Download - Foresight Group

Download - Foresight Group

Download - Foresight Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Interim Report<br />

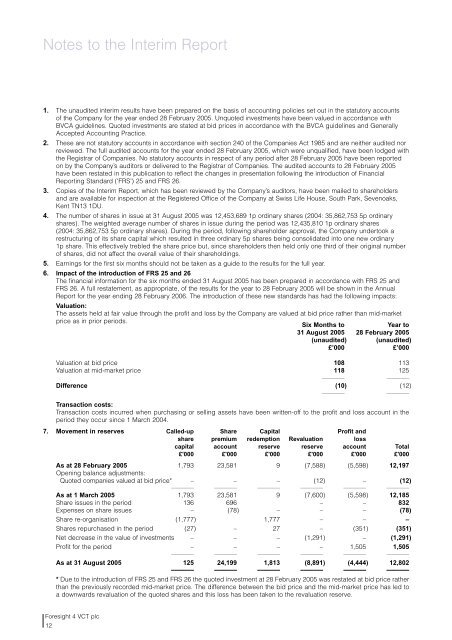

1. The unaudited interim results have been prepared on the basis of accounting policies set out in the statutory accounts<br />

of the Company for the year ended 28 February 2005. Unquoted investments have been valued in accordance with<br />

BVCA guidelines. Quoted investments are stated at bid prices in accordance with the BVCA guidelines and Generally<br />

Accepted Accounting Practice.<br />

2. These are not statutory accounts in accordance with section 240 of the Companies Act 1985 and are neither audited nor<br />

reviewed. The full audited accounts for the year ended 28 February 2005, which were unqualified, have been lodged with<br />

the Registrar of Companies. No statutory accounts in respect of any period after 28 February 2005 have been reported<br />

on by the Company’s auditors or delivered to the Registrar of Companies. The audited accounts to 28 February 2005<br />

have been restated in this publication to reflect the changes in presentation following the introduction of Financial<br />

Reporting Standard (‘FRS’) 25 and FRS 26.<br />

3. Copies of the Interim Report, which has been reviewed by the Company’s auditors, have been mailed to shareholders<br />

and are available for inspection at the Registered Office of the Company at Swiss Life House, South Park, Sevenoaks,<br />

Kent TN13 1DU.<br />

4. The number of shares in issue at 31 August 2005 was 12,453,689 1p ordinary shares (2004: 35,862,753 5p ordinary<br />

shares). The weighted average number of shares in issue during the period was 12,435,810 1p ordinary shares<br />

(2004: 35,862,753 5p ordinary shares). During the period, following shareholder approval, the Company undertook a<br />

restructuring of its share capital which resulted in three ordinary 5p shares being consolidated into one new ordinary<br />

1p share. This effectively trebled the share price but, since shareholders then held only one third of their original number<br />

of shares, did not affect the overall value of their shareholdings.<br />

5. Earnings for the first six months should not be taken as a guide to the results for the full year.<br />

6. Impact of the introduction of FRS 25 and 26<br />

The financial information for the six months ended 31 August 2005 has been prepared in accordance with FRS 25 and<br />

FRS 26. A full restatement, as appropriate, of the results for the year to 28 February 2005 will be shown in the Annual<br />

Report for the year ending 28 February 2006. The introduction of these new standards has had the following impacts:<br />

Valuation:<br />

The assets held at fair value through the profit and loss by the Company are valued at bid price rather than mid-market<br />

price as in prior periods.<br />

Six Months to Year to<br />

31 August 2005 28 February 2005<br />

(unaudited) (unaudited)<br />

£’000 £’000<br />

Valuation at bid price 108 113<br />

Valuation at mid-market price 118 125<br />

––––––– –––––––<br />

Difference (10) (12)<br />

Transaction costs:<br />

––––––– –––––––<br />

Transaction costs incurred when purchasing or selling assets have been written-off to the profit and loss account in the<br />

period they occur since 1 March 2004.<br />

7. Movement in reserves Called-up Share Capital Profit and<br />

share premium redemption Revaluation loss<br />

capital account reserve reserve account Total<br />

£'000 £'000 £'000 £'000 £'000 £'000<br />

As at 28 February 2005<br />

Opening balance adjustments:<br />

1,793 23,581 9 (7,588) (5,598) 12,197<br />

Quoted companies valued at bid price* – – – (12) – (12)<br />

––––––– ––––––– ––––––– ––––––– ––––––– –––––––<br />

As at 1 March 2005 1,793 23,581 9 (7,600) (5,598) 12,185<br />

Share issues in the period 136 696 – – 832<br />

Expenses on share issues – (78) – – – (78)<br />

Share re-organisation (1,777) 1,777 – – –<br />

Shares repurchased in the period (27) – 27 – (351) (351)<br />

Net decrease in the value of investments – – – (1,291) – (1,291)<br />

Profit for the period – – – – 1,505 1,505<br />

––––––– ––––––– ––––––– ––––––– ––––––– –––––––<br />

As at 31 August 2005 125 24,199 1,813 (8,891) (4,444) 12,802<br />

––––––– ––––––– ––––––– ––––––– ––––––– –––––––<br />

* Due to the introduction of FRS 25 and FRS 26 the quoted investment at 28 February 2005 was restated at bid price rather<br />

than the previously recorded mid-market price. The difference between the bid price and the mid-market price has led to<br />

a downwards revaluation of the quoted shares and this loss has been taken to the revaluation reserve.<br />

<strong>Foresight</strong> 4 VCT plc<br />

12