Consultation paper Rate of return guidelines - Australian Energy ...

Consultation paper Rate of return guidelines - Australian Energy ...

Consultation paper Rate of return guidelines - Australian Energy ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Source: AER, Final decision: SPI Networks (Gas) Pty Ltd access arrangement, Part 3: Appendices, March 2013, p. 60.<br />

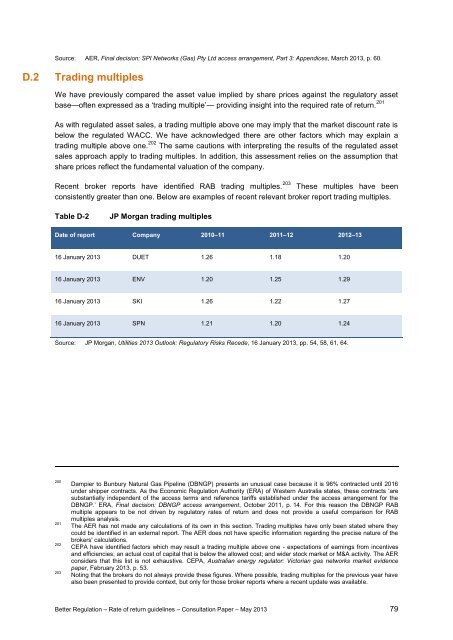

D.2 Trading multiples<br />

We have previously compared the asset value implied by share prices against the regulatory asset<br />

base—<strong>of</strong>ten expressed as a ‘trading multiple’— providing insight into the required rate <strong>of</strong> <strong>return</strong>. 201<br />

As with regulated asset sales, a trading multiple above one may imply that the market discount rate is<br />

below the regulated WACC. We have acknowledged there are other factors which may explain a<br />

trading multiple above one. 202 The same cautions with interpreting the results <strong>of</strong> the regulated asset<br />

sales approach apply to trading multiples. In addition, this assessment relies on the assumption that<br />

share prices reflect the fundamental valuation <strong>of</strong> the company.<br />

Recent broker reports have identified RAB trading multiples. 203 These multiples have been<br />

consistently greater than one. Below are examples <strong>of</strong> recent relevant broker report trading multiples.<br />

Table D-2<br />

JP Morgan trading multiples<br />

Date <strong>of</strong> report Company 2010–11 2011–12 2012–13<br />

16 January 2013 DUET 1.26 1.18 1.20<br />

16 January 2013 ENV 1.20 1.25 1.29<br />

16 January 2013 SKI 1.26 1.22 1.27<br />

16 January 2013 SPN 1.21 1.20 1.24<br />

Source: JP Morgan, Utilities 2013 Outlook: Regulatory Risks Recede, 16 January 2013, pp. 54, 58, 61, 64.<br />

200<br />

201<br />

202<br />

203<br />

Dampier to Bunbury Natural Gas Pipeline (DBNGP) presents an unusual case because it is 96% contracted until 2016<br />

under shipper contracts. As the Economic Regulation Authority (ERA) <strong>of</strong> Western Australia states, these contracts ‘are<br />

substantially independent <strong>of</strong> the access terms and reference tariffs established under the access arrangement for the<br />

DBNGP.’ ERA, Final decision: DBNGP access arrangement, October 2011, p. 14. For this reason the DBNGP RAB<br />

multiple appears to be not driven by regulatory rates <strong>of</strong> <strong>return</strong> and does not provide a useful comparison for RAB<br />

multiples analysis.<br />

The AER has not made any calculations <strong>of</strong> its own in this section. Trading multiples have only been stated where they<br />

could be identified in an external report. The AER does not have specific information regarding the precise nature <strong>of</strong> the<br />

brokers' calculations.<br />

CEPA have identified factors which may result a trading multiple above one - expectations <strong>of</strong> earnings from incentives<br />

and efficiencies; an actual cost <strong>of</strong> capital that is below the allowed cost; and wider stock market or M&A activity. The AER<br />

considers that this list is not exhaustive. CEPA, <strong>Australian</strong> energy regulator: Victorian gas networks market evidence<br />

<strong>paper</strong>, February 2013, p. 53.<br />

Noting that the brokers do not always provide these figures. Where possible, trading multiples for the previous year have<br />

also been presented to provide context, but only for those broker reports where a recent update was available.<br />

Better Regulation – <strong>Rate</strong> <strong>of</strong> <strong>return</strong> <strong>guidelines</strong> – <strong>Consultation</strong> Paper – May 2013 79