- Page 1 and 2: UNITED STATES SECURITIES AND EXCHAN

- Page 3 and 4: Exelon Generation Company, LLC and

- Page 5 and 6: Page No. ITEM 7A. QUANTITATIVE AND

- Page 7 and 8: GLOSSARY OF TERMS AND ABBREVIATIONS

- Page 9 and 10: Other Terms and Abbreviations LTIP

- Page 11 and 12: FILING FORMAT This combined Annual

- Page 13 and 14: including the City of Baltimore, as

- Page 15 and 16: following the merger completion. In

- Page 17 and 18: egulations by the NRC may require a

- Page 19 and 20: of new merchant nuclear power plant

- Page 21: y third parties. In 2012 and 2011,

- Page 25 and 26: ComEd ComEd is engaged principally

- Page 27 and 28: due to weather events or conditions

- Page 29 and 30: Smart Meter, Smart Grid and Energy

- Page 31 and 32: BGE’s highest peak load occurred

- Page 33 and 34: • a liquefied natural gas facilit

- Page 35 and 36: Environmental Regulation General Ex

- Page 37 and 38: attributable to low level radioacti

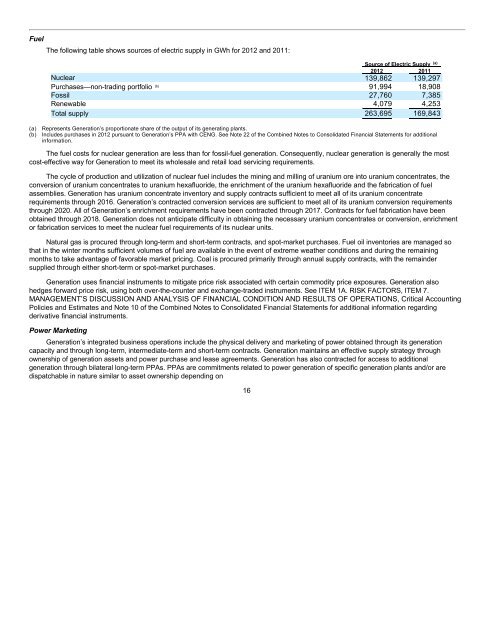

- Page 39 and 40: hydro and pumped storage, and suppl

- Page 41 and 42: Name Age Position Period Pramaggior

- Page 43 and 44: Name Age Position Period O’Neill,

- Page 45 and 46: ITEM 1A. RISK FACTORS Each of the R

- Page 47 and 48: under their obligations for operati

- Page 49 and 50: ComEd’s financial swap contract w

- Page 51 and 52: 1999 sale of fossil generating asse

- Page 53 and 54: lived assets for potential impairme

- Page 55 and 56: were weather and the economy. With

- Page 57 and 58: Generation’s affiliation with Com

- Page 59 and 60: Federal and state legislation manda

- Page 61 and 62: Generation may be negatively affect

- Page 63 and 64: the Registrants face a risk that th

- Page 65 and 66: of funds necessary for decommission

- Page 67 and 68: with most companies in today’s en

- Page 69 and 70: ITEM 2. PROPERTIES Generation The f

- Page 71 and 72: Primary Net Station Region Location

- Page 73 and 74:

Transmission and Distribution PECO

- Page 75 and 76:

(Dollars in millions except per sha

- Page 77 and 78:

PECO As of January 31, 2013, there

- Page 79 and 80:

ITEM 6. SELECTED FINANCIAL DATA Exe

- Page 81 and 82:

December 31, (In millions) 2012 201

- Page 83 and 84:

Item 7. MANAGEMENT’S DISCUSSION A

- Page 85 and 86:

purchased power and fuel expense in

- Page 87 and 88:

units and compensation for operatin

- Page 89 and 90:

(2) the rate of expansion of subsid

- Page 91 and 92:

Hedging Strategy Exelon’s policy

- Page 93 and 94:

number of factors, including RTO re

- Page 95 and 96:

On December 16, 2011, the U.S. EPA

- Page 97 and 98:

In April 2011, the NRC named six se

- Page 99 and 100:

