CA8454 - HM Revenue & Customs

CA8454 - HM Revenue & Customs

CA8454 - HM Revenue & Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

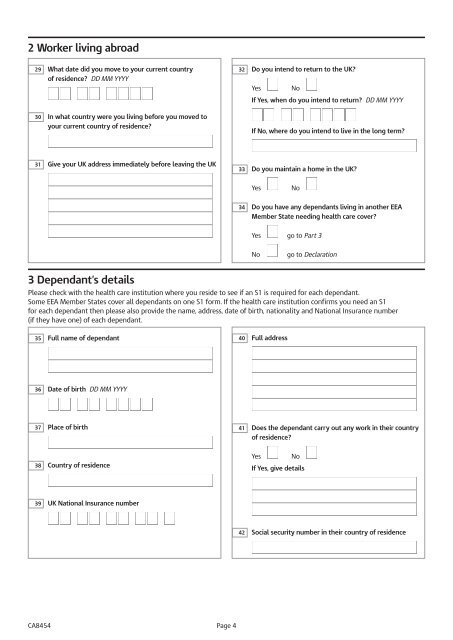

2 Worker living abroad<br />

29<br />

What date did you move to your current country<br />

32<br />

Do you intend to return to the UK?<br />

of residence? DD MM YYYY<br />

Yes<br />

No<br />

If Yes, when do you intend to return? DD MM YYYY<br />

30<br />

In what country were you living before you moved to<br />

your current country of residence?<br />

If No, where do you intend to live in the long term?<br />

31<br />

Give your UK address immediately before leaving the UK<br />

33<br />

Do you maintain a home in the UK?<br />

Yes<br />

No<br />

34<br />

Do you have any dependants living in another EEA<br />

Member State needing health care cover?<br />

Yes go to Part 3<br />

No<br />

go to Declaration<br />

3 Dependant’s details<br />

Please check with the health care institution where you reside to see if an S1 is required for each dependant.<br />

Some EEA Member States cover all dependants on one S1 form. If the health care institution confirms you need an S1<br />

for each dependant then please also provide the name, address, date of birth, nationality and National Insurance number<br />

(if they have one) of each dependant.<br />

35<br />

Full name of dependant<br />

40<br />

Full address<br />

36<br />

Date of birth DD MM YYYY<br />

37<br />

Place of birth<br />

41<br />

Does the dependant carry out any work in their country<br />

of residence?<br />

38<br />

Country of residence<br />

Yes No<br />

If Yes, give details<br />

39<br />

UK National Insurance number<br />

42<br />

Social security number in their country of residence<br />

<strong>CA8454</strong> Page 4