2012 Dryland Field Day Abstracts - Dept. of Crop and Soil Sciences ...

2012 Dryland Field Day Abstracts - Dept. of Crop and Soil Sciences ...

2012 Dryland Field Day Abstracts - Dept. of Crop and Soil Sciences ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Page 42<br />

<strong>2012</strong> <strong>Field</strong> <strong>Day</strong> <strong>Abstracts</strong>: Highlights <strong>of</strong> Research Progress<br />

advanced bi<strong>of</strong>uels. In Washington, camelina incentives equaled $102/ac in Spokane County, $99.50/ac in Whitman County, $91/ac<br />

in Garfield County, $64/ac in Adams County, <strong>and</strong> $56/ac in Franklin County. Despite the sizeable incentives, not a single<br />

Washington farmer signed a BCAP contract to grow camelina.<br />

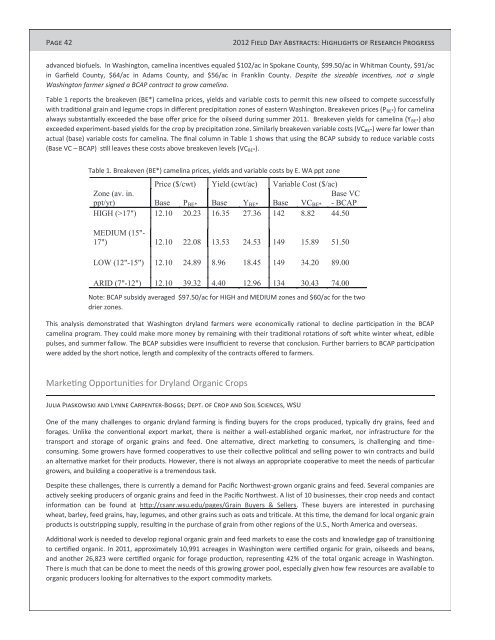

Table 1 reports the breakeven (BE*) camelina prices, yields <strong>and</strong> variable costs to permit this new oilseed to compete successfully<br />

with traditional grain <strong>and</strong> legume crops in different precipitation zones <strong>of</strong> eastern Washington. Breakeven prices (PBE*) for camelina<br />

always substantially exceeded the base <strong>of</strong>fer price for the oilseed during summer 2011. Breakeven yields for camelina (YBE*) also<br />

exceeded experiment-based yields for the crop by precipitation zone. Similarly breakeven variable costs (VCBE*) were far lower than<br />

actual (base) variable costs for camelina. The final column in Table 1 shows that using the BCAP subsidy to reduce variable costs<br />

(Base VC – BCAP) still leaves these costs above breakeven levels (VCBE*).<br />

Table 1. Breakeven (BE*) camelina prices, yields <strong>and</strong> variable costs by E. WA ppt zone<br />

Price ($/cwt) Yield (cwt/ac) Variable Cost ($/ac)<br />

Zone (av. in.<br />

Base VC<br />

ppt/yr) Base PBE* Base YBE* Base VCBE* - BCAP<br />

HIGH (>17") 12.10 20.23 16.35 27.36 142 8.82 44.50<br />

MEDIUM (15"-<br />

17") 12.10 22.08 13.53 24.53 149 15.89 51.50<br />

LOW (12"-15") 12.10 24.89 8.96 18.45 149 34.20 89.00<br />

ARID (7"-12") 12.10 39.32 4.40 12.96 134 30.43 74.00<br />

Note: BCAP subsidy averaged $97.50/ac for HIGH <strong>and</strong> MEDIUM zones <strong>and</strong> $60/ac for the two<br />

drier zones.<br />

This analysis demonstrated that Washington dryl<strong>and</strong> farmers were economically rational to decline participation in the BCAP<br />

camelina program. They could make more money by remaining with their traditional rotations <strong>of</strong> s<strong>of</strong>t white winter wheat, edible<br />

pulses, <strong>and</strong> summer fallow. The BCAP subsidies were insufficient to reverse that conclusion. Further barriers to BCAP participation<br />

were added by the short notice, length <strong>and</strong> complexity <strong>of</strong> the contracts <strong>of</strong>fered to farmers.<br />

Marketing Opportunities for <strong>Dryl<strong>and</strong></strong> Organic <strong>Crop</strong>s<br />

Julia Piaskowski <strong>and</strong> Lynne Carpenter-Boggs; <strong>Dept</strong>. <strong>of</strong> <strong>Crop</strong> <strong>and</strong> <strong>Soil</strong> <strong>Sciences</strong>, WSU<br />

One <strong>of</strong> the many challenges to organic dryl<strong>and</strong> farming is finding buyers for the crops produced, typically dry grains, feed <strong>and</strong><br />

forages. Unlike the conventional export market, there is neither a well-established organic market, nor infrastructure for the<br />

transport <strong>and</strong> storage <strong>of</strong> organic grains <strong>and</strong> feed. One alternative, direct marketing to consumers, is challenging <strong>and</strong> timeconsuming.<br />

Some growers have formed cooperatives to use their collective political <strong>and</strong> selling power to win contracts <strong>and</strong> build<br />

an alternative market for their products. However, there is not always an appropriate cooperative to meet the needs <strong>of</strong> particular<br />

growers, <strong>and</strong> building a cooperative is a tremendous task.<br />

Despite these challenges, there is currently a dem<strong>and</strong> for Pacific Northwest-grown organic grains <strong>and</strong> feed. Several companies are<br />

actively seeking producers <strong>of</strong> organic grains <strong>and</strong> feed in the Pacific Northwest. A list <strong>of</strong> 10 businesses, their crop needs <strong>and</strong> contact<br />

information can be found at http://csanr.wsu.edu/pages/Grain_Buyers_&_Sellers. These buyers are interested in purchasing<br />

wheat, barley, feed grains, hay, legumes, <strong>and</strong> other grains such as oats <strong>and</strong> triticale. At this time, the dem<strong>and</strong> for local organic grain<br />

products is outstripping supply, resulting in the purchase <strong>of</strong> grain from other regions <strong>of</strong> the U.S., North America <strong>and</strong> overseas.<br />

Additional work is needed to develop regional organic grain <strong>and</strong> feed markets to ease the costs <strong>and</strong> knowledge gap <strong>of</strong> transitioning<br />

to certified organic. In 2011, approximately 10,991 acreages in Washington were certified organic for grain, oilseeds <strong>and</strong> beans,<br />

<strong>and</strong> another 26,823 were certified organic for forage production, representing 42% <strong>of</strong> the total organic acreage in Washington.<br />

There is much that can be done to meet the needs <strong>of</strong> this growing grower pool, especially given how few resources are available to<br />

organic producers looking for alternatives to the export commodity markets.