The Child Trust Fund (Amendment) - HM Revenue & Customs

The Child Trust Fund (Amendment) - HM Revenue & Customs

The Child Trust Fund (Amendment) - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

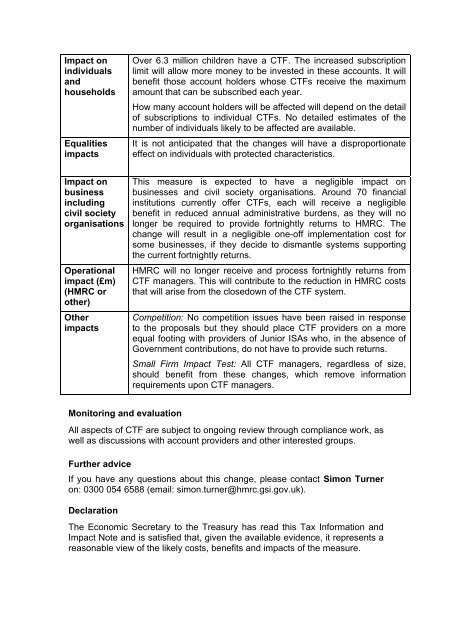

Impact on<br />

individuals<br />

and<br />

households<br />

Equalities<br />

impacts<br />

Over 6.3 million children have a CTF. <strong>The</strong> increased subscription<br />

limit will allow more money to be invested in these accounts. It will<br />

benefit those account holders whose CTFs receive the maximum<br />

amount that can be subscribed each year.<br />

How many account holders will be affected will depend on the detail<br />

of subscriptions to individual CTFs. No detailed estimates of the<br />

number of individuals likely to be affected are available.<br />

It is not anticipated that the changes will have a disproportionate<br />

effect on individuals with protected characteristics.<br />

Impact on<br />

business<br />

including<br />

civil society<br />

organisations<br />

Operational<br />

impact (£m)<br />

(<strong>HM</strong>RC or<br />

other)<br />

Other<br />

impacts<br />

This measure is expected to have a negligible impact on<br />

businesses and civil society organisations. Around 70 financial<br />

institutions currently offer CTFs, each will receive a negligible<br />

benefit in reduced annual administrative burdens, as they will no<br />

longer be required to provide fortnightly returns to <strong>HM</strong>RC. <strong>The</strong><br />

change will result in a negligible one-off implementation cost for<br />

some businesses, if they decide to dismantle systems supporting<br />

the current fortnightly returns.<br />

<strong>HM</strong>RC will no longer receive and process fortnightly returns from<br />

CTF managers. This will contribute to the reduction in <strong>HM</strong>RC costs<br />

that will arise from the closedown of the CTF system.<br />

Competition: No competition issues have been raised in response<br />

to the proposals but they should place CTF providers on a more<br />

equal footing with providers of Junior ISAs who, in the absence of<br />

Government contributions, do not have to provide such returns.<br />

Small Firm Impact Test: All CTF managers, regardless of size,<br />

should benefit from these changes, which remove information<br />

requirements upon CTF managers.<br />

Monitoring and evaluation<br />

All aspects of CTF are subject to ongoing review through compliance work, as<br />

well as discussions with account providers and other interested groups.<br />

Further advice<br />

If you have any questions about this change, please contact Simon Turner<br />

on: 0300 054 6588 (email: simon.turner@hmrc.gsi.gov.uk).<br />

Declaration<br />

<strong>The</strong> Economic Secretary to the Treasury has read this Tax Information and<br />

Impact Note and is satisfied that, given the available evidence, it represents a<br />

reasonable view of the likely costs, benefits and impacts of the measure.