Presentation slides - Federal Reserve Bank of New York

Presentation slides - Federal Reserve Bank of New York

Presentation slides - Federal Reserve Bank of New York

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

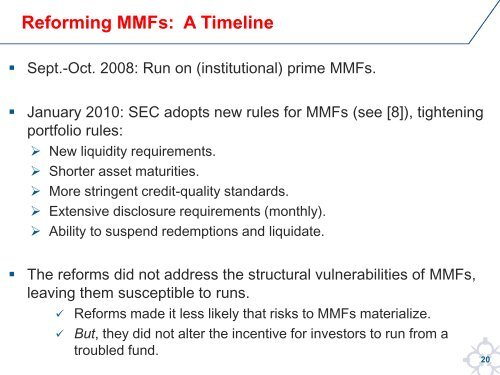

Reforming MMFs: A Timeline<br />

• Sept.-Oct. 2008: Run on (institutional) prime MMFs.<br />

• January 2010: SEC adopts new rules for MMFs (see [8]), tightening<br />

portfolio rules:<br />

‣ <strong>New</strong> liquidity requirements.<br />

‣ Shorter asset maturities.<br />

‣ More stringent credit-quality standards.<br />

‣ Extensive disclosure requirements (monthly).<br />

‣ Ability to suspend redemptions and liquidate.<br />

• The reforms did not address the structural vulnerabilities <strong>of</strong> MMFs,<br />

leaving them susceptible to runs.<br />

<br />

<br />

Reforms made it less likely that risks to MMFs materialize.<br />

But, they did not alter the incentive for investors to run from a<br />

troubled fund.<br />

20