Private Company Stock Options: Determining Fair Market Value in ...

Private Company Stock Options: Determining Fair Market Value in ...

Private Company Stock Options: Determining Fair Market Value in ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

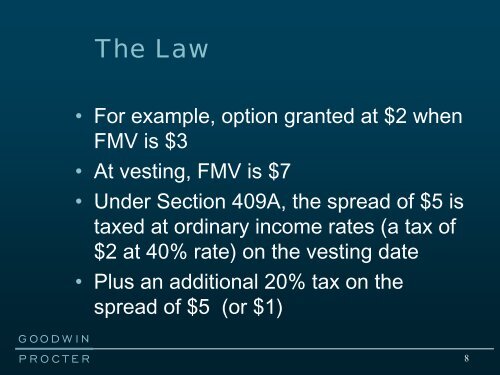

The Law<br />

• For example, option granted at $2 when<br />

FMV is $3<br />

• At vest<strong>in</strong>g, FMV is $7<br />

• Under Section 409A, the spread of $5 is<br />

taxed at ord<strong>in</strong>ary <strong>in</strong>come rates (a tax of<br />

$2 at 40% rate) on the vest<strong>in</strong>g date<br />

• Plus an additional 20% tax on the<br />

spread of $5 (or $1)<br />

8