School and package comparison - KHEAA

School and package comparison - KHEAA

School and package comparison - KHEAA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

March 2012<br />

By now, most high school seniors should have<br />

completed the college application process <strong>and</strong> will<br />

soon begin receiving financial aid award letters.<br />

Seniors <strong>and</strong> their parents should compare those<br />

letters to find the one that offers the best financial aid<br />

<strong>package</strong>.<br />

The letter will usually show the total cost of<br />

attendance — what it costs to go to that school for<br />

one year, including tuition, fees, room, meals, books,<br />

supplies, transportation <strong>and</strong> personal expenses. Keep<br />

in mind that we’re talking about a school year, which<br />

doesn’t include summer school.<br />

It may also show how much the student’s family is<br />

expected to pay toward those costs, the expected<br />

family contribution (EFC). The EFC is subtracted<br />

from the total cost of attendance to get a student’s<br />

financial need. The letter will then list various sources<br />

of financial aid offered to pay for the costs not<br />

covered by the EFC. Students can accept or reject any<br />

or all of those proposed sources.<br />

One consideration is how much of the financial aid<br />

will have to be paid back after a student finishes<br />

school, especially if the financial aid <strong>package</strong>, like<br />

most <strong>package</strong>s, includes federal student loans.<br />

(Continued on next page)<br />

For help with your higher education <strong>and</strong> financial aid questions, visit www.kheaa.com<br />

<strong>KHEAA</strong> is an EEOC employer.<br />

Follow us on<br />

Twitter <strong>and</strong><br />

Facebook!<br />

http://bit.ly/<strong>KHEAA</strong>facebook<br />

The contents of this newsletter were developed under a grant from the Department of Education. However, those contents do not necessarily represent the policy of the Department<br />

of Education, <strong>and</strong> you should not assume endorsement by the Federal Government.

(Continued from previous page)<br />

If the <strong>package</strong> isn’t enough to pay all expenses,<br />

students may be looking at a private education loan.<br />

Comparison shopping is a must in that case. Visit<br />

kheaamarketplace.com to find the best private loan<br />

for you.<br />

Be sure to weigh all options before deciding on a<br />

school.<br />

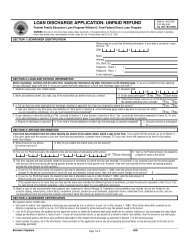

The chart below will help you compare both schools<br />

<strong>and</strong> school <strong>package</strong>s. Use your award letters that<br />

you receive from colleges’ financial aid offices<br />

<strong>and</strong> the Student Aid Report (SAR) that you receive<br />

after filling out the FAFSA to fill out this chart to<br />

compare the schools <strong>and</strong> financial aid <strong>package</strong>s you<br />

are considering. The sample column will give you<br />

an idea of how to fill in the needed information.<br />

Sometimes the most expensive schools have<br />

scholarships that will bring them in line with others.<br />

So don’t limit yourself; consider all your choices<br />

<strong>and</strong> compare.<br />

<strong>School</strong> <strong>and</strong> <strong>package</strong> <strong>comparison</strong><br />

Sample <strong>School</strong> A <strong>School</strong> B<br />

Need Calculation<br />

$3,000<br />

800<br />

6,200<br />

1,800<br />

1,200<br />

13,000<br />

-1,000<br />

12,000<br />

Tuition <strong>and</strong> Fees<br />

Books <strong>and</strong> Supplies<br />

Room <strong>and</strong> Board<br />

Transportation<br />

Personal Expenses<br />

Total Cost of Attendance (varies from school to school)<br />

Minus Estimated Family Contribution (remains the same)<br />

Financial Need<br />

Financial Aid Package<br />

$3,000<br />

1,500<br />

0<br />

500<br />

1,700<br />

0<br />

2,000<br />

3,300<br />

0<br />

12,000<br />

0<br />

Federal Pell Grant<br />

College Access Program Grant<br />

Kentucky Tuition Grant<br />

Other Grants/Scholarships<br />

Kentucky Educational Excellence Scholarship (KEES)<br />

Work-Study<br />

Federal Perkins Loan<br />

Federal Stafford Loan<br />

Other Loans<br />

Total Financial Aid Package<br />

Unmet Need (Financial Need minus Total Financial Aid Package)<br />

2

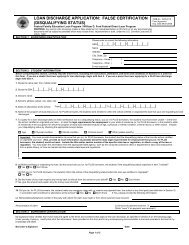

Adults returning to school can find lots of help<br />

Are you an adult thinking about returning to college or<br />

enrolling for the first time? Or perhaps you’re thinking<br />

about taking courses online. If you are, Kentucky has<br />

resources that can make the transition to college an<br />

easier one. The state also offers financial aid programs<br />

to help you.<br />

<strong>KHEAA</strong> publishes Adults Returning to <strong>School</strong>,<br />

