The market reaction to capital expenditure announcements

The market reaction to capital expenditure announcements

The market reaction to capital expenditure announcements

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>The</strong> <strong>market</strong> <strong>reaction</strong> <strong>to</strong> <strong>capital</strong> <strong>expenditure</strong> <strong>announcements</strong><br />

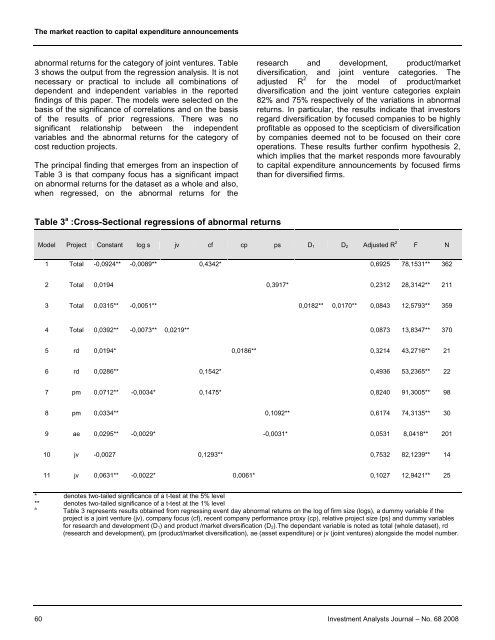

abnormal returns for the category of joint ventures. Table<br />

3 shows the output from the regression analysis. It is not<br />

necessary or practical <strong>to</strong> include all combinations of<br />

dependent and independent variables in the reported<br />

findings of this paper. <strong>The</strong> models were selected on the<br />

basis of the significance of correlations and on the basis<br />

of the results of prior regressions. <strong>The</strong>re was no<br />

significant relationship between the independent<br />

variables and the abnormal returns for the category of<br />

cost reduction projects.<br />

<strong>The</strong> principal finding that emerges from an inspection of<br />

Table 3 is that company focus has a significant impact<br />

on abnormal returns for the dataset as a whole and also,<br />

when regressed, on the abnormal returns for the<br />

research and development, product/<strong>market</strong><br />

diversification, and joint venture categories. <strong>The</strong><br />

adjusted R 2 for the model of product/<strong>market</strong><br />

diversification and the joint venture categories explain<br />

82% and 75% respectively of the variations in abnormal<br />

returns. In particular, the results indicate that inves<strong>to</strong>rs<br />

regard diversification by focused companies <strong>to</strong> be highly<br />

profitable as opposed <strong>to</strong> the scepticism of diversification<br />

by companies deemed not <strong>to</strong> be focused on their core<br />

operations. <strong>The</strong>se results further confirm hypothesis 2,<br />

which implies that the <strong>market</strong> responds more favourably<br />

<strong>to</strong> <strong>capital</strong> <strong>expenditure</strong> <strong>announcements</strong> by focused firms<br />

than for diversified firms.<br />

Table 3 a :Cross-Sectional regressions of abnormal returns<br />

Model Project Constant log s jv cf cp ps D 1 D 2 Adjusted R 2 F N<br />

1 Total -0,0924** -0,0089** 0,4342* 0,6925 78,1531** 362<br />

2 Total 0,0194 0,3917* 0,2312 28,3142** 211<br />

3 Total 0,0315** -0,0051** 0,0182** 0,0170** 0,0843 12,5793** 359<br />

4 Total 0,0392** -0,0073** 0,0219** 0,0873 13,8347** 370<br />

5 rd 0,0194* 0,0186** 0,3214 43,2716** 21<br />

6 rd 0,0286** 0,1542* 0,4936 53,2365** 22<br />

7 pm 0,0712** -0,0034* 0,1475* 0,8240 91,3005** 98<br />

8 pm 0,0334** 0,1092** 0,6174 74,3135** 30<br />

9 ae 0,0295** -0,0029* -0,0031* 0,0531 8,0418** 201<br />

10 jv -0,0027 0,1293** 0,7532 82,1239** 14<br />

11 jv 0,0631** -0,0022* 0,0061* 0,1027 12,9421** 25<br />

* denotes two-tailed significance of a t-test at the 5% level<br />

** denotes two-tailed significance of a t-test at the 1% level<br />

a<br />

Table 3 represents results obtained from regressing event day abnormal returns on the log of firm size (logs), a dummy variable if the<br />

project is a joint venture (jv), company focus (cf), recent company performance proxy (cp), relative project size (ps) and dummy variables<br />

for research and development (D 1) and product /<strong>market</strong> diversification (D 2).<strong>The</strong> dependant variable is noted as <strong>to</strong>tal (whole dataset), rd<br />

(research and development), pm (product/<strong>market</strong> diversification), ae (asset <strong>expenditure</strong>) or jv (joint ventures) alongside the model number.<br />

60 Investment Analysts Journal – No. 68 2008