Financial Statements - Berjaya Corporation Berhad

Financial Statements - Berjaya Corporation Berhad

Financial Statements - Berjaya Corporation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes To The <strong>Financial</strong> <strong>Statements</strong><br />

30 April 2001<br />

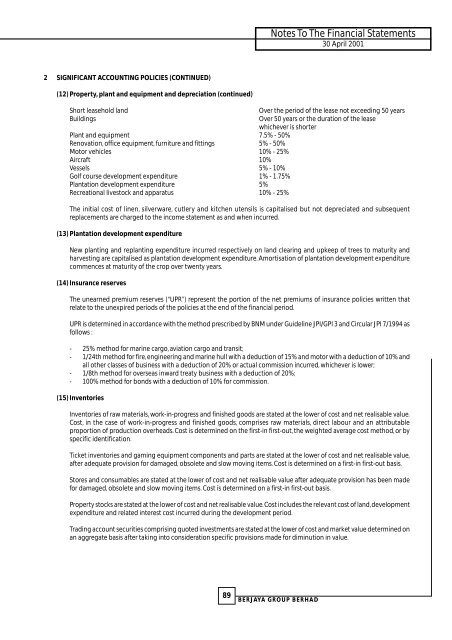

2 SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)<br />

(12) Property, plant and equipment and depreciation (continued)<br />

Short leasehold land<br />

Buildings<br />

Plant and equipment 7.5% - 50%<br />

Renovation, office equipment, furniture and fittings 5% - 50%<br />

Motor vehicles 10% - 25%<br />

Aircraft 10%<br />

Vessels 5% - 10%<br />

Golf course development expenditure 1% - 1.75%<br />

Plantation development expenditure 5%<br />

Recreational livestock and apparatus 10% - 25%<br />

Over the period of the lease not exceeding 50 years<br />

Over 50 years or the duration of the lease<br />

whichever is shorter<br />

The initial cost of linen, silverware, cutlery and kitchen utensils is capitalised but not depreciated and subsequent<br />

replacements are charged to the income statement as and when incurred.<br />

(13) Plantation development expenditure<br />

New planting and replanting expenditure incurred respectively on land clearing and upkeep of trees to maturity and<br />

harvesting are capitalised as plantation development expenditure. Amortisation of plantation development expenditure<br />

commences at maturity of the crop over twenty years.<br />

(14) Insurance reserves<br />

The unearned premium reserves (“UPR”) represent the portion of the net premiums of insurance policies written that<br />

relate to the unexpired periods of the policies at the end of the financial period.<br />

UPR is determined in accordance with the method prescribed by BNM under Guideline JPI/GPI 3 and Circular JPI 7/1994 as<br />

follows :<br />

- 25% method for marine cargo, aviation cargo and transit;<br />

- 1/24th method for fire, engineering and marine hull with a deduction of 15% and motor with a deduction of 10% and<br />

all other classes of business with a deduction of 20% or actual commission incurred, whichever is lower;<br />

- 1/8th method for overseas inward treaty business with a deduction of 20%;<br />

- 100% method for bonds with a deduction of 10% for commission.<br />

(15) Inventories<br />

Inventories of raw materials, work-in-progress and finished goods are stated at the lower of cost and net realisable value.<br />

Cost, in the case of work-in-progress and finished goods, comprises raw materials, direct labour and an attributable<br />

proportion of production overheads. Cost is determined on the first-in first-out, the weighted average cost method, or by<br />

specific identification.<br />

Ticket inventories and gaming equipment components and parts are stated at the lower of cost and net realisable value,<br />

after adequate provision for damaged, obsolete and slow moving items. Cost is determined on a first-in first-out basis.<br />

Stores and consumables are stated at the lower of cost and net realisable value after adequate provision has been made<br />

for damaged, obsolete and slow moving items. Cost is determined on a first-in first-out basis.<br />

Property stocks are stated at the lower of cost and net realisable value. Cost includes the relevant cost of land, development<br />

expenditure and related interest cost incurred during the development period.<br />

Trading account securities comprising quoted investments are stated at the lower of cost and market value determined on<br />

an aggregate basis after taking into consideration specific provisions made for diminution in value.<br />

89 BERJAYA GROUP BERHAD