available FREE from adult education centers or<br />

directly from <strong>KHEAA</strong>. E-mail publications@kheaa.<br />

com, <strong>and</strong> we’ll mail you a copy. The entire book is<br />

online at www.kheaa.com, <strong>and</strong> a copy is sent to every<br />

public library in the state. Adults Returning to <strong>School</strong><br />

has information about entrance exams, financial aid<br />

programs, student loans <strong>and</strong> Kentucky schools.<br />

Another <strong>KHEAA</strong> book, Affording Higher Education,<br />

lists over 5,000 student aid programs available to<br />

Kentucky students at Kentucky colleges. Copies are<br />

sent to all public libraries, <strong>and</strong> the book is searchable<br />

online on www.kheaa.com. That way you can find<br />

programs specifically for adult students.<br />

Adults Returning<br />

To <strong>School</strong><br />

2011–2012<br />

Guide to<br />

Higher Education<br />

for Adult Students<br />

Provided by the Kentucky Higher Education Assistance Authority<br />

Adult students are eligible for most state financial<br />

aid programs, as long as they meet the general<br />

requirements. For full details, go to www.kheaa.<br />

com, click on “Adult Learners,” then click on<br />

the links to grants, scholarships <strong>and</strong> financial aid<br />

programs.<br />

College grants available for adult students<br />

Adult Kentuckians who are interested in taking college<br />

classes may be eligible for a Go Higher Grant administered<br />

by <strong>KHEAA</strong>.<br />

Go Higher Grants are available to adults age 24 or older who<br />

are enrolled less than half-time at a participating Kentucky<br />

college or university. Applicants must show financial need.<br />

The maximum award amount is $1,000 per academic year. It<br />

covers tuition <strong>and</strong> a book allowance of $50 per credit hour.<br />

To be considered for a grant, students must complete a Go<br />

Higher Grant application <strong>and</strong> the FAFSA. Grant applications<br />

are available at www.kheaa.com. The FAFSA can be<br />

submitted online at www.fafsa.gov. Students are encouraged<br />

to apply as early as possible because funding is limited.<br />

3

Federal student aid programs can help pay college costs<br />

The federal government sponsors numerous financial aid<br />

programs that can help students <strong>and</strong> their parents pay college<br />

expenses. Below is a brief summary that describes some of<br />

the more common federal grant <strong>and</strong> loan programs. Grants<br />

generally don’t have to be repaid, but loans do.<br />

• Federal Pell Grant. Pell Grants provide up to $5,550<br />

per year for undergraduates with financial need.<br />

• Federal Supplemental Educational Opportunity<br />

Grant. These provide up to $4,000 per year for<br />

undergraduate students who have exceptional financial<br />

need.<br />

• Federal Perkins Loan. These loans are for students<br />

with exceptional financial need. Undergraduates can get<br />

up to $5,500 per year, while graduate students can get<br />

up to $8,000 per year.<br />

• Federal Stafford Loan. Stafford Loans are available<br />

to undergraduate, graduate <strong>and</strong> professional students.<br />

The amount students may borrow varies depending<br />

upon their year in school.<br />

• Federal PLUS Loan. Parents of dependent<br />

undergraduate students may qualify for PLUS Loans, depending on the parents’ credit ratings. The<br />

amount available depends on how much other financial aid the student receives. Graduate students may<br />

apply for PLUS Loans if they have exhausted all of their Stafford Loan eligibility.<br />

The Free Application for Federal Student Aid (FAFSA) is used to apply for all of these programs. Families<br />

seeking a PLUS Loan must also submit a separate application.<br />

New booklet will help freshmen adjust to first year at college<br />

Kentucky students headed to college in the fall have a<br />

new resource to help them through their first year on<br />

campus.<br />

Surviving College, a guide to students’ first year, is now<br />

available free from <strong>KHEAA</strong>.<br />

A guide to GET You through your freshman year<br />

The 36-page booklet includes the following sections:<br />

• Majors <strong>and</strong> class schedules.<br />

• Staying healthy <strong>and</strong> safe on campus.<br />

• Learning styles <strong>and</strong> study tips.<br />

• Campus life.<br />

• Financial basics.<br />

To order a copy of Surviving College, e-mail<br />

publications@kheaa.com, call (800) 928-8926, ext.<br />

6-7372 or order online at http://bit.ly/<strong>KHEAA</strong>orderform.<br />

4

KESPT offers free activity book for children<br />

Parents who want to get younger children thinking about college have<br />

an excellent resource in an activity book from the Kentucky Education<br />

Savings Plan Trust (KESPT), a college savings program administered by<br />

<strong>KHEAA</strong>.<br />

The activity book, called “I Can Go to College, Too,” has child-friendly<br />

text <strong>and</strong> fun things for children to do. They can try their h<strong>and</strong>s at a saving<br />

for college maze, a word search puzzle, a connect the dots picture <strong>and</strong><br />

other activities.<br />

KESPT is the state’s official college saving plan. It is managed by TIAA-<br />

CREF Tuition Financing Inc., a leading financial services provider.<br />

For more information about KESPT, visit www.kysaves.com or call<br />

1.877.598.7878.<br />

To order a copy of the activity book, go to http://bit.ly/<strong>KHEAA</strong>orderform.<br />

