IMPACT INVESTING: A Framework for Policy Design and Analysis

IMPACT INVESTING: A Framework for Policy Design and Analysis

IMPACT INVESTING: A Framework for Policy Design and Analysis

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6<br />

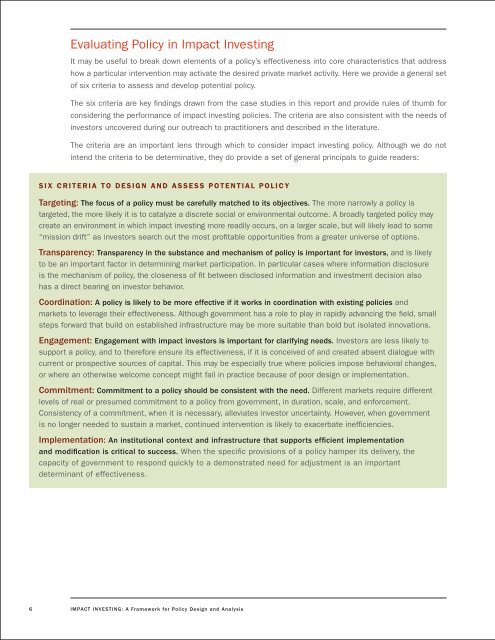

Evaluating <strong>Policy</strong> in Impact Investing<br />

It may be useful to break down elements of a policy’s effectiveness into core characteristics that address<br />

how a particular intervention may activate the desired private market activity. Here we provide a general set<br />

of six criteria to assess <strong>and</strong> develop potential policy.<br />

The six criteria are key findings drawn from the case studies in this report <strong>and</strong> provide rules of thumb <strong>for</strong><br />

considering the per<strong>for</strong>mance of impact investing policies. The criteria are also consistent with the needs of<br />

investors uncovered during our outreach to practitioners <strong>and</strong> described in the literature.<br />

The criteria are an important lens through which to consider impact investing policy. Although we do not<br />

intend the criteria to be determinative, they do provide a set of general principals to guide readers:<br />

SIX CR ITER IA TO DESIGN AND ASSESS P O TENTIAL POLICY<br />

Targeting: The focus of a policy must be carefully matched to its objectives. The more narrowly a policy is<br />

targeted, the more likely it is to catalyze a discrete social or environmental outcome. A broadly targeted policy may<br />

create an environment in which impact investing more readily occurs, on a larger scale, but will likely lead to some<br />

“mission drift” as investors search out the most profitable opportunities from a greater universe of options.<br />

Transparency: Transparency in the substance <strong>and</strong> mechanism of policy is important <strong>for</strong> investors, <strong>and</strong> is likely<br />

to be an important factor in determining market participation. In particular cases where in<strong>for</strong>mation disclosure<br />

is the mechanism of policy, the closeness of fit between disclosed in<strong>for</strong>mation <strong>and</strong> investment decision also<br />

has a direct bearing on investor behavior.<br />

Coordination: A policy is likely to be more effective if it works in coordination with existing policies <strong>and</strong><br />

markets to leverage their effectiveness. Although government has a role to play in rapidly advancing the field, small<br />

steps <strong>for</strong>ward that build on established infrastructure may be more suitable than bold but isolated innovations.<br />

Engagement: Engagement with impact investors is important <strong>for</strong> clarifying needs. Investors are less likely to<br />

support a policy, <strong>and</strong> to there<strong>for</strong>e ensure its effectiveness, if it is conceived of <strong>and</strong> created absent dialogue with<br />

current or prospective sources of capital. This may be especially true where policies impose behavioral changes,<br />

or where an otherwise welcome concept might fail in practice because of poor design or implementation.<br />

Commitment: Commitment to a policy should be consistent with the need. Different markets require different<br />

levels of real or presumed commitment to a policy from government, in duration, scale, <strong>and</strong> en<strong>for</strong>cement.<br />

Consistency of a commitment, when it is necessary, alleviates investor uncertainty. However, when government<br />

is no longer needed to sustain a market, continued intervention is likely to exacerbate inefficiencies.<br />

Implementation: An institutional context <strong>and</strong> infrastructure that supports efficient implementation<br />

<strong>and</strong> modification is critical to success. When the specific provisions of a policy hamper its delivery, the<br />

capacity of government to respond quickly to a demonstrated need <strong>for</strong> adjustment is an important<br />

determinant of effectiveness.<br />

<strong>IMPACT</strong> <strong>INVESTING</strong>: A <strong>Framework</strong> <strong>for</strong> <strong>Policy</strong> <strong>Design</strong> <strong>and</strong> <strong>Analysis</strong>