FERC Ameren Order. In July 2012, FE

- Page 101 and 102:

decommissioning. Probabilities assi

- Page 103 and 104:

guidance, which became effective Ja

- Page 105 and 106:

Impairment may occur when the carry

- Page 107 and 108:

changes or experience different fro

- Page 109 and 110:

Sensitivity to Changes in Key Assum

- Page 111 and 112:

The Registrants account for derivat

- Page 113 and 114:

Interest Rate Derivative Instrument

- Page 115 and 116:

upon actual costs incurred and inve

- Page 117 and 118:

Net Income Year Ended December 31,

- Page 119 and 120:

Generation’s supply sources by re

- Page 121 and 122:

decreased realized margins in 2011

- Page 123 and 124:

Year Ended December 31, 2011 Compar

- Page 125 and 126:

ecorded in 2012, a $36 million barg

- Page 127 and 128:

Electric revenues and purchased pow

- Page 129 and 130:

Volume—delivery Revenues net of p

- Page 131 and 132:

Operating and Maintenance Expense Y

- Page 133 and 134:

Other, Net The changes in other, ne

- Page 135 and 136:

Operating Revenues Net of Purchased

- Page 137 and 138:

The changes in PECO’s operating r

- Page 139 and 140:

The changes in operating and mainte

- Page 141 and 142:

year ended December 31, 2011 includ

- Page 143 and 144:

Results of Operations—BGE 2012 20

- Page 145 and 146:

Volume. Heating and cooling degree

- Page 147 and 148:

Other Other revenues increased duri

- Page 149 and 150:

BGE Electric Operating Statistics a

- Page 151 and 152:

The Registrants primarily use their

- Page 153 and 154:

Cash flows provided by operations f

- Page 155 and 156:

(e) The projected capital expenditu

- Page 157 and 158:

Company Issuances of long-term debt

- Page 159 and 160:

From time to time and as market con

- Page 161 and 162:

Other Credit Matters Capital Struct

- Page 163 and 164:

Contractual Obligations The followi

- Page 165 and 166:

ComEd Total 2013 Payment due within

- Page 167 and 168:

• variable interest entities, see

- Page 169 and 170:

ComEd The financial swap contract b

- Page 171 and 172:

Generation ComEd PECO Intercompany

- Page 173 and 174:

Credit Risk, Collateral, and Contin

- Page 175 and 176:

PECO’s supplier master agreements

- Page 177 and 178:

PECO As of December 31, 2012, PECO

- Page 179 and 180:

ITEM 7. MANAGEMENT’S DISCUSSION A

- Page 181 and 182:

ITEM 7. MANAGEMENT’S DISCUSSION A

- Page 183 and 184:

ITEM 7. MANAGEMENT’S DISCUSSION A

- Page 185 and 186:

ITEM 7. MANAGEMENT’S DISCUSSION A

- Page 187 and 188:

ITEM 8. FINANCIAL STATEMENTS AND SU

- Page 189 and 190:

Management’s Report on Internal C

- Page 191 and 192:

Management’s Report on Internal C

- Page 193 and 194:

Report of Independent Registered Pu

- Page 195 and 196:

Report of Independent Registered Pu

- Page 197 and 198:

Exelon Corporation and Subsidiary C

- Page 199 and 200:

Exelon Corporation and Subsidiary C

- Page 201 and 202:

Exelon Corporation and Subsidiary C

- Page 203 and 204:

Exelon Generation Company, LLC and

- Page 205 and 206:

Exelon Generation Company, LLC and

- Page 207 and 208:

Commonwealth Edison Company and Sub

- Page 209 and 210:

Commonwealth Edison Company and Sub

- Page 211 and 212:

(In millions) Commonwealth Edison C

- Page 213 and 214:

PECO Energy Company and Subsidiary

- Page 215 and 216:

PECO Energy Company and Subsidiary

- Page 217 and 218:

BALTIMORE GAS AND ELECTRIC COMPANY

- Page 219 and 220:

BALTIMORE GAS AND ELECTRIC COMPANY

- Page 221 and 222:

(In millions) BALTIMORE GAS AND ELE

- Page 223 and 224:

