Report of the Committee to Study State and Local Taxes - Ohio ...

Report of the Committee to Study State and Local Taxes - Ohio ...

Report of the Committee to Study State and Local Taxes - Ohio ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

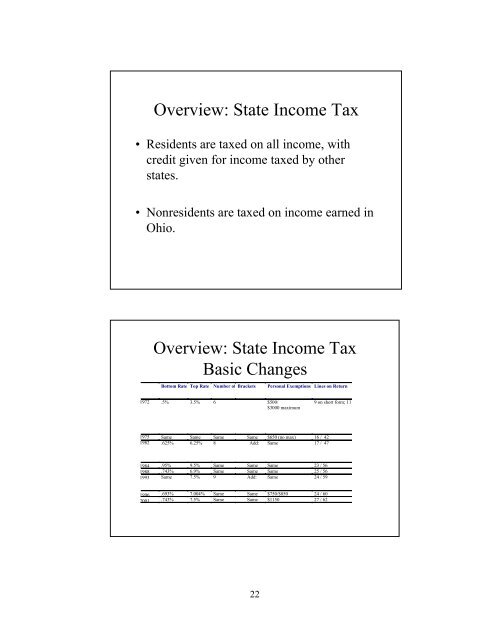

Overview: <strong>State</strong> Income Tax<br />

• Residents are taxed on all income, with<br />

credit given for income taxed by o<strong>the</strong>r<br />

states.<br />

• Nonresidents are taxed on income earned in<br />

<strong>Ohio</strong>.<br />

1972<br />

1975<br />

1982<br />

1984<br />

1988<br />

1993<br />

1996<br />

2001<br />

Overview: <strong>State</strong> Income Tax<br />

Basic Changes<br />

Bot<strong>to</strong>m Rate Top Rate Number <strong>of</strong> Brackets Personal Exemptions Lines on Return<br />

.5% 3.5% 6 $500/<br />

$3000 maximum<br />

Same Same Same Same $650 (no max) 16 / 42<br />

.625% 6.25% 8 Add: Same 17 / 47<br />

.95% 9.5% Same Same Same 23 / 56<br />

.743% 6.9% Same Same Same 25 / 56<br />

Same 7.5% 9 Add: Same 24 / 59<br />

.693% 7.004% Same Same $750/$850 24 / 60<br />

.743% 7.5% Same Same $1150 27 / 62<br />

22<br />

9 on short form; 11