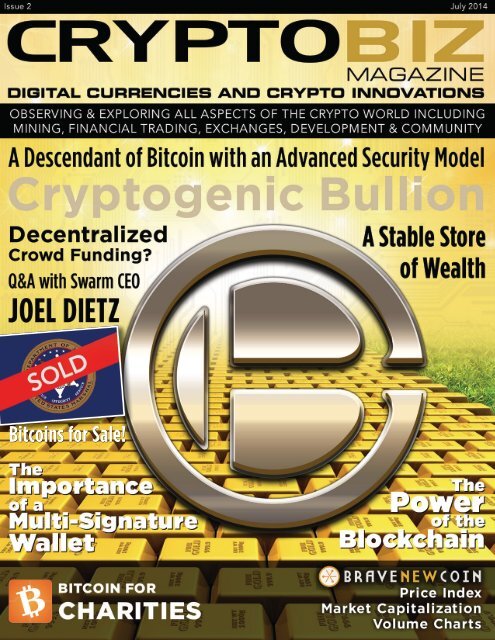

Crypto Biz Magazine—July, 2014/Issue.02

Digital Currencies & Crypto Innovations—We observe and explore all aspects of the crypto world, including mining, financial trading, exchanges, development and business.

Digital Currencies & Crypto Innovations—We observe and explore all aspects of the crypto world, including mining, financial trading, exchanges, development and business.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Bitcoins for Sale!

CONTENTS<br />

14<br />

26<br />

30<br />

The Power of The Blockchain:<br />

Future Developments and<br />

Applications<br />

by Dom Steil<br />

Why You Should Probably<br />

Be Using a MultiSig Bitcoin<br />

Wallet<br />

by Arianna Simpson<br />

<strong>Crypto</strong>genic Bullion and the<br />

Consultancy Culture<br />

by Brian Vereschagin<br />

Expert Advisory Board 9<br />

Visual Culture and <strong>Crypto</strong>currency 10<br />

by Nikki Olson<br />

<strong>Crypto</strong> <strong>Biz</strong> Magazine Page.4 July.<strong>2014</strong><br />

yesbitcoin 12<br />

by Branden Petersen<br />

Can Bitcoin Displace Gold as a Store of Value? 18<br />

by Ariel Deschappel<br />

Bitcoin for Charities 22<br />

by Piotr Piasecki<br />

<strong>Crypto</strong>Coin Social 32<br />

Q&A with Swarm 28<br />

Continued on page.8

<strong>Issue.02</strong><br />

July.<strong>2014</strong><br />

I AM SOSHI…<br />

Published by CRYPTO BIZ MEDIA,<br />

a division of CRYPTO BIZ GROUP<br />

Editor-In-Chief<br />

SOSHI<br />

Chief Operations Advisor<br />

TRENT NELLIS<br />

Chief Financial Advisor<br />

BARRY MORGAN<br />

Chief Technical & Media Advisor<br />

JAY ADDISON<br />

Senior VP of Business Development<br />

NATHAN WOSNACK<br />

Art Director<br />

VANESSA KING<br />

Social Media Crusader<br />

TYLER OMICHINSKI<br />

COVER DESIGN Jay Addison<br />

CONTRIBUTING WRITERS Oleg Andreev,<br />

Kristov Atlas, Gary Boddington, Sean<br />

Comeau, Ariel Deschappel, Susan Fourtané,<br />

Ben Isgur, Reed Jessen, Daniel Krawisz,<br />

Alexander Merricks, Vivek Nair, Phoenix<br />

Olivia, Nikki Olson, Jacob Payne, Branden<br />

Petersen, Piotr Piasecki, Arianna Simpson,<br />

Domenic Steil, Brian Vereschagin<br />

CRYPTO BIZ MAGAZINE<br />

PH3507 1111 West Pender St<br />

Vancouver BC CANADA<br />

V6E2B4<br />

TEL 1 844 CRYPTO1 (1 844 279 7861)<br />

E-MAIL contact@cryptobizmagazine.com<br />

www.cryptobizmagazine.com<br />

<strong>Crypto</strong> <strong>Biz</strong> Magazine assumes no responsi<br />

bility for unsolicited material. Opinions<br />

expressed herein are those of the authors<br />

and advertisers and do necessarily reflect<br />

those of CRYPTO BIZ GROUP, editors,<br />

advisors or staff. Readers are encour aged<br />

to thoroughly investigate and consult with<br />

a crypto financial advisor before embarking<br />

on any investment, speculation or financial<br />

opportunities. <strong>Crypto</strong> <strong>Biz</strong> Magazine makes<br />

no warranties or guarantees and we<br />

assume no lia bility regarding advertisements<br />

or editorial con tent or any claims<br />

that may arise from them. The contents<br />

of <strong>Crypto</strong> <strong>Biz</strong> Magazine are Copyright ©<br />

<strong>2014</strong>, all rights reserved. <strong>Crypto</strong> <strong>Biz</strong> Magazine<br />

may not be reproduced in whole or in part<br />

without the ex pressed written permission<br />

of CRYPTO BIZ GROUP.<br />

subscriptions@cryptobizmagazine.com<br />

for a FREE subscription to <strong>Crypto</strong> <strong>Biz</strong><br />

Magazine<br />

Receive our monthly editions delivered to<br />

you in the digital format of your choice.<br />

FOLLOW US ON<br />

I am Soshi and this is <strong>Issue.02</strong> of <strong>Crypto</strong> <strong>Biz</strong> Magazine. I welcome you to our journey<br />

into the futuristic world of crypto currency. Over the next decade, the world’s economy<br />

will be revolutionized by innovation and efficiency through the mass adoption of<br />

crypto currency, and its unlimited benefits and improvements on the current global<br />

economic models.<br />

Mankind’s creativity has always been driven by innovation and necessity. There is almost<br />

always a “better way” with which to achieve our goals, whether they are on an individual<br />

level or a global scale. Look at the evolution of finance and technology as a natural<br />

progression from the centuries-old centralized system we have all been beholden to. As<br />

a consumer, you can expect to see the infrastructure for Bitcoin growing around you.<br />

Recently, we have seen Overstock.com, Dish Network and Expedia boldly and proudly<br />

announce to the world that they are accepting Bitcoin. Our global economic substructure<br />

will experience an infiltration of payment gateways, implemented and accepted as<br />

seamlessly as the introduction of debit transactions were in the 1980s. Look for the<br />

official “Bitcoin” sticker in retail storefronts around the world, adjacent to the traditional<br />

VISA, Amex and MasterCard logos. Consumer adoption and confidence will innately grow<br />

as crypto currency and Bitcoin become familiar terms in the world’s vocabulary.<br />

In this issue we bring you an eclectic mix of articles surrounding crypto currency and<br />

goings-on in our sector. A descendant of Bitcoin with an advanced security model,<br />

our cover story is about <strong>Crypto</strong>genic Bullion. This is a hybrid concept that presents a<br />

strategy to buy and hold crypto currency as a commodity, in much the same way you<br />

would precious metals like gold and silver.<br />

US Marshals recently auctioned off nearly 30,000 Bitcoins seized from Silk Road, which<br />

was speculated to have negatively impacted the price of Bitcoin. However, this supply<br />

only strengthened the demand for Bitcoin, and the price actually rose nearly 7%. What<br />

does this tell us? Consumer confidence, buoyed by the US Government’s validation of<br />

Bitcoin, equals increased demand—and thus the price did, and will continue to, increase.<br />

You can read about the Silk Road Legacy of Dread Pirate Roberts inside.<br />

In late June there was a Bitcoin conference in Washington, DC. We have a review of<br />

Bitcoin in the Beltway by Ben Isgur that details the attendees, speakers and the general<br />

positive aura that accompanies this growing sector of finance. Innovation and community<br />

are the strong points in this space, and the reports we’ve had from those in attendance<br />

were very positive.<br />

The organizer of the Bitcoin in the Beltway conference was Jason King, the founder of<br />

Sean’s Outpost, a Pensacola, FL non-profit named after a deceased friend of Jason’s. His<br />

mandate has been to help the less fortunate in his area with Bitcoin donations. Bitcoin<br />

community members have proven to be compassionate and generous, as noted by<br />

Sean’s Outpost and another charitable organization, The Water Project. Our Advisory<br />

Board member, Piotr Piasecki, shows us the benefits of crypto currency for donations in<br />

Bitcoin for Charities.<br />

Finally, we very are proud to announce that Minnesota State Senator Branden Petersen<br />

recently joined our Advisory Board. Petersen was elected to the House in 2010. His<br />

legislative priorities include funding equity for schools with great needs but insufficient<br />

revenue, and “value-added” teacher evaluations that measure effectiveness by student<br />

progress, rather than teacher proficiency. Recently, Petersen announced that he’s<br />

founding a new non-profit, yesbitcoin, with a mission to communicate to people and<br />

organizations how Bitcoin works, and the ideas and infrastructure behind it.<br />

Read and enjoy. If you have feedback, including questions, please feel free to contact<br />

me at soshi@cryptobizmagazine.com.<br />

Enjoy! —S<br />

July.<strong>2014</strong> Page.5 <strong>Crypto</strong> <strong>Biz</strong> Magazine

THE EVOLUTION<br />

OF TRANSACTION<br />

SOLUTIONS<br />

SPECIAL ADVERTISING FEATURE<br />

Bitcoin offers merchants transaction fees that<br />

are much lower than other payment solutions<br />

With the excitement of all the various cryptocurrencies currently in the<br />

space, what sometimes is under-discussed is their role in the future<br />

of transactions. As merchants learn about the benefits of accepting<br />

cryptocurrencies like Bitcoin, skepticism will be met by the numerous<br />

advantages of using this type of protocol for payment.<br />

At BitPay we currently have 30,000 merchants, including higher profile<br />

clients like Gyft, TigerDirect and the NBA’s Sacramento Kings. While these<br />

forward thinking companies immediately saw the benefit of Bitcoin and<br />

were quick to jump aboard, the mainstream acceptance of Bitcoin also<br />

requires our smaller merchants that sell specialized items or services.<br />

Once skepticism and misinformation is quelled, the facts of Bitcoin as a<br />

payment method become crystal clear to many merchants.<br />

Through BitPay merchants pay 1% or less of their transaction amount<br />

(depending on volume) as a processing fee which is significantly less<br />

than other payment processing options. It’s the P2P nature of the Bitcoin<br />

network that enables this extremely low payment processing option. It’s<br />

also important to realize that Bitcoin is still in its infancy and other payment<br />

options have had 50 plus years to build their network and infrastructure.<br />

Bitcoin has been around since 2009 and in those five years the user<br />

experience for merchants and customers has become drastically easier.<br />

This will continue to improve as the open source platform develops.<br />

What’s important is for other Bitcoin companies in the space to contribute<br />

development time to ensure the protocol can grow properly. At BitPay,<br />

Bitcoin Core developer Jeff Garzik is a member of our team and we<br />

continue to contribute to the platform through projects such as Bitcore.<br />

One of our biggest hopes is as other startups grow that they will be able<br />

to expand their development teams to contribute to Bitcoin.<br />

Bitcoin users currently have various reasons to use the protocol;<br />

including technological, political, financial and economic. As merchant<br />

acceptance grows and education on the subject grows, the user base<br />

will diversify and the platform will become easier to use. We aren’t close<br />

to widespread acceptability in the same vein as a credit card, but it is<br />

something that the Bitcoin community is currently developing.<br />

An analogy I quite often make is to the music industry in the early 2000s.<br />

Napster forced record labels to change their business model to one that<br />

is more in line with what the consumers wanted. Some advantages that<br />

Bitcoin has over what happened with Napster include the existence<br />

of a global marketplace, venture capital investments and continued<br />

development of the protocol. The switch to digital was something that was<br />

confusing and scary for many music fans and the immediate resistance<br />

slowly faded away and business opportunities such as iTunes and Google<br />

Music came to make buying digital music easier and the preferred way<br />

to purchase a song. Bitcoin is controversial now because it’s challenging<br />

something that has been the same for a very long time. It’s more important<br />

to realize that, like any other technology, it becomes more mature and<br />

easier to use over time.<br />

Some of the smartest and most successful entrepreneurs in the world<br />

are embracing Bitcoin.<br />

These individuals see the long term potential in how it could drastically<br />

reduce payment costs as well as the global reach it has. BitPay has<br />

continued to bring credibility, excellent support and development of the<br />

platform to the community and that has resulted in being the market<br />

leader for Bitcoin Payment Processing. We also hope to continue to grow<br />

globally with new offices in San Francisco, New York City, Argentina<br />

and Amsterdam as well as a new location for our continuously growing<br />

Atlanta office.<br />

ACCEPT BITCOIN<br />

www.bitpay.com

CONTENTScontinued<br />

Boatcoin <strong>2014</strong> Debuts During The London Technology Week 34<br />

by Susan Fourtané<br />

Where does Accounting/ERP meet Bitcoin, Dollar, Euro & Yen? 36<br />

by Gary Boddington<br />

Dark Marketplaces Positioned to Accelerate the Collapse of Governments 38<br />

by Kristov Atlas<br />

The Legacy of the Dread Pirate Roberts 40<br />

by Daniel Krawisz<br />

Bitbasket Q&A 42<br />

by Jacob Payne<br />

OPENCL vs OPENGL for Mining 43<br />

by Vivek Nair and Alexander Merricks<br />

<strong>Crypto</strong> <strong>Biz</strong> Magazine Page.8 July.<strong>2014</strong><br />

What