EPIC Securities_16pp - EPIC Private Equity

EPIC Securities_16pp - EPIC Private Equity

EPIC Securities_16pp - EPIC Private Equity

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

7<br />

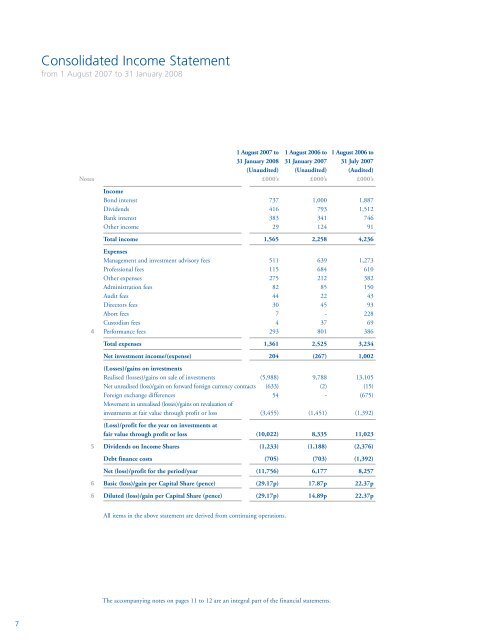

Consolidated Income Statement<br />

from 1 August 2007 to 31 January 2008<br />

1 August 2007 to 1 August 2006 to 1 August 2006 to<br />

31 January 2008 31 January 2007 31 July 2007<br />

(Unaudited) (Unaudited) (Audited)<br />

Notes £000’s £000’s £000’s<br />

Income<br />

Bond interest 737 1,000 1,887<br />

Dividends 416 793 1,512<br />

Bank interest 383 341 746<br />

Other income 29 124 91<br />

Total income<br />

Expenses<br />

1,565 2,258 4,236<br />

Management and investment advisory fees 511 639 1,273<br />

Professional fees 115 684 610<br />

Other expenses 275 212 382<br />

Administration fees 82 85 150<br />

Audit fees 44 22 43<br />

Directors fees 30 45 93<br />

Abort fees 7 - 228<br />

Custodian fees 4 37 69<br />

4 Performance fees 293 801 386<br />

Total expenses 1,361 2,525 3,234<br />

Net investment income/(expense)<br />

(Losses)/gains on investments<br />

204 (267) 1,002<br />

Realised (losses)/gains on sale of investments (5,988) 9,788 13,105<br />

Net unrealised (loss)/gain on forward foreign currency contracts (633) (2) (15)<br />

Foreign exchange differences<br />

Movement in unrealised (losses)/gains on revaluation of<br />

54 - (675)<br />

investments at fair value through profit or loss (3,455) (1,451) (1,392)<br />

(Loss)/profit for the year on investments at<br />

fair value through profit or loss (10,022) 8,335 11,023<br />

5 Dividends on Income Shares (1,233) (1,188) (2,376)<br />

Debt finance costs (705) (703) (1,392)<br />

Net (loss)/profit for the period/year (11,756) 6,177 8,257<br />

6 Basic (loss)/gain per Capital Share (pence) (29.17p) 17.87p 22.37p<br />

6 Diluted (loss)/gain per Capital Share (pence) (29.17p) 14.89p 22.37p<br />

All items in the above statement are derived from continuing operations.<br />

The accompanying notes on pages 11 to 12 are an integral part of the financial statements.