Bank Secrecy Act/Anti-Money Laundering Examination Manual - ffiec

Bank Secrecy Act/Anti-Money Laundering Examination Manual - ffiec

Bank Secrecy Act/Anti-Money Laundering Examination Manual - ffiec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

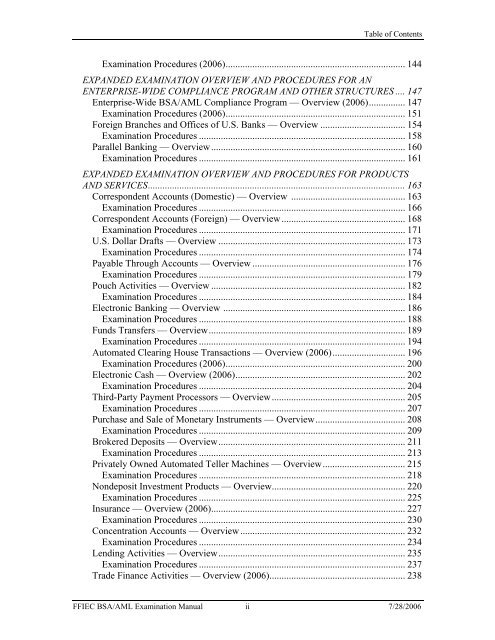

Table of Contents<br />

<strong>Examination</strong> Procedures (2006).......................................................................... 144<br />

EXPANDED EXAMINATION OVERVIEW AND PROCEDURES FOR AN<br />

ENTERPRISE-WIDE COMPLIANCE PROGRAM AND OTHER STRUCTURES .... 147<br />

Enterprise-Wide BSA/AML Compliance Program — Overview (2006)............... 147<br />

<strong>Examination</strong> Procedures (2006).......................................................................... 151<br />

Foreign Branches and Offices of U.S. <strong>Bank</strong>s — Overview ................................... 154<br />

<strong>Examination</strong> Procedures ..................................................................................... 158<br />

Parallel <strong>Bank</strong>ing — Overview................................................................................ 160<br />

<strong>Examination</strong> Procedures ..................................................................................... 161<br />

EXPANDED EXAMINATION OVERVIEW AND PROCEDURES FOR PRODUCTS<br />

AND SERVICES.......................................................................................................... 163<br />

Correspondent Accounts (Domestic) — Overview ............................................... 163<br />

<strong>Examination</strong> Procedures ..................................................................................... 166<br />

Correspondent Accounts (Foreign) — Overview................................................... 168<br />

<strong>Examination</strong> Procedures ..................................................................................... 171<br />

U.S. Dollar Drafts — Overview ............................................................................. 173<br />

<strong>Examination</strong> Procedures ..................................................................................... 174<br />

Payable Through Accounts — Overview ............................................................... 176<br />

<strong>Examination</strong> Procedures ..................................................................................... 179<br />

Pouch <strong>Act</strong>ivities — Overview ................................................................................ 182<br />

<strong>Examination</strong> Procedures ..................................................................................... 184<br />

Electronic <strong>Bank</strong>ing — Overview ........................................................................... 186<br />

<strong>Examination</strong> Procedures ..................................................................................... 188<br />

Funds Transfers — Overview................................................................................. 189<br />

<strong>Examination</strong> Procedures ..................................................................................... 194<br />

Automated Clearing House Transactions — Overview (2006).............................. 196<br />

<strong>Examination</strong> Procedures (2006).......................................................................... 200<br />

Electronic Cash — Overview (2006)...................................................................... 202<br />

<strong>Examination</strong> Procedures ..................................................................................... 204<br />

Third-Party Payment Processors — Overview....................................................... 205<br />

<strong>Examination</strong> Procedures ..................................................................................... 207<br />

Purchase and Sale of Monetary Instruments — Overview..................................... 208<br />

<strong>Examination</strong> Procedures ..................................................................................... 209<br />

Brokered Deposits — Overview............................................................................. 211<br />

<strong>Examination</strong> Procedures ..................................................................................... 213<br />

Privately Owned Automated Teller Machines — Overview.................................. 215<br />

<strong>Examination</strong> Procedures ..................................................................................... 218<br />

Nondeposit Investment Products — Overview....................................................... 220<br />

<strong>Examination</strong> Procedures ..................................................................................... 225<br />

Insurance — Overview (2006)................................................................................ 227<br />

<strong>Examination</strong> Procedures ..................................................................................... 230<br />

Concentration Accounts — Overview.................................................................... 232<br />

<strong>Examination</strong> Procedures ..................................................................................... 234<br />

Lending <strong>Act</strong>ivities — Overview............................................................................. 235<br />

<strong>Examination</strong> Procedures ..................................................................................... 237<br />

Trade Finance <strong>Act</strong>ivities — Overview (2006)........................................................ 238<br />

FFIEC BSA/AML <strong>Examination</strong> <strong>Manual</strong> ii 7/28/2006