FORM 4 - Garmin

FORM 4 - Garmin

FORM 4 - Garmin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

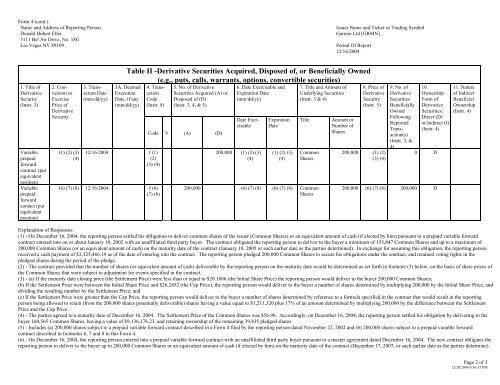

Form 4 (cont.)<br />

Name and Address of Reporting Person<br />

Donald Hubert Eller<br />

3111 Bel Air Drive, No. 18G<br />

Las Vegas NV 89109<br />

1. Title of<br />

Derivative<br />

Security<br />

(Instr. 3)<br />

Variable<br />

prepaid<br />

forward<br />

contract (put<br />

equivalent<br />

position)<br />

Variable<br />

prepaid<br />

forward<br />

contact (put<br />

equivalent<br />

position)<br />

2. Con-<br />

version or<br />

Exercise<br />

Price of<br />

Derivative<br />

Security<br />

(1) (2) (3)<br />

(4)<br />

3. Trans-<br />

action Date<br />

(mm/dd/yy)<br />

Issuer Name and Ticker or Trading Symbol<br />

<strong>Garmin</strong> Ltd [GRMN]<br />

Period Of Report<br />

12/16/2004<br />

Table II -Derivative Securities Acquired, Disposed of, or Beneficially Owned<br />

(e.g., puts, calls, warrants, options, convertible securities)<br />

3A. Deemed<br />

Execution<br />

Date, if any<br />

(mm/dd/yy)<br />

4. Trans-<br />

action<br />

Code<br />

(Instr. 8)<br />

12/16/2004 J (1)<br />

(2)<br />

(3) (4)<br />

(6) (7) (8) 12/16/2004 J (6)<br />

(7) (8)<br />

5. No. of Derivative<br />

Securities Acquired (A) or<br />

Disposed of (D)<br />

(Instr. 3, 4, & 5)<br />

Code V (A) (D)<br />

6. Date Exercisable and<br />

Expiration Date<br />

(mm/dd/yy)<br />

Date Exer-<br />

cisable<br />

200,000 (1) (2) (3)<br />

(4)<br />

Expiration<br />

Date<br />

(1) (2) (3)<br />

(4)<br />

7. Title and Amount of<br />

Underlying Securities<br />

(Instr. 3 & 4)<br />

Title Amount or<br />

Number of<br />

Shares<br />

Common<br />

Shares<br />

200,000 (6) (7) (8) (6) (7) (8) Common<br />

Shares<br />

8. Price of<br />

Derivative<br />

Security<br />

(Instr. 5)<br />

200,000 (1) (2)<br />

(3) (4)<br />

9. No. of<br />

Derivative<br />

Securities<br />

Beneficially<br />

Owned<br />

Following<br />

Reported<br />

Transaction(s)<br />

(Instr. 3, &<br />

4)<br />

10.<br />

Ownership<br />

Form of<br />

Derivative<br />

Securities:<br />

Direct (D)<br />

or Indirect (I)<br />

(Instr. 4)<br />

0 D<br />

200,000 (6) (7) (8) 200,000 D<br />

11. Nature<br />

of Indirect<br />

Beneficial<br />

Ownership<br />

(Instr. 4)<br />

Explanation of Responses:<br />

(1) - On December 16, 2004, the reporting person settled his obligation to deliver common shares of the issuer (Common Shares) or an equivalent amount of cash (if elected by him) pursuant to a prepaid variable forward<br />

contract entered into on or about January 10, 2002 with an unaffiliated third party buyer. The contract obligated the reporting person to deliver to the buyer a minimum of 153,847 Common Shares and up to a maximum of<br />

200,000 Common Shares (or an equivalent amount of cash) on the maturity date of the contract (January 10, 2005 or such earlier date as the parties determined). In exchange for assuming this obligation, the reporting person<br />

received a cash payment of $3,325,466.19 as of the date of entering into the contract. The reporting person pledged 200,000 Common Shares to secure his obligations under the contract, and retained voting rights in the<br />

pledged shares during the period of the pledge.<br />

(2) - The contract provided that the number of shares (or equivalent amount of cash) deliverable by the reporting person on the maturity date would be determined as set forth in footnote (3) below, on the basis of share prices of<br />

the Common Shares that were subject to adjustment for events specified in the contract.<br />

(3) - (a) If the maturity date closing price (the Settlement Price) were less than or equal to $20.1886 (the Initial Share Price) the reporting person would deliver to the buyer 200,000 Common Shares;<br />

(b) If the Settlement Price were between the Initial Share Price and $26.2452 (the Cap Price), the reporting person would deliver to the buyer a number of shares determined by multiplying 200,000 by the Initial Share Price, and<br />

dividing the resulting number by the Settlement Price; and<br />

(c) If the Settlement Price were greater than the Cap Price, the reporting person would deliver to the buyer a number of shares determined by reference to a formula specified in the contract that would result in the reporting<br />

person being allowed to retain (from the 200,000 shares potentially deliverable) shares having a value equal to $1,211,320 plus 17% of an amount determined by multiplying 200,000 by the difference between the Settlement<br />

Price and the Cap Price.<br />

(4) - The parties agreed to a maturity date of December 16, 2004. The Settlement Price of the Common Shares was $56.90. Accordingly, on December 16, 2004, the reporting person settled his obligation by delivering to the<br />

buyer 160,565 Common Shares, having a value of $9,136,176.23, and retaining ownership of the remaining 39,435 pledged shares.<br />

(5) - Includes (a) 200,000 shares subject to a prepaid variable forward contract described in a Form 4 filed by the reporting person dated November 22, 2002 and (b) 200,000 shares subject to a prepaid variable forward<br />

contract described in footnotes 6, 7 and 8 to this Form 4.<br />

(6) - On December 16, 2004, the reporting person entered into a prepaid variable forward contract with an unaffiliated third party buyer pursuant to a master agreement dated December 16, 2004. The new contract obligates the<br />

reporting person to deliver to the buyer up to 200,000 Common Shares or an equivalent amount of cash (if elected by him) on the maturity date of the contract (December 17, 2007, or such earlier date as the parties determine).<br />

Page 2 of 3<br />

12/20/2004 6:36:35 PM