College Planning - Tustin Unified School District

College Planning - Tustin Unified School District

College Planning - Tustin Unified School District

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

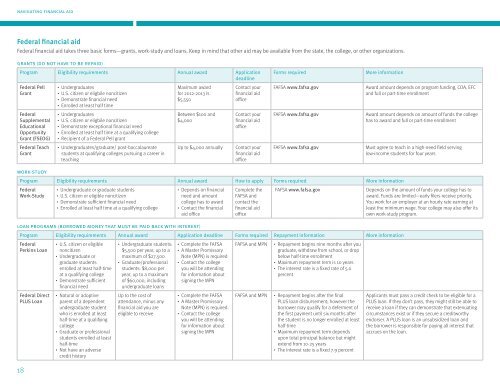

navigating financial aid<br />

Federal financial aid<br />

Federal financial aid takes three basic forms—grants, work-study and loans. Keep in mind that other aid may be available from the state, the college, or other organizations.<br />

grants (do not have to be repaid)<br />

Program Eligibility requirements Annual award Application<br />

deadline<br />

Federal Pell<br />

Grant<br />

Federal<br />

Supplemental<br />

Educational<br />

Opportunity<br />

Grant (FSEOG)<br />

Federal Teach<br />

Grant<br />

··<br />

Undergraduates<br />

··<br />

U.S. citizen or eligbile noncitizen<br />

··<br />

Demonstrate financial need<br />

··<br />

Enrolled at least half time<br />

··<br />

Undergraduates<br />

··<br />

U.S. citizen or eligbile noncitizen<br />

··<br />

Demonstrate exceptional financial need<br />

··<br />

Enrolled at least half time at a qualifying college<br />

··<br />

Recipient of a Federal Pell grant<br />

··<br />

Undergraduates/graduate/ post-baccalaureate<br />

students at qualifying colleges pursuing a career in<br />

teaching<br />

Maximum award<br />

for 2012-2013 is<br />

$5,550<br />

Between $100 and<br />

$4,000<br />

Up to $4,000 annually<br />

Contact your<br />

financial aid<br />

office<br />

Contact your<br />

financial aid<br />

office<br />

Contact your<br />

financial aid<br />

office<br />

Forms required<br />

FAFSA www.fafsa.gov<br />

FAFSA www.fafsa.gov<br />

FAFSA www.fafsa.gov<br />

More information<br />

Award amount depends on program funding, COA, EFC<br />

and full or part-time enrollment<br />

Award amount depends on amount of funds the college<br />

has to award and full or part-time enrollment<br />

Must agree to teach in a high-need field serving<br />

low-income students for four years<br />

work-study<br />

Program Eligibility requirements Annual award How to apply Forms required More information<br />

Federal<br />

Work-Study<br />

··<br />

Undergraduate or graduate students<br />

··<br />

U.S. citizen or eligible noncitizen<br />

··<br />

Demonstrate sufficient financial need<br />

··<br />

Enrolled at least half time at a qualifying college<br />

··<br />

Depends on financial<br />

need and amount<br />

college has to award<br />

··<br />

Contact the financial<br />

aid office<br />

Complete the<br />

FAFSA and<br />

contact the<br />

financial aid<br />

office<br />

FAFSA www.fafsa.gov<br />

Depends on the amount of funds your college has to<br />

award. Funds are limited—early filers receive priority.<br />

You work for an employer at an hourly rate earning at<br />

least the minimum wage. Your college may also offer its<br />

own work-study program.<br />

loan programs (borrowed money that must be paid back with interest)<br />

Program Eligibility requirements Annual award Application deadline Forms required Repayment information More information<br />

Federal<br />

Perkins Loan<br />

··<br />

U.S. citizen or eligible<br />

noncitizen<br />

··<br />

Undergraduate or<br />

graduate students<br />

enrolled at least half-time<br />

at a qualifying college<br />

··<br />

Undergraduate students:<br />

$5,500 per year, up to a<br />

maximum of $27,500<br />

··<br />

Graduate/professional<br />

students: $8,000 per<br />

year, up to a maximum<br />

··<br />

Complete the FAFSA<br />

··<br />

A Master Promissory<br />

Note (MPN) is required<br />

··<br />

Contact the college<br />

you will be attending<br />

for information about<br />

FAFSA and MPN ··<br />

Repayment begins nine months after you<br />

graduate, withdraw from school, or drop<br />

below half-time enrollment<br />

··<br />

Maximum repayment term is 10 years<br />

··<br />

The interest rate is a fixed rate of 5.0<br />

percent<br />

··<br />

Demonstrate sufficient<br />

financial need<br />

of $60,000, including<br />

undergraduate loans<br />

signing the MPN<br />

Federal Direct<br />

PLUS Loan<br />

··<br />

Natural or adoptive<br />

parent of a dependent<br />

undergraduate student<br />

who is enrolled at least<br />

half-time at a qualifying<br />

college<br />

··<br />

Graduate or professional<br />

students enrolled at least<br />

half-time<br />

··<br />

Not have an adverse<br />

credit history<br />

Up to the cost of<br />

attendance, minus any<br />

financial aid you are<br />

eligible to receive<br />

··<br />

Complete the FAFSA<br />

··<br />

A Master Promissory<br />

Note (MPN) is required.<br />

··<br />

Contact the college<br />

you will be attending<br />

for information about<br />

signing the MPN<br />

FAFSA and MPN ··<br />

Repayment begins after the final<br />

PLUS loan disbursement; however the<br />

borrower may qualify for a deferment of<br />

the first payment until six months after<br />

the student is no longer enrolled at least<br />

half-time<br />

··<br />

Maximum repayment term depends<br />

upon total principal balance but might<br />

extend from 10-25 years<br />

··<br />

The interest rate is a fixed 7.9 percent<br />

Applicants must pass a credit check to be eligible for a<br />

PLUS loan. If they don’t pass, they might still be able to<br />

receive a loan if they can demonstrate that extenuating<br />

circumstances exist or if they secure a creditworthy<br />

endorser. A PLUS loan is an unsubsidized loan and<br />

the borrower is responsible for paying all interest that<br />

accrues on the loan.<br />

18