Combined Notes to Consolidated Fina

- Page 225 and 226:

Combined Notes to Consolidated Fina

- Page 227 and 228:

Combined Notes to Consolidated Fina

- Page 229 and 230:

Combined Notes to Consolidated Fina

- Page 231 and 232:

Combined Notes to Consolidated Fina

- Page 233 and 234:

Combined Notes to Consolidated Fina

- Page 235 and 236:

Combined Notes to Consolidated Fina

- Page 237 and 238:

Combined Notes to Consolidated Fina

- Page 239 and 240:

Combined Notes to Consolidated Fina

- Page 241 and 242:

Combined Notes to Consolidated Fina

- Page 243 and 244:

Formula Rate Tariff Combined Notes

- Page 245 and 246:

Combined Notes to Consolidated Fina

- Page 247 and 248:

Combined Notes to Consolidated Fina

- Page 249 and 250:

Combined Notes to Consolidated Fina

- Page 251 and 252:

Combined Notes to Consolidated Fina

- Page 253 and 254:

Combined Notes to Consolidated Fina

- Page 255 and 256:

Combined Notes to Consolidated Fina

- Page 257 and 258:

Combined Notes to Consolidated Fina

- Page 259 and 260:

Combined Notes to Consolidated Fina

- Page 261 and 262:

Combined Notes to Consolidated Fina

- Page 263 and 264:

Combined Notes to Consolidated Fina

- Page 265 and 266:

Combined Notes to Consolidated Fina

- Page 267 and 268:

4. Merger and Acquisitions Combined

- Page 269 and 270:

Combined Notes to Consolidated Fina

- Page 271 and 272:

Combined Notes to Consolidated Fina

- Page 273 and 274:

Combined Notes to Consolidated Fina

- Page 275 and 276:

Combined Notes to Consolidated Fina

- Page 277 and 278:

Combined Notes to Consolidated Fina

- Page 279 and 280:

Combined Notes to Consolidated Fina

- Page 281 and 282:

Combined Notes to Consolidated Fina

- Page 283 and 284:

Combined Notes to Consolidated Fina

- Page 285 and 286:

Combined Notes to Consolidated Fina

- Page 287 and 288:

Combined Notes to Consolidated Fina

- Page 289 and 290:

Combined Notes to Consolidated Fina

- Page 291 and 292:

Combined Notes to Consolidated Fina

- Page 293 and 294:

Combined Notes to Consolidated Fina

- Page 295 and 296:

For the Year Ended December 31, 201

- Page 297 and 298:

Combined Notes to Consolidated Fina

- Page 299 and 300:

Combined Notes to Consolidated Fina

- Page 301 and 302:

For the Year Ended December 31, 201

- Page 303 and 304:

Combined Notes to Consolidated Fina

- Page 305 and 306:

BGE Combined Notes to Consolidated

- Page 307 and 308:

Combined Notes to Consolidated Fina

- Page 309 and 310:

Combined Notes to Consolidated Fina

- Page 311 and 312:

Combined Notes to Consolidated Fina

- Page 313 and 314:

Combined Notes to Consolidated Fina

- Page 315 and 316:

Combined Notes to Consolidated Fina

- Page 317 and 318:

Combined Notes to Consolidated Fina

- Page 319 and 320:

Combined Notes to Consolidated Fina

- Page 321 and 322:

Year Ended December 31, 2011 (As Re

- Page 323 and 324:

Combined Notes to Consolidated Fina

- Page 325 and 326:

Combined Notes to Consolidated Fina

- Page 327 and 328:

Combined Notes to Consolidated Fina

- Page 329 and 330:

Combined Notes to Consolidated Fina

- Page 331 and 332:

Combined Notes to Consolidated Fina

- Page 333 and 334:

Generation Combined Notes to Consol

- Page 335 and 336:

Combined Notes to Consolidated Fina

- Page 337 and 338:

Combined Notes to Consolidated Fina

- Page 339 and 340:

Combined Notes to Consolidated Fina

- Page 341 and 342:

Combined Notes to Consolidated Fina

- Page 343 and 344:

