Newsletter

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Research • Center of Excellence SAFE • Quarter 1/2014<br />

I targeted our research on banks, insurers, hedge<br />

funds and brokers operating in the U.S. market.<br />

We proposed several econometric measures of<br />

connectedness based on principal component<br />

analysis and Granger causality networks applied<br />

to the monthly returns of the target institutions.<br />

The aim of our research was to capture the network<br />

of causal relationships between the largest<br />

financial institutions across the four types of institutions<br />

mentioned. Moreover, we tried to understand<br />

whether these measures of connectedness<br />

are meaningful indicators of the condition<br />

of the financial markets and to discover, in the<br />

light of the last financial crisis, which are the key<br />

banks, insurers, hedge funds and brokers as far as<br />

systemic risk is concerned.<br />

The empirical analysis conducted shows that the<br />

degree of connectedness increases before and during<br />

crises, and the pattern of the last financial crisis<br />

suggests that banks are more central to systemic<br />

risk than the so-called “shadow banking system”.<br />

Moreover, the proposed measures are able to reflect<br />

periods of market dislocation and distress<br />

with promising out-of-sample characteristics.<br />

“Sovereign, bank and insurance credit spreads:<br />

connectedness and system networks”<br />

As banking and insurance system risk has become<br />

an important element in the determination of sovereign<br />

risk and vice-versa, in this article (Billio et al.,<br />

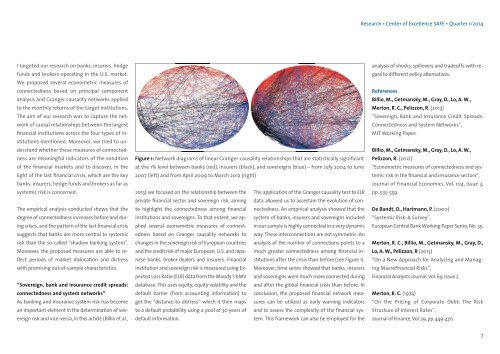

Figure 1: Network diagrams of linear Granger-causality relationships that are statistically significant<br />

at the 1% level between banks (red), insurers (black), and sovereigns (blue) – from July 2004 to June<br />

2007 (left) and from April 2009 to March 2012 (right)<br />

2013) we focused on the relationship between the The application of the Granger causality test to ELR<br />

private financial sector and sovereign risk, aiming data allowed us to ascertain the evolution of connectedness.<br />

An empirical analysis showed that the<br />

to highlight the connectedness among financial<br />

institutions and sovereigns. To that extent, we applied<br />

several econometric measures of connect-<br />

in our sample is highly connected in a very dynamic<br />

system of banks, insurers and sovereigns included<br />

edness based on Granger causality networks to way. These interconnections are not symmetric. An<br />

changes in the sovereign risk of European countries analysis of the number of connections points to a<br />

and the credit risk of major European, U.S. and Japanese<br />

banks, broker-dealers and insurers. Financial stitutions after the crisis than before (see Figure 1).<br />

much greater connectedness among financial in-<br />

institution and sovereign risk is measured using Expected<br />

Loss Ratio (ELR) data from the Moody’s KMV and sovereigns were much more connected during<br />

Moreover, time series showed that banks, insurers<br />

database. This uses equity, equity volatility and the and after the global financial crisis than before. In<br />

default barrier (from accounting information) to conclusion, the proposed financial network measures<br />

can be utilized as early warning indicators<br />

get the “distance-to-distress” which it then maps<br />

to a default probability using a pool of 30 years of and to assess the complexity of the financial system.<br />

This framework can also be employed for default information.<br />

the<br />

analysis of shocks, spillovers and tradeoffs with regard<br />

to different policy alternatives.<br />

References<br />

Billio, M., Getmansky, M., Gray, D., Lo, A. W.,<br />

Merton, R. C., Pelizzon, R. (2013)<br />

“Sovereign, Bank and Insurance Credit Spreads:<br />

Connectedness and System Networks”,<br />

MIT Working Paper.<br />

Billio, M., Getmansky, M., Gray, D., Lo, A. W.,<br />

Pelizzon, R. (2012)<br />

“Econometric measures of connectedness and systemic<br />

risk in the financial and insurance sectors”,<br />

Journal of Financial Economics, Vol. 104, Issue 3,<br />

pp. 535-559.<br />

De Bandt, O., Hartmann, P. (2000)<br />

“Systemic Risk: A Survey”,<br />

European Central Bank Working Paper Series, No. 35.<br />

Merton, R. C., Billio, M., Getmansky, M., Gray, D.,<br />

Lo, A. W., Pelizzon, R (2013)<br />

“On a New Approach for Analyzing and Managing<br />

Macrofinancial Risks”,<br />

Financial Analysts Journal, Vol. 69, Issue 2.<br />

Merton, R. C. (1974)<br />

“On the Pricing of Corporate Debt: The Risk<br />

Structure of Interest Rates”,<br />

Journal of Finance, Vol. 29, pp. 449-470.<br />

7