Chapter 1 Contribution Limits, Voluntary Expenditure Ceilings, and ...

Chapter 1 Contribution Limits, Voluntary Expenditure Ceilings, and ...

Chapter 1 Contribution Limits, Voluntary Expenditure Ceilings, and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

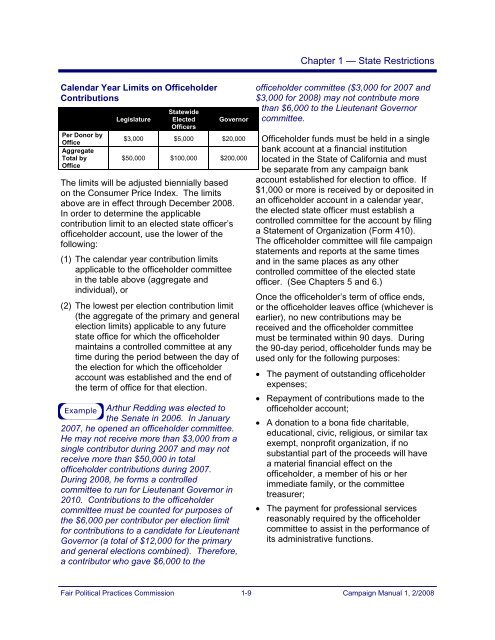

Calendar Year <strong>Limits</strong> on Officeholder<br />

<strong>Contribution</strong>s<br />

Per Donor by<br />

Office<br />

Aggregate<br />

Total by<br />

Office<br />

Legislature<br />

Statewide<br />

Elected<br />

Officers<br />

Governor<br />

$3,000 $5,000 $20,000<br />

$50,000 $100,000 $200,000<br />

The limits will be adjusted biennially based<br />

on the Consumer Price Index. The limits<br />

above are in effect through December 2008.<br />

In order to determine the applicable<br />

contribution limit to an elected state officer’s<br />

officeholder account, use the lower of the<br />

following:<br />

(1) The calendar year contribution limits<br />

applicable to the officeholder committee<br />

in the table above (aggregate <strong>and</strong><br />

individual), or<br />

(2) The lowest per election contribution limit<br />

(the aggregate of the primary <strong>and</strong> general<br />

election limits) applicable to any future<br />

state office for which the officeholder<br />

maintains a controlled committee at any<br />

time during the period between the day of<br />

the election for which the officeholder<br />

account was established <strong>and</strong> the end of<br />

the term of office for that election.<br />

Example<br />

Arthur Redding was elected to<br />

the Senate in 2006. In January<br />

2007, he opened an officeholder committee.<br />

He may not receive more than $3,000 from a<br />

single contributor during 2007 <strong>and</strong> may not<br />

receive more than $50,000 in total<br />

officeholder contributions during 2007.<br />

During 2008, he forms a controlled<br />

committee to run for Lieutenant Governor in<br />

2010. <strong>Contribution</strong>s to the officeholder<br />

committee must be counted for purposes of<br />

the $6,000 per contributor per election limit<br />

for contributions to a c<strong>and</strong>idate for Lieutenant<br />

Governor (a total of $12,000 for the primary<br />

<strong>and</strong> general elections combined). Therefore,<br />

a contributor who gave $6,000 to the<br />

<strong>Chapter</strong> 1 — State Restrictions<br />

officeholder committee ($3,000 for 2007 <strong>and</strong><br />

$3,000 for 2008) may not contribute more<br />

than $6,000 to the Lieutenant Governor<br />

committee.<br />

Officeholder funds must be held in a single<br />

bank account at a financial institution<br />

located in the State of California <strong>and</strong> must<br />

be separate from any campaign bank<br />

account established for election to office. If<br />

$1,000 or more is received by or deposited in<br />

an officeholder account in a calendar year,<br />

the elected state officer must establish a<br />

controlled committee for the account by filing<br />

a Statement of Organization (Form 410).<br />

The officeholder committee will file campaign<br />

statements <strong>and</strong> reports at the same times<br />

<strong>and</strong> in the same places as any other<br />

controlled committee of the elected state<br />

officer. (See <strong>Chapter</strong>s 5 <strong>and</strong> 6.)<br />

Once the officeholder’s term of office ends,<br />

or the officeholder leaves office (whichever is<br />

earlier), no new contributions may be<br />

received <strong>and</strong> the officeholder committee<br />

must be terminated within 90 days. During<br />

the 90-day period, officeholder funds may be<br />

used only for the following purposes:<br />

• The payment of outst<strong>and</strong>ing officeholder<br />

expenses;<br />

• Repayment of contributions made to the<br />

officeholder account;<br />

• A donation to a bona fide charitable,<br />

educational, civic, religious, or similar tax<br />

exempt, nonprofit organization, if no<br />

substantial part of the proceeds will have<br />

a material financial effect on the<br />

officeholder, a member of his or her<br />

immediate family, or the committee<br />

treasurer;<br />

• The payment for professional services<br />

reasonably required by the officeholder<br />

committee to assist in the performance of<br />

its administrative functions.<br />

Fair Political Practices Commission 1-9 Campaign Manual 1, 2/2008