Other Tax Matters Combined Notes to

- Page 345 and 346:

Combined Notes to Consolidated Fina

- Page 347 and 348:

Combined Notes to Consolidated Fina

- Page 349 and 350:

Combined Notes to Consolidated Fina

- Page 351 and 352:

Combined Notes to Consolidated Fina

- Page 353 and 354:

Combined Notes to Consolidated Fina

- Page 355 and 356:

Combined Notes to Consolidated Fina

- Page 357 and 358:

Combined Notes to Consolidated Fina

- Page 359 and 360:

Components of AOCI and Regulatory A

- Page 361 and 362:

Combined Notes to Consolidated Fina

- Page 363 and 364:

Contributions Combined Notes to Con

- Page 365 and 366:

Combined Notes to Consolidated Fina

- Page 367 and 368:

Combined Notes to Consolidated Fina

- Page 369 and 370:

Combined Notes to Consolidated Fina

- Page 371 and 372:

Combined Notes to Consolidated Fina

- Page 373 and 374:

Eddystone Station and Cromby Statio

- Page 375 and 376:

Combined Notes to Consolidated Fina

- Page 377 and 378:

Combined Notes to Consolidated Fina

- Page 379 and 380:

Combined Notes to Consolidated Fina

- Page 381 and 382:

Combined Notes to Consolidated Fina

- Page 383 and 384:

Combined Notes to Consolidated Fina

- Page 385 and 386:

Combined Notes to Consolidated Fina

- Page 387 and 388:

Combined Notes to Consolidated Fina

- Page 389 and 390:

Other Purchase Obligations Combined

- Page 391 and 392:

Combined Notes to Consolidated Fina

- Page 393 and 394:

Combined Notes to Consolidated Fina

- Page 395 and 396:

Combined Notes to Consolidated Fina

- Page 397 and 398:

Combined Notes to Consolidated Fina

- Page 399 and 400:

Combined Notes to Consolidated Fina

- Page 401 and 402:

Solid and Hazardous Waste Combined

- Page 403 and 404:

Combined Notes to Consolidated Fina

- Page 405 and 406:

Combined Notes to Consolidated Fina

- Page 407 and 408:

Combined Notes to Consolidated Fina

- Page 409 and 410:

Combined Notes to Consolidated Fina

- Page 411 and 412:

Combined Notes to Consolidated Fina

- Page 413 and 414:

Combined Notes to Consolidated Fina

- Page 415 and 416:

Combined Notes to Consolidated Fina

- Page 417 and 418:

Accumulated Other Comprehensive Inc

- Page 419 and 420:

Combined Notes to Consolidated Fina

- Page 421 and 422:

Combined Notes to Consolidated Fina

- Page 423 and 424:

Combined Notes to Consolidated Fina

- Page 425 and 426:

Combined Notes to Consolidated Fina

- Page 427 and 428:

Combined Notes to Consolidated Fina

- Page 429 and 430:

Combined Notes to Consolidated Fina

- Page 431 and 432:

Combined Notes to Consolidated Fina

- Page 433 and 434:

ITEM 9. CHANGES IN AND DISAGREEMENT

- Page 435 and 436:

PART III Exelon Generation Company,

- Page 437 and 438:

ITEM 12. SECURITY OWNERSHIP OF CERT

- Page 439 and 440:

ITEM 14. PRINCIPAL ACCOUNTING FEES

- Page 441 and 442:

Exelon Corporation and Subsidiary C

- Page 443 and 444:

Exelon Corporation and Subsidiary C

- Page 445 and 446:

1. Basis of Presentation Exelon Cor

- Page 447 and 448:

5. Related Party Transactions Exelo

- Page 449 and 450:

Exelon Corporation and Subsidiary C

- Page 451 and 452:

Exelon Generation Company, LLC and

- Page 453 and 454:

Commonwealth Edison Company and Sub

- Page 455 and 456:

PECO Energy Company and Subsidiary

- Page 457 and 458:

Baltimore Gas and Electric Company

- Page 459 and 460:

Exhibit No. Description 2-13 Contri

- Page 461 and 462:

