 6.500 9/1/2039 BBB 2,973,540 3,111,471<br />

KINDER MORGAN INC SR NT............................. 6.500 9/1/2012 BB 12,269,814 12,834,150<br />

KINDRED HEALTHCARE INC.............................. 8.250 6/1/2019 B- 835,000 830,825<br />

KINGDOM OF JORDAN......................................... 3.875 11/12/2015 BB 4,017,810 4,185,280<br />

KOHL'S CORP......................................................... 6.250 12/15/2017 BBB+ 5,612,550 5,849,094<br />

KONINKLIJKE PHILIPS ELECTRONIC................ 5.750 3/11/2018 A- 8,881,350 9,316,736<br />

KOPPERS INC......................................................... 7.875 12/1/2019 B+ 226,125 240,188<br />

KOREA TREASURY BOND................................... 3.000 12/10/2013 NR 2,240,637 2,290,552<br />

KOREA TREASURY BOND................................... 5.750 9/10/2018 A+ 6,064,959 6,748,316<br />

KRAFT FOODS INC................................................ 5.375 2/10/2020 BBB- 6,470,280 7,091,753<br />

KREDITANSTALT FUER WIEDERAUFBA.......... 1.875 1/14/2013 AAA 39,955,600 40,825,544<br />

KREDITANSTALT FUER WIEDERAUFBA.......... 3.500 5/16/2013 AAA 9,954,000 10,531,107<br />

KREDITANSTALT FUER WIEDERAUFBA.......... 4.500 7/16/2018 AAA 9,969,700 11,099,895<br />

KREDITANSTALT FUR WIEDERAUFBAU......... 5.500 12/7/2015 AAA 3,337,821 3,115,374<br />

KROGER CO NT..................................................... 6.750 4/15/2012 BBB 5,414,025 5,227,950<br />

KROGER CO/THE................................................... 5.000 4/15/2013 BBB 9,887,830 10,677,066<br />

KROGER CO/THE................................................... 6.400 8/15/2017 BBB 11,235,795 11,671,103<br />

KROGER CO/THE................................................... 6.800 12/15/2018 BBB 4,822,300 5,839,260<br />

KROGER CO/THE................................................... 7.500 1/15/2014 BBB 5,307,340 5,718,725<br />

LAFARGE SA.......................................................... 6.500 7/15/2016 BB+ 5,109,750 5,243,945<br />

LAFARGE SA.......................................................... 7.125 7/15/2036 BB+ 6,138,198 6,097,576<br />

LAKESIDE FOODS INC.......................................... 6.610 2/1/2016 NR 8,500,000 8,724,145<br />

LAKESIDE FOODS INC 6.91% SR........................ 6.910 8/1/2018 NR 12,000,000 12,317,880<br />

LAMAR MEDIA CORP........................................... 6.625 8/15/2015 B+ 1,004,111 1,015,000<br />

LAMAR MEDIA CORP........................................... 6.625 8/15/2015 B+ 1,201,049 1,265,625<br />

LAMAR MEDIA CORP........................................... 6.625 8/15/2015 B+ 47,434 50,563<br />

LAMAR MEDIA CORP........................................... 7.875 4/15/2018 B+ 2,511,955 2,618,750<br />

LAND O'LAKES INC SR SEC SER B..................... 6.670 12/15/2019 NR 5,000,000 5,416,050<br />

LAND O'LAKES INC SR SEC SER C..................... 6.770 12/15/2021 NR 5,000,000 5,380,150<br />

LEAR CORP............................................................ 7.875 3/15/2018 BB 1,494,568 1,612,500<br />

LEAR CORP............................................................ 8.125 3/15/2020 BB 148,746 161,625<br />

LEGG MASON MTG 02 CTL 1 KOHLS................. 7.330 2/1/2023 NR 2,863,961 3,263,312<br />

LEHMAN BROTHERS HOLDINGS INC............... 5.750 5/17/2013 NR 4,856,250 1,306,250<br />

LEHMAN MORTGAGE TRUST 8 2A1.................. 6.500 9/25/2037 CCC 1,004,353 1,093,459<br />

LENNAR CORP....................................................... 5.600 5/31/2015 B+ 1,438,105 1,498,313<br />

LENNAR CORP....................................................... 6.950 6/1/2018 B+ 795,588 887,550<br />

LEVEL 3 ESCROW INC.......................................... 8.125 7/1/2019 CCC 3,399,792 3,442,125<br />

LEVEL 3 FINANCING INC..................................... 9.250 11/1/2014 CCC 1,488,591 1,523,579<br />

LEVEL 3 FINANCING INC..................................... 10.000 2/1/2018 CCC 793,844 859,000<br />

LEVI STRAUSS & CO............................................ 7.625 5/15/2020 B+ 1,734,250 1,725,000<br />

LEVI STRAUSS & CO............................................ 8.875 4/1/2016 B+ 104,375 103,750<br />

LIFEPOINT HOSPITALS INC................................. 6.625 10/1/2020 BB- 600,000 618,000<br />

LILLY ELI & CO...................................................... 7.125 6/1/2025 AA- 5,973,172 6,270,234<br />

LIN TELEVISION CORP......................................... 6.500 5/15/2013 B- 989,375 1,001,250<br />

LINN ENERGY LLC/LINN ENERGY FI................ 6.500 5/15/2019 B 372,120 371,250<br />

LINN ENERGY LLC/LINN ENERGY FI................ 7.750 2/1/2021 B 1,865,383 1,924,000<br />

LITHUANIA GOVERNMENT INTERNATI........... 5.125 9/14/2017 BBB 2,416,786 2,438,138<br />

- 75 - STATE OF WISCONSIN INVESTMENT BOARD