You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

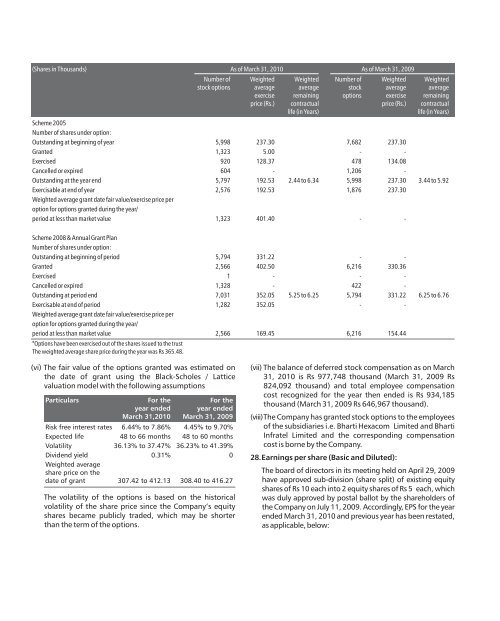

(Shares in Thousands) As of March 31, 2010<br />

(vi) The fair value of the options granted was estimated on<br />

the date of grant using the Black-Scholes / Lattice<br />

valuation model with the following assumptions<br />

Particulars For the<br />

For the<br />

year ended year ended<br />

March 31,2010 March 31, 2009<br />

Risk free interest rates 6.44% to 7.86% 4.45% to 9.70%<br />

Expected life 48 to 66 months 48 to 60 months<br />

Volatility 36.13% to 37.47% 36.23% to 41.39%<br />

Dividend yield 0.31% 0<br />

Weighted average<br />

share price on the<br />

date of grant 307.42 to 412.13 308.40 to 416.27<br />

The volatility of the options is based on the historical<br />

volatility of the share price since the Company’s equity<br />

shares became publicly traded, which may be shorter<br />

than the term of the options.<br />

As of March 31, 2009<br />

Number of Weighted Weighted Number of Weighted Weighted<br />

stock options average average stock average average<br />

exercise remaining options exercise remaining<br />

price (Rs.) contractual price (Rs.) contractual<br />

life (in Years) life (in Years)<br />

Scheme 2005<br />

Number of shares under option:<br />

Outstanding at beginning of year 5,998 237.30 7,682 237.30<br />

Granted 1,323 5.00 - -<br />

Exercised 920 128.37 478 134.08<br />

Cancelled or expired 604 - 1,206 -<br />

Outstanding at the year end 5,797 192.53 2.44 to 6.34 5,998 237.30 3.44 to 5.92<br />

Exercisable at end of year 2,576 192.53 1,876 237.30<br />

Weighted average grant date fair value/exercise price per<br />

option for options granted during the year/<br />

period at less than market value 1,323 401.40 - -<br />

Scheme 2008 & Annual Grant Plan<br />

Number of shares under option:<br />

Outstanding at beginning of period 5,794 331.22 - -<br />

Granted 2,566 402.50 6,216 330.36<br />

Exercised 1 - - -<br />

Cancelled or expired 1,328 - 422 -<br />

Outstanding at period end 7,031 352.05 5.25 to 6.25 5,794 331.22 6.25 to 6.76<br />

Exercisable at end of period 1,282 352.05 - -<br />

Weighted average grant date fair value/exercise price per<br />

option for options granted during the year/<br />

period at less than market value 2,566 169.45 6,216 154.44<br />

*Options have been exercised out of the shares issued to the trust<br />

The weighted average share price during the year was Rs 365.48.<br />

(vii) The balance of deferred stock compensation as on March<br />

31, 2010 is Rs 977,748 thousand (March 31, 2009 Rs<br />

824,092 thousand) and total employee compensation<br />

cost recognized for the year then ended is Rs 934,185<br />

thousand (March 31, 2009 Rs 646,967 thousand).<br />

(viii)The Company has granted stock options to the employees<br />

of the subsidiaries i.e. Bharti Hexacom Limited and Bharti<br />

Infratel Limited and the corresponding compensation<br />

cost is borne by the Company.<br />

28.Earnings per share (Basic and Diluted):<br />

The board of directors in its meeting held on April 29, 2009<br />

have approved sub-division (share split) of existing equity<br />

shares of Rs 10 each into 2 equity shares of Rs 5 each, which<br />

was duly approved by postal ballot by the shareholders of<br />

the Company on July 11, 2009. Accordingly, EPS for the year<br />

ended March 31, 2010 and previous year has been restated,<br />

as applicable, below: