Kanatas, G. and D. Besanko, 1996. The regulation of bank capital: Do capital standards promote bank safety? Journal of Financial Intermediation, 5, pp. 160- 183. Krishnaswami, S., P. Spindt, and V. Subramaniam, 1999. Information asymmetry, monitoring, and the placement structure of <strong>corporate</strong> <strong>debt</strong>. Journal of Financial Economics, 51, pp. 407-34. Lee, S.W. and D. J. Mullineaux, 2004. Monitoring, financial distress, and the sturcure of commercial lending syndicates. Financial Management, 33, pp.107-30. Lummer, S.L. and J.J. McConnel, 1989. Further evidence on the bank lending process and the capital market response to bank loan agreements. Journal of Financial Economics, 25, pp. 99-122. Meggison, W., A. Poulsen and J. Sinkey, 1995. Syndicated loan announcements and the market value of the firm. Journal of Money, Credit and Banking, 27, pp. 457-75. Modigliani, F. and M. H. Miller, 1958. The cost of capital, corporation finance and the theory of investments. American Economic Review, 48 (3), pp. 261-297. Mullineaux, D. and M. Pyles 2004. Constraints on loan sales and the price of liquidity, Working paper, University of Kentucky. Myers, S., 1977. Determinants of <strong>corporate</strong> borrowing. Journal of Financial Economics, 25, pp. 99-122. Preece, D. and D. Mullineaux, 1996. Monitoring, loan renegotiability and firm value: The role lending syndicates. Journal of Banking and Finance, 20, pp. 577-593. Simons, K., 1993. Why do banks syndicate <strong>loans</strong>? New England Economic Review, Federal Reserve Bank Boston, pp. 45-52. Smith, C. and J. B. Warner, 1979. On financial contracting: An analysis of bond covenants, Journal of Financial Economics, 7, pp. 117-161. Smith, C. 1986. Investment Banking and the Acquisition Process. Journal of Financial Economics, 15, pp. 3-29. Smith, C., and R. Watts 1992. The investment opportunity set and <strong>corporate</strong> <strong>financing</strong>, dividend, and compensation policies. Journal of Financial Economics, 32, pp. 263-292. Song, F., and A.V. Thakor, 2008. Financial system architecture and the co-evolution of banks and capital markets. Working paper, Pennsylvania State University. Steffen, S. and M. Wahrenburg 2008. Syndicated <strong>loans</strong>, lending relationships and the business cycle. Goethe University Frankfurt, Working paper. Sufi, A., 2007. Information asymmetry and <strong>financing</strong> arrangements: evidence from <strong>syndicated</strong> <strong>loans</strong>. Journal of Finance, 17(2), pp. 629- 668. Thomas, H. and Z. Wang, 2004. The integration of bank <strong>syndicated</strong> loan and junk bond markets. Journal of Banking and Finance, 28 (2), pp. 299-329. Thomson Financial, Global Capital Markets Report 2007. Available at: http://www.thomson.com/cms/assets/pdfs/financial/league_table/<strong>debt</strong>_and_equit y/4Q2006/4Q04_DE_PR_Global_Capital_Markets.pdf. Tirole, J., 2006. The theory of <strong>corporate</strong> finance, Princeton and Oxford: Princeton University Press. ECB Working Paper Series No 1028 March 2009 31

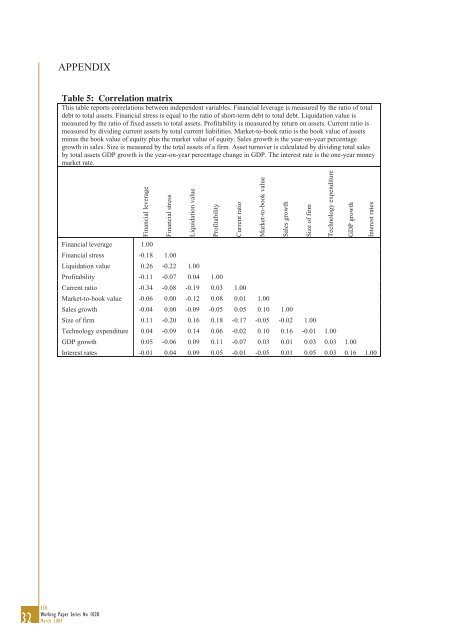

APPENDIX Table 5: Correlation matrix This table reports correlations between independent variables. Financial leverage is measured by the ratio of total <strong>debt</strong> to total assets. Financial stress is equal to the ratio of short-term <strong>debt</strong> to total <strong>debt</strong>. Liquidation value is measured by the ratio of fixed assets to total assets. Profitability is measured by return on assets. Current ratio is measured by dividing current assets by total current liabilities. Market-to-book ratio is the book value of assets minus the book value of equity plus the market value of equity. Sales growth is the year-on-year percentage growth in sales. Size is measured by the total assets of a firm. Asset turnover is calculated by dividing total sales by total assets GDP growth is the year-on-year percentage change in GDP. The interest rate is the one-year money market rate. 32 ECB Working Paper Series No 1028 March 2009 Financial leverage Financial stress Liquidation value Profitability Financial leverage 1.00 Financial stress -0.18 1.00 Liquidation value 0.26 -0.22 1.00 Profitability -0.11 -0.07 0.04 1.00 Current ratio -0.34 -0.08 -0.19 0.03 1.00 Market-to-book value -0.06 0.00 -0.12 0.08 0.01 1.00 Sales growth -0.04 0.00 -0.09 -0.05 0.05 0.10 1.00 Size of firm 0.11 -0.20 0.16 0.18 -0.17 -0.05 -0.02 1.00 Technology expenditure 0.04 -0.09 0.14 0.06 -0.02 0.10 0.16 -0.01 1.00 GDP growth 0.05 -0.06 0.09 0.11 -0.07 0.03 0.01 0.03 0.03 1.00 Interest rates -0.01 0.04 0.09 0.05 -0.01 -0.05 0.01 0.05 0.03 0.16 1.00 Current ratio Market-to-book value Sales growth Size of firm Technology expenditure GDP growth Interest rates