Raffles Insitutep Xpo - Raffles Medical Group

Raffles Insitutep Xpo - Raffles Medical Group

Raffles Insitutep Xpo - Raffles Medical Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

RAFFLES MEDICAL GROUP<br />

p54<br />

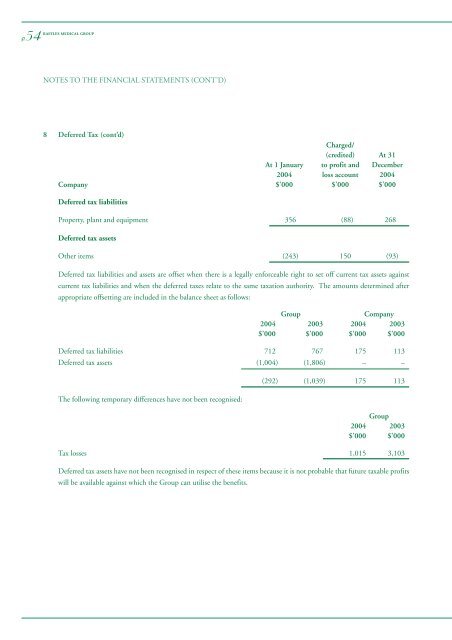

NOTES TO THE FINANCIAL STATEMENTS (CONT’D)<br />

8 Deferred Tax (cont’d)<br />

Charged/<br />

(credited) At 31<br />

At 1 January to profit and December<br />

2004 loss account 2004<br />

Company $’000 $’000 $’000<br />

Deferred tax liabilities<br />

Property, plant and equipment 356 (88) 268<br />

Deferred tax assets<br />

Other items (243) 150 (93)<br />

Deferred tax liabilities and assets are offset when there is a legally enforceable right to set off current tax assets against<br />

current tax liabilities and when the deferred taxes relate to the same taxation authority. The amounts determined after<br />

appropriate offsetting are included in the balance sheet as follows:<br />

<strong>Group</strong><br />

Company<br />

2004 2003 2004 2003<br />

$’000 $’000 $’000 $’000<br />

Deferred tax liabilities 712 767 175 113<br />

Deferred tax assets (1,004) (1,806) – –<br />

The following temporary differences have not been recognised:<br />

(292) (1,039) 175 113<br />

<strong>Group</strong><br />

2004 2003<br />

$’000 $’000<br />

Tax losses 1,015 3,103<br />

Deferred tax assets have not been recognised in respect of these items because it is not probable that future taxable profits<br />

will be available against which the <strong>Group</strong> can utilise the benefits.