Schedule 1299-A - Illinois Department of Revenue

Schedule 1299-A - Illinois Department of Revenue

Schedule 1299-A - Illinois Department of Revenue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

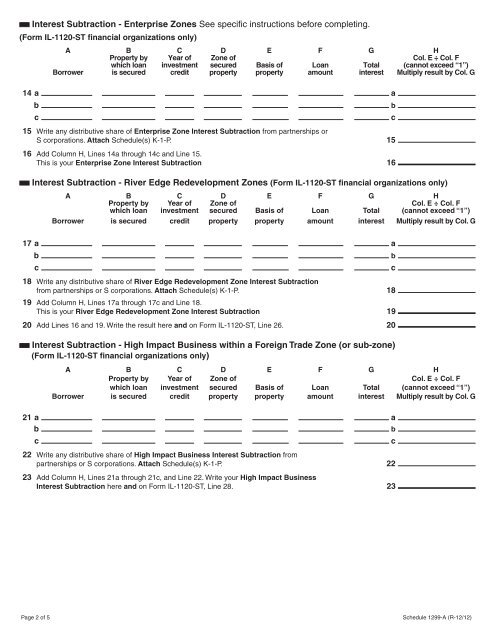

Interest Subtraction - Enterprise Zones See specific instructions before completing.<br />

(Form IL-1120-ST financial organizations only)<br />

14 a<br />

15<br />

A B C D E F G H<br />

Property by Year <strong>of</strong> Zone <strong>of</strong> Col. E ÷ Col. F<br />

which loan investment secured Basis <strong>of</strong> Loan Total (cannot exceed “1”)<br />

Borrower is secured credit property property amount interest Multiply result by Col. G<br />

b b<br />

c c<br />

Write any distributive share <strong>of</strong> Enterprise Zone Interest Subtraction from partnerships or<br />

S corporations. Attach <strong>Schedule</strong>(s) K-1-P.<br />

16 Add Column H, Lines 14a through 14c and Line 15.<br />

This is your Enterprise Zone Interest Subtraction<br />

Interest Subtraction - River Edge Redevelopment Zones (Form IL-1120-ST financial organizations only)<br />

A B C D E F G H<br />

Property by Year <strong>of</strong> Zone <strong>of</strong> Col. E ÷ Col. F<br />

which loan investment secured Basis <strong>of</strong> Loan Total (cannot exceed “1”)<br />

Borrower is secured credit property property amount interest Multiply result by Col. G<br />

17 a<br />

a<br />

b b<br />

c c<br />

18 Write any distributive share <strong>of</strong> River Edge Redevelopment Zone Interest Subtraction<br />

from partnerships or S corporations. Attach <strong>Schedule</strong>(s) K-1-P.<br />

19 Add Column H, Lines 17a through 17c and Line 18.<br />

This is your River Edge Redevelopment Zone Interest Subtraction<br />

20 Add Lines 16 and 19. Write the result here and on Form IL-1120-ST, Line 26.<br />

20<br />

Interest Subtraction - High Impact Business within a Foreign Trade Zone (or sub-zone)<br />

(Form IL-1120-ST financial organizations only)<br />

A B C D E F G H<br />

Property by Year <strong>of</strong> Zone <strong>of</strong> Col. E ÷ Col. F<br />

which loan investment secured Basis <strong>of</strong> Loan Total (cannot exceed “1”)<br />

Borrower is secured credit property property amount interest Multiply result by Col. G<br />

21 a<br />

a<br />

b b<br />

c c<br />

22 Write any distributive share <strong>of</strong> High Impact Business Interest Subtraction from<br />

partnerships or S corporations. Attach <strong>Schedule</strong>(s) K-1-P.<br />

23 Add Column H, Lines 21a through 21c, and Line 22. Write your High Impact Business<br />

Interest Subtraction here and on Form IL-1120-ST, Line 28.<br />

a<br />

15<br />

16<br />

18<br />

19<br />

22<br />

23<br />

Page 2 <strong>of</strong> 5<br />

<strong>Schedule</strong> <strong>1299</strong>-A (R-12/12)