Download and print the PDF version of this report - Solari

Download and print the PDF version of this report - Solari

Download and print the PDF version of this report - Solari

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

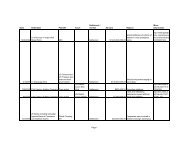

enefits <strong>of</strong> each product <strong>of</strong>fered, discussed or referred to, nature <strong>of</strong><br />

originator’s relationship with consumer <strong>and</strong> cost <strong>of</strong> services provided by<br />

originator <strong>and</strong> statement <strong>the</strong> originator is not acting as agent for consumer,<br />

relevant conflicts <strong>of</strong> interest<br />

• certify to creditor that mortgage originator has fulfilled all requirements under<br />

<strong>this</strong> section<br />

• include in loan documents any unique identifier <strong>of</strong> mortgage originator provided<br />

by Nationwide Mortgage Licensing System <strong>and</strong> Registry<br />

9003 Prohibition <strong>of</strong> steering incentives<br />

9004 Liability<br />

Maximum liability <strong>of</strong> mortgage originator for violation <strong>of</strong> <strong>this</strong> section not to exceed<br />

3X total amount <strong>of</strong> direct or indirect compensation or gain to <strong>the</strong> originator from <strong>the</strong><br />

mortgage loan involved In <strong>the</strong> transaction, plus consumer’s cost <strong>of</strong> <strong>the</strong> action<br />

(including attorney’s fee).<br />

9005 Regulations<br />

TILA amended to provide that <strong>the</strong> federal banking agencies, by jointly-issued<br />

regulations, may prohibit or condition terms, acts or practices relating to residential<br />

mortgage loans that agencies find to be unfair abusive, deceptive, predatory,<br />

inconsistent with reasonable underwriting st<strong>and</strong>ards as necessary or proper to assure<br />

that responsible affordable mortgage credit remains available to consumers.<br />

Regulations to be issued in final form within 12 months <strong>of</strong> enactment <strong>and</strong> to take<br />

effect 18 months after enactment.<br />

9006 Study <strong>of</strong> shared appreciation mortgages<br />

Conducted by HUD Secretary in consultation with Secretary <strong>of</strong> Treasury <strong>and</strong> o<strong>the</strong>r<br />

relevant agencies<br />

Subtitle B – Minimum St<strong>and</strong>ards for Mortgages<br />

9105 Defense <strong>of</strong> foreclosure<br />

<strong>Solari</strong> Report - Notes on<br />

Wall Street Reform <strong>and</strong> Consumer Protection Act<br />

<strong>of</strong> 2009 (HR 4173)<br />

Truth in Lending Act (“TILA”) right <strong>of</strong> rescission available against <strong>the</strong> originator <strong>of</strong> a<br />

loan or its assignee is available against <strong>the</strong> holder <strong>of</strong> a mortgage loan in judicial or<br />

non-judicial foreclosure. If <strong>the</strong> foreclosure is begun after <strong>the</strong> time period for<br />

© 2010 <strong>Solari</strong>, Inc. Page 32