Distrito Escolar del - Osceola County School District

Distrito Escolar del - Osceola County School District

Distrito Escolar del - Osceola County School District

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

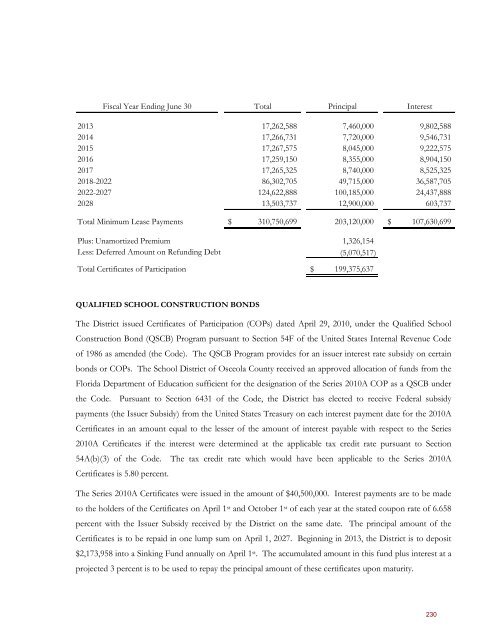

Fiscal Year Ending June 30 Total Principal Interest<br />

2013 17,262,588 7,460,000 9,802,588<br />

2014 17,266,731 7,720,000 9,546,731<br />

2015 17,267,575 8,045,000 9,222,575<br />

2016 17,259,150 8,355,000 8,904,150<br />

2017 17,265,325 8,740,000 8,525,325<br />

2018-2022 86,302,705 49,715,000 36,587,705<br />

2022-2027 124,622,888 100,185,000 24,437,888<br />

2028 13,503,737 12,900,000 603,737<br />

Total Minimum Lease Payments $ 310,750,699 203,120,000 $ 107,630,699<br />

Plus: Unamortized Premium 1,326,154<br />

Less: Deferred Amount on Refunding Debt (5,070,517)<br />

Total Certificates of Participation $ 199,375,637<br />

QUALIFIED SCHOOL CONSTRUCTION BONDS<br />

The <strong>District</strong> issued Certificates of Participation (COPs) dated April 29, 2010, under the Qualified <strong>School</strong><br />

Construction Bond (QSCB) Program pursuant to Section 54F of the United States Internal Revenue Code<br />

of 1986 as amended (the Code). The QSCB Program provides for an issuer interest rate subsidy on certain<br />

bonds or COPs. The <strong>School</strong> <strong>District</strong> of <strong>Osceola</strong> <strong>County</strong> received an approved allocation of funds from the<br />

Florida Department of Education sufficient for the designation of the Series 2010A COP as a QSCB under<br />

the Code. Pursuant to Section 6431 of the Code, the <strong>District</strong> has elected to receive Federal subsidy<br />

payments (the Issuer Subsidy) from the United States Treasury on each interest payment date for the 2010A<br />

Certificates in an amount equal to the lesser of the amount of interest payable with respect to the Series<br />

2010A Certificates if the interest were determined at the applicable tax credit rate pursuant to Section<br />

54A(b)(3) of the Code. The tax credit rate which would have been applicable to the Series 2010A<br />

Certificates is 5.80 percent.<br />

The Series 2010A Certificates were issued in the amount of $40,500,000. Interest payments are to be made<br />

to the holders of the Certificates on April 1 st and October 1 st of each year at the stated coupon rate of 6.658<br />

percent with the Issuer Subsidy received by the <strong>District</strong> on the same date. The principal amount of the<br />

Certificates is to be repaid in one lump sum on April 1, 2027. Beginning in 2013, the <strong>District</strong> is to deposit<br />

$2,173,958 into a Sinking Fund annually on April 1 st . The accumulated amount in this fund plus interest at a<br />

projected 3 percent is to be used to repay the principal amount of these certificates upon maturity.<br />

230