Download (PDF, 733 kb) - Kabel Deutschland

Download (PDF, 733 kb) - Kabel Deutschland

Download (PDF, 733 kb) - Kabel Deutschland

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Kabel</strong> <strong>Deutschland</strong> GmbH<br />

Notes to the consolidated financial statements<br />

7<br />

1.4 Currency Translation<br />

The functional and reporting currency of KDG GmbH is the Euro.<br />

Foreign currency transactions were converted to Euros at the exchange rate applicable<br />

on the date of the transaction. Monetary assets and liabilities denominated in foreign currencies<br />

existing as of the balance sheet date are translated to Euros at the exchange rate of the<br />

European Central Bank on the balance sheet date. The foreign currency gain or loss on<br />

monetary items is the difference between amortized cost in the functional currency at the<br />

beginning of the period, adjusted for effective interest and payments during the period, and the<br />

amortized cost in foreign currency translated at the exchange rate at the end of the reporting<br />

period. These currency differences are recognized in the consolidated statement of income.<br />

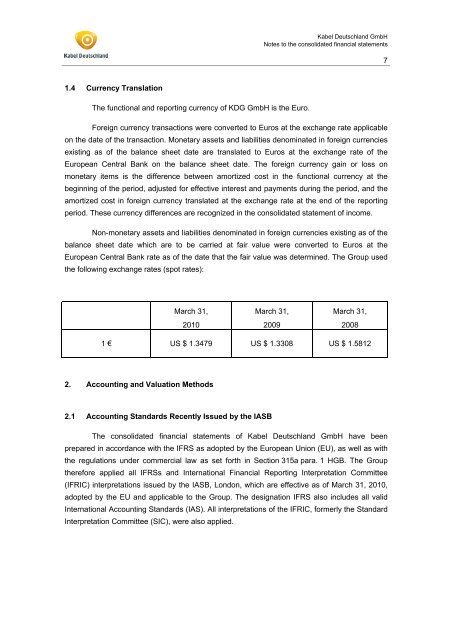

Non-monetary assets and liabilities denominated in foreign currencies existing as of the<br />

balance sheet date which are to be carried at fair value were converted to Euros at the<br />

European Central Bank rate as of the date that the fair value was determined. The Group used<br />

the following exchange rates (spot rates):<br />

March 31,<br />

2010<br />

March 31,<br />

2009<br />

March 31,<br />

2008<br />

1 € US $ 1.3479 US $ 1.3308 US $ 1.5812<br />

2. Accounting and Valuation Methods<br />

2.1 Accounting Standards Recently Issued by the IASB<br />

The consolidated financial statements of <strong>Kabel</strong> <strong>Deutschland</strong> GmbH have been<br />

prepared in accordance with the IFRS as adopted by the European Union (EU), as well as with<br />

the regulations under commercial law as set forth in Section 315a para. 1 HGB. The Group<br />

therefore applied all IFRSs and International Financial Reporting Interpretation Committee<br />

(IFRIC) interpretations issued by the IASB, London, which are effective as of March 31, 2010,<br />

adopted by the EU and applicable to the Group. The designation IFRS also includes all valid<br />

International Accounting Standards (IAS). All interpretations of the IFRIC, formerly the Standard<br />

Interpretation Committee (SIC), were also applied.