You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

There are several requirements which African countries must meet in order to qualify for AGOA.<br />

Countries with economic and political policies in place that promote open markets and political<br />

systems, implement policies to reduce poverty, make efforts to fight corruption, protect human<br />

rights and the rights of workers, and eliminate child labor practices are eligible for AGOA<br />

benefits. Uganda has already qualified for such eligibility, given its strong reform record. The<br />

second requirement is implementation of a certificate of origin customs visa subject to approval<br />

by the U.S. Government, necessary to prevent illegal transshipment from non-AGOA sources. 2<br />

Finally, countries must agree to make their industries open and available to U.S. Customs<br />

Service inspection teams, while individual firms must maintain records of raw materials,<br />

employment, production equipment, and sales for five years after export for review by the U.S.<br />

Customs officials.<br />

Once a country meets these conditions, AGOA offers duty-free access to the U.S. market for<br />

African apparel items made of fabric and yarns originating either in the U.S. or in eligible sub-<br />

Saharan African countries. In addition, for the continent’s poorest members, including Uganda,<br />

third-country raw material sources are allowable until September 30, 2004. This latter provision<br />

is important, for it allows Uganda to “jump-start” its garment make-up sector into exports, using<br />

fabric which can be imported from leading suppliers around the world. At the same time, it sets a<br />

deadline by which time African fiber, yarn, and fabric (or U.S.-sourced raw materials) must be<br />

used in the garment industries in order to continue to benefit through the life of the treaty, which<br />

expires on September 30, 2008.<br />

AGOA does not offer duty-free access for non-apparel textile products. Non-clothing textile<br />

products presently produced in Uganda, such as blankets, bed linens, handbags and carrying<br />

cases, cloth art, and religious accessories, would be taxed upon importation into the U.S.<br />

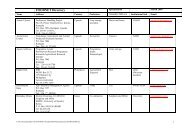

according to the rates specified in the U.S. Harmonized Tariff System (HTS). Current rates and<br />

rates expected in 2004 at the expiry of the Agreement on Textiles and Clothing for some of these<br />

products are presented in Table 1.<br />

Some early experiences with AGOA have been frustrating. In a potential upset to Mauritian<br />

exports to the U.S. and to South African suppliers of yarns into Mauritius, a sample order of<br />

lamb’s wool sweaters were subject in February 2001 to duty by the Customs Service upon arrival<br />

in the U.S. The Customs Service argued that the knit-to-shape panels from which the sweaters<br />

were assembled are not “fabric,” and thus not eligible for duty-free consideration into the U.S.<br />

market. The interpretation was sharply rebuked by the originators of the Act in the U.S. House of<br />

Representatives Ways and Means Committee and by the National Retail Federation in the U.S. 3<br />

2 Uganda is still in the process of revising its proposed visa form in conjunction with feedback received on an earlier<br />

draft from the Office of the U.S. Trade Representative. Approval is likely still a month or two away.<br />

3 “African clothes not duty-free in U.S.,” Business Day. Also, House Committee On Ways And Means press release,<br />

March 6, 2001, http://waysandmeans.house.gov/press/press3-6-01.htm.<br />

2