Dream Out Loud Challenge reminder<br />

Just a reminder that Kentucky students in grades K-6 have a<br />

chance to win $1,500 toward college <strong>and</strong> $500 for their school<br />

in the Dream Out Loud Challenge. Students are invited to<br />

answer the question “How will I change the world after I go to<br />

college?”<br />

Nine winning entries will be selected by a panel of judges.<br />

One winner will be chosen from each of three categories in<br />

grades K-2, grades 3-4 <strong>and</strong> grades 5-6. The categories are:<br />

• Drawing.<br />

• Poem or essay.<br />

• Video.<br />

Each winning student will receive a $1,500 college savings<br />

account, <strong>and</strong> their schools will win $500. The contest runs<br />

through March 16. Entries must be postmarked by March 16<br />

<strong>and</strong> received by March 23.<br />

The challenge is sponsored by KESPT.<br />

Visit www.kysaves.com to learn more about the challenge,<br />

including official rules <strong>and</strong> a complete description of entry<br />

requirements. No purchase necessary. Void where prohibited.<br />

5

Mary Jo Young Scholarship update<br />

(Note: An article on this scholarship was in the<br />

February Your <strong>KHEAA</strong> College Connection. This<br />

contains updated information.)<br />

Kentucky high school students may qualify for a<br />

scholarship to help pay for dual credit classes taken<br />

at a Kentucky college or university or for Advanced<br />

Placement (AP) courses taken through the Kentucky<br />

Virtual High <strong>School</strong>.<br />

The Mary Jo Young Scholarship, named for a<br />

former member of the Board of Directors of<br />

<strong>KHEAA</strong>, is available to Kentucky students in<br />

grades 9 through 12. Priority is given to low-income<br />

students. The scholarship provides up to $405 per<br />

class toward tuition for up to two classes each<br />

semester <strong>and</strong> up to $125 per class for textbooks.<br />

Scholarships can only be used in the fall <strong>and</strong> spring<br />

semesters.<br />

A contract is a written agreement between two<br />

or more parties in which an offer is made <strong>and</strong><br />

accepted. If you’re thinking about signing a<br />

contract, make sure you underst<strong>and</strong> it.<br />

If you rent an apartment or have your own cell<br />

phone plan, you’ve probably signed a contract. If<br />

you’ve taken out a federal student loan, you entered<br />

a contract when you signed your Master Promissory<br />

Note.<br />

The application is available on www.kheaa.com,<br />

linked from http://www.kheaa.com/website/kheaa/<br />

mjyoung?main=1 <strong>and</strong> the application period runs<br />

through May 1.<br />

Senior year planner<br />

March<br />

❏ Submit mid-year grades if the colleges you’ve<br />

applied to require them.<br />

❏ Send in any required deposits.<br />

❏ If you’ve been accepted by more than one college<br />

but haven’t heard from your first choice, contact<br />

that school about a decision before you make any<br />

nonrefundable deposits to other schools.<br />

❏ If you’ve decided on which school to attend,<br />

notify that college of your decision. Let any other<br />

colleges that have accepted you know about your<br />

decision.<br />

Be sure you underst<strong>and</strong> contracts before signing<br />

Since a contract sets out in detail what each party<br />

is obligated to do for the other party, you should<br />

read each contract thoroughly <strong>and</strong> ask questions.<br />

If one of the parties agrees to make a change in the<br />

contract, make sure the change is in writing. Get<br />

all your questions answered before you sign the<br />

contract, <strong>and</strong> keep a copy after you have signed. In<br />

some cases, it might make sense to have an attorney<br />

look over the contract before you sign it.<br />

Consumer protection laws let you cancel some<br />

contracts within three days of signing. Before you<br />

6<br />

sign any contract, find out if you have that option.<br />

If you don’t, your options of getting out of the<br />

contract are limited.<br />

If someone uses high-pressure tactics to get you to<br />

sign a contract, consider that a warning sign that<br />

things may not be on the up <strong>and</strong> up. When that<br />

happens, walk away.