Exhibit No. Description 4-2 Exelon

- Page 463 and 464:

Exhibit No. Description 4-5 4-6 Ind

- Page 465 and 466:

Exhibit No. Description 4-31 Series

- Page 467 and 468:

Exhibit No. Description 10-31 Amend

- Page 469 and 470:

Exhibit No. Description 10-57 Admin

- Page 471 and 472:

Exhibit No. Description 24-29 Chari

- Page 473 and 474:

SIGNATURES Pursuant to the requirem

- Page 475 and 476:

SIGNATURES Pursuant to the requirem

- Page 477 and 478:

SIGNATURES Pursuant to the requirem

- Page 479 and 480:

Exelon Generation Company, LLC Rati

- Page 481 and 482:

PECO Energy Company Ratio of Earnin

- Page 483 and 484:

Exelon Corporation Subsidiary Listi

- Page 485 and 486:

CLT Energy Services Group, L.L.C. P

- Page 487 and 488:

Exelon AOG Holding #1, Inc. Delawar

- Page 489 and 490:

Michigan Wind 1, LLC Delaware Michi

- Page 491 and 492:

Exelon Generation Company, LLC Subs

- Page 493 and 494:

Cogenex Corporation MA CoLa Resourc

- Page 495 and 496:

Exelon New Boston, LLC DE Exelon Ne

- Page 497 and 498:

Residential Solar Holding, LLC DE R

- Page 499 and 500:

PECO Energy Company Subsidiary List

- Page 501 and 502:

CONSENT OF INDEPENDENT REGISTERED P

- Page 503 and 504:

CONSENT OF INDEPENDENT REGISTERED P

- Page 505 and 506:

CONSENT OF INDEPENDENT REGISTERED P

- Page 507 and 508:

POWER OF ATTORNEY Exhibit 24.2 KNOW

- Page 509 and 510:

POWER OF ATTORNEY Exhibit 24.4 KNOW

- Page 511 and 512:

POWER OF ATTORNEY Exhibit 24.6 KNOW

- Page 513 and 514:

POWER OF ATTORNEY Exhibit 24.8 KNOW

- Page 515 and 516:

POWER OF ATTORNEY Exhibit 24.10 KNO

- Page 517 and 518:

POWER OF ATTORNEY Exhibit 24.12 KNO

- Page 519 and 520:

POWER OF ATTORNEY Exhibit 24.14 KNO

- Page 521 and 522:

POWER OF ATTORNEY Exhibit 24.16 KNO

- Page 523 and 524:

POWER OF ATTORNEY Exhibit 24.18 KNO

- Page 525 and 526:

POWER OF ATTORNEY Exhibit 24.20 KNO

- Page 527 and 528:

POWER OF ATTORNEY Exhibit 24.22 KNO

- Page 529 and 530:

POWER OF ATTORNEY Exhibit 24.24 KNO

- Page 531 and 532:

POWER OF ATTORNEY Exhibit 24.26 KNO

- Page 533 and 534:

POWER OF ATTORNEY Exhibit 24.28 KNO

- Page 535 and 536:

POWER OF ATTORNEY Exhibit 24.30 KNO

- Page 537 and 538:

POWER OF ATTORNEY Exhibit 24.32 KNO

- Page 539 and 540:

POWER OF ATTORNEY Exhibit 24.34 KNO

- Page 541 and 542:

POWER OF ATTORNEY Exhibit 24.36 KNO

- Page 543 and 544:

I, Christopher M. Crane, certify th

- Page 545 and 546:

I, Christopher M. Crane, certify th

- Page 547 and 548:

I, Anne R. Pramaggiore, certify tha

- Page 549 and 550:

I, Craig L. Adams, certify that: CE

- Page 551 and 552:

I, Kenneth W. DeFontes Jr., certify

- Page 553 and 554:

Certificate Pursuant to Section 135

- Page 555 and 556:

Certificate Pursuant to Section 135

- Page 557 and 558:

Certificate Pursuant to Section 135

- Page 559 and 560:

Certificate Pursuant to Section 135

- Page 561 and 562:

Certificate Pursuant to Section 135