2012 Synthesis of Results - Interpump

2012 Synthesis of Results - Interpump

2012 Synthesis of Results - Interpump

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

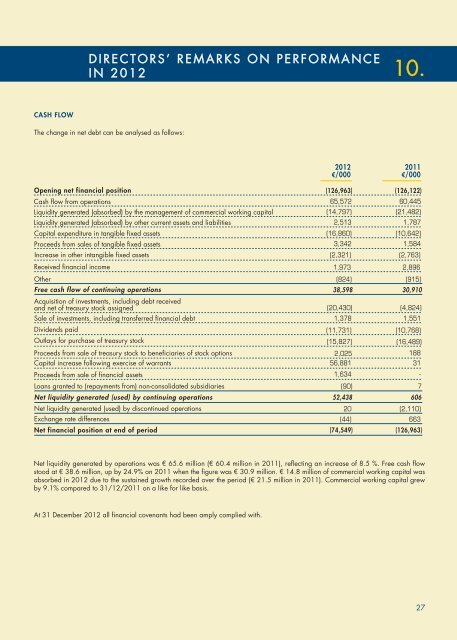

DIRECTORS’ REMARKS ON PERFORMANCE<br />

IN <strong>2012</strong> 10.<br />

CASH FLOW<br />

The change in net debt can be analysed as follows:<br />

Opening net financial position<br />

Cash flow from operations<br />

Liquidity generated (absorbed) by the management <strong>of</strong> commercial working capital<br />

Liquidity generated (absorbed) by other current assets and liabilities<br />

Capital expenditure in tangible fixed assets<br />

Proceeds from sales <strong>of</strong> tangible fixed assets<br />

Increase in other intangible fixed assets<br />

Received financial income<br />

Other<br />

Free cash flow <strong>of</strong> continuing operations<br />

<strong>2012</strong><br />

€/000<br />

(126,963)<br />

65,572<br />

(14,797)<br />

2,513<br />

(16,860)<br />

3,342<br />

(2,321)<br />

1,973<br />

(824)<br />

38,598<br />

2011<br />

€/000<br />

(126,122)<br />

60,445<br />

(21,482)<br />

1,787<br />

(10,642)<br />

1,584<br />

(2,763)<br />

2,896<br />

(915)<br />

30,910<br />

Acquisition <strong>of</strong> investments, including debt received<br />

and net <strong>of</strong> treasury stock assigned<br />

(20,430)<br />

Sale <strong>of</strong> investments, including transferred financial debt 1,378<br />

(4,824)<br />

1,551<br />

Dividends paid<br />

Outlays for purchase <strong>of</strong> treasury stock<br />

Proceeds from sale <strong>of</strong> treasury stock to beneficiaries <strong>of</strong> stock options<br />

Capital increase following exercise <strong>of</strong> warrants<br />

Proceeds from sale <strong>of</strong> financial assets<br />

Loans granted to (repayments from) non-consolidated subsidiaries<br />

Net liquidity generated (used) by continuing operations<br />

(11,731)<br />

(15,827)<br />

2,025<br />

56,881<br />

1,634<br />

(90)<br />

52,438<br />

(10,768)<br />

(16,489)<br />

188<br />

31<br />

-<br />

7<br />

606<br />

Net liquidity generated (used) by discontinued operations 20 (2,110)<br />

Exchange rate differences<br />

Net financial position at end <strong>of</strong> period (74,549)<br />

(44)<br />

663<br />

(126,963)<br />

Net liquidity generated by operations was € 65.6 million (€ 60.4 million in 2011), reflecting an increase <strong>of</strong> 8.5 %. Free cash flow<br />

stood at € 38.6 million, up by 24.9% on 2011 when the figure was € 30.9 million. € 14.8 million <strong>of</strong> commercial working capital was<br />

absorbed in <strong>2012</strong> due to the sustained growth recorded over the period (€ 21.5 million in 2011). Commercial working capital grew<br />

by 9.1% compared to 31/12/2011 on a like for like basis.<br />

At 31 December <strong>2012</strong> all financial covenants had been amply complied with.<br />

27