PAYE Guide - Kenya Revenue Authority

PAYE Guide - Kenya Revenue Authority

PAYE Guide - Kenya Revenue Authority

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

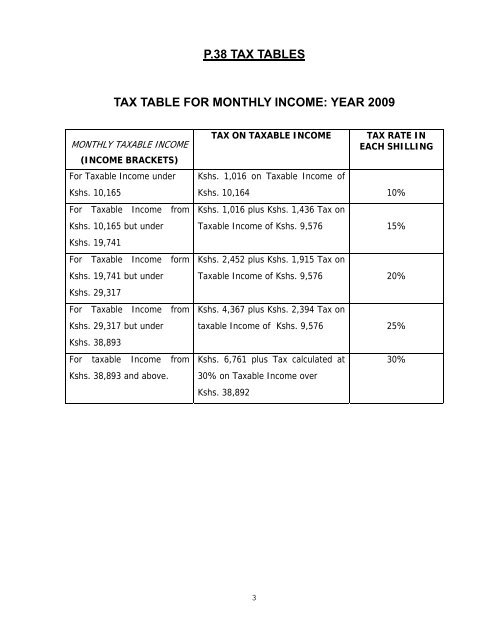

P.38 TAX TABLES<br />

TAX TABLE FOR MONTHLY INCOME: YEAR 2009<br />

MONTHLY TAXABLE INCOME<br />

(INCOME BRACKETS)<br />

For Taxable Income under<br />

Kshs. 10,165<br />

For Taxable Income from<br />

Kshs. 10,165 but under<br />

Kshs. 19,741<br />

For Taxable Income form<br />

Kshs. 19,741 but under<br />

Kshs. 29,317<br />

For Taxable Income from<br />

Kshs. 29,317 but under<br />

Kshs. 38,893<br />

For taxable Income from<br />

Kshs. 38,893 and above.<br />

TAX ON TAXABLE INCOME<br />

Kshs. 1,016 on Taxable Income of<br />

TAX RATE IN<br />

EACH SHILLING<br />

Kshs. 10,164 10%<br />

Kshs. 1,016 plus Kshs. 1,436 Tax on<br />

Taxable Income of Kshs. 9,576 15%<br />

Kshs. 2,452 plus Kshs. 1,915 Tax on<br />

Taxable Income of Kshs. 9,576 20%<br />

Kshs. 4,367 plus Kshs. 2,394 Tax on<br />

taxable Income of Kshs. 9,576 25%<br />

Kshs. 6,761 plus Tax calculated at<br />

30% on Taxable Income over<br />

Kshs. 38,892<br />

30%<br />

3