annual report 2007 - ChartNexus

annual report 2007 - ChartNexus

annual report 2007 - ChartNexus

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

N OTES TO THE FINANCIAL STATEMENTS<br />

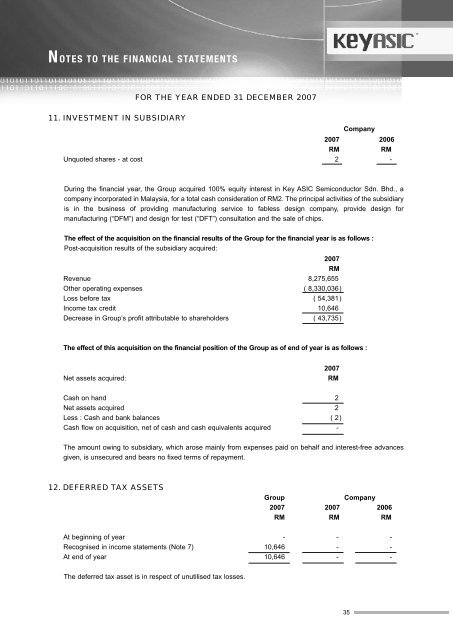

11. INVESTMENT IN SUBSIDIARY<br />

FOR THE YEAR ENDED 31 DECEMBER <strong>2007</strong><br />

Company<br />

<strong>2007</strong> 2006<br />

RM RM<br />

Unquoted shares - at cost 2 -<br />

During the financial year, the Group acquired 100% equity interest in Key ASIC Semiconductor Sdn. Bhd., a<br />

company incorporated in Malaysia, for a total cash consideration of RM2. The principal activities of the subsidiary<br />

is in the business of providing manufacturing service to fabless design company, provide design for<br />

manufacturing (“DFM”) and design for test (“DFT”) consultation and the sale of chips.<br />

The effect of the acquisition on the financial results of the Group for the financial year is as follows :<br />

Post-acquisition results of the subsidiary acquired:<br />

<strong>2007</strong><br />

RM<br />

Revenue 8,275,655<br />

Other operating expenses ( 8,330,036)<br />

Loss before tax ( 54,381)<br />

Income tax credit 10,646<br />

Decrease in Group’s profit attributable to shareholders ( 43,735)<br />

The effect of this acquisition on the financial position of the Group as of end of year is as follows :<br />

<strong>2007</strong><br />

Net assets acquired: RM<br />

Cash on hand 2<br />

Net assets acquired 2<br />

Less : Cash and bank balances ( 2)<br />

Cash flow on acquisition, net of cash and cash equivalents acquired -<br />

The amount owing to subsidiary, which arose mainly from expenses paid on behalf and interest-free advances<br />

given, is unsecured and bears no fixed terms of repayment.<br />

12. DEFERRED TAX ASSETS<br />

Group Company<br />

<strong>2007</strong> <strong>2007</strong> 2006<br />

RM RM RM<br />

At beginning of year - - -<br />

Recognised in income statements (Note 7) 10,646 - -<br />

At end of year 10,646 - -<br />

The deferred tax asset is in respect of unutilised tax losses.<br />

35