2003-2004 - Ontario College of Pharmacists

2003-2004 - Ontario College of Pharmacists

2003-2004 - Ontario College of Pharmacists

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

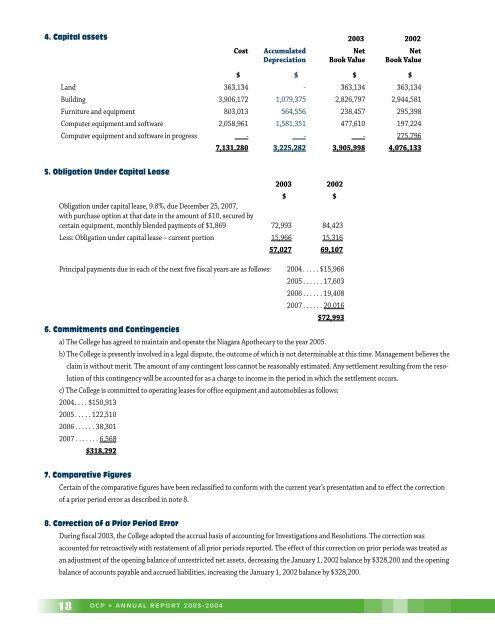

4. Capital assets <strong>2003</strong> 2002<br />

Cost Accumulated Net Net<br />

Depreciation Book Value Book Value<br />

$ $ $ $<br />

Land 363,134 - 363,134 363,134<br />

Building 3,906,172 1,079,375 2,826,797 2,944,581<br />

Furniture and equipment 803,013 564,556 238,457 295,398<br />

Computer equipment and s<strong>of</strong>tware 2,058,961 1,581,351 477,610 197,224<br />

Computer equipment and s<strong>of</strong>tware in progress - - - 275,796<br />

7,131,280 3,225,282 3,905,998 4,076,133<br />

5. Obligation Under Capital Lease<br />

<strong>2003</strong> 2002<br />

$ $<br />

Obligation under capital lease, 9.8%, due December 25, 2007,<br />

with purchase option at that date in the amount <strong>of</strong> $10, secured by<br />

certain equipment, monthly blended payments <strong>of</strong> $1,869 72,993 84,423<br />

Less: Obligation under capital lease – current portion 15,966 15,316<br />

Principal payments due in each <strong>of</strong> the next five fiscal years are as follows:<br />

6. Commitments and Contingencies<br />

57,027 69,107<br />

a) The <strong>College</strong> has agreed to maintain and operate the Niagara Apothecary to the year 2005.<br />

b) The <strong>College</strong> is presently involved in a legal dispute, the outcome <strong>of</strong> which is not determinable at this time. Management believes the<br />

claim is without merit. The amount <strong>of</strong> any contingent loss cannot be reasonably estimated. Any settlement resulting from the resolution<br />

<strong>of</strong> this contingency will be accounted for as a charge to income in the period in which the settlement occurs.<br />

c) The <strong>College</strong> is committed to operating leases for <strong>of</strong>fice equipment and automobiles as follows:<br />

<strong>2004</strong>. . . . $150,913<br />

2005 . . . . . 122,510<br />

2006 . . . . . . 38,301<br />

2007 . . . . . . . 6,568<br />

$318,292<br />

<strong>2004</strong> . . . . . $15,966<br />

2005 . . . . . . 17,603<br />

2006 . . . . . . 19,408<br />

2007 . . . . . . 20,016<br />

$72,993<br />

7. Comparative Figures<br />

Certain <strong>of</strong> the comparative figures have been reclassified to conform with the current year’s presentation and to effect the correction<br />

<strong>of</strong> a prior period error as described in note 8.<br />

8. Correction <strong>of</strong> a Prior Period Error<br />

During fiscal <strong>2003</strong>, the <strong>College</strong> adopted the accrual basis <strong>of</strong> accounting for Investigations and Resolutions. The correction was<br />

accounted for retroactively with restatement <strong>of</strong> all prior periods reported. The effect <strong>of</strong> this correction on prior periods was treated as<br />

an adjustment <strong>of</strong> the opening balance <strong>of</strong> unrestricted net assets, decreasing the January 1, 2002 balance by $328,200 and the opening<br />

balance <strong>of</strong> accounts payable and accrued liabilities, increasing the January 1, 2002 balance by $328,200.<br />

18<br />

OCP • ANNUAL REPORT <strong>2003</strong>-<strong>2004</strong>