EFG Group Pillar 3 (pdf) - EFG Bank Group

EFG Group Pillar 3 (pdf) - EFG Bank Group

EFG Group Pillar 3 (pdf) - EFG Bank Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

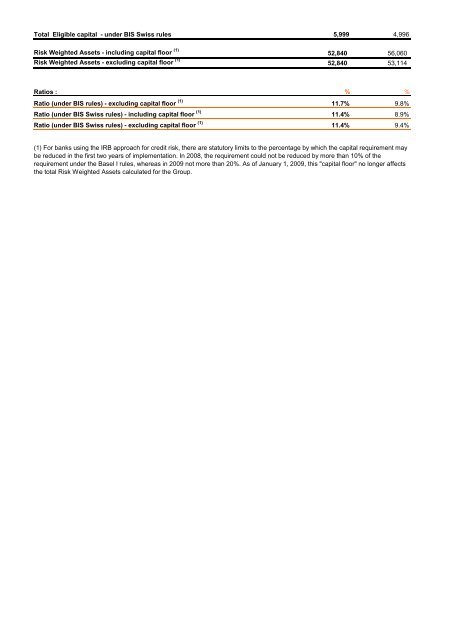

Total Eligible capital - under BIS Swiss rules 5,999 4,996<br />

Risk Weighted Assets - including capital floor (1)<br />

Risk Weighted Assets - excluding capital floor (1)<br />

52,840<br />

52,840<br />

56,060<br />

53,114<br />

Ratios : % %<br />

Ratio (under BIS rules) - excluding capital floor (1)<br />

Ratio (under BIS Swiss rules) - including capital floor (1)<br />

Ratio (under BIS Swiss rules) - excluding capital floor (1)<br />

11.7% 9.8%<br />

11.4% 8.9%<br />

11.4% 9.4%<br />

(1) For banks using the IRB approach for credit risk, there are statutory limits to the percentage by which the capital requirement may<br />

be reduced in the first two years of implementation. In 2008, the requirement could not be reduced by more than 10% of the<br />

requirement under the Basel I rules, whereas in 2009 not more than 20%. As of January 1, 2009, this "capital floor" no longer affects<br />

the total Risk Weighted Assets calculated for the <strong>Group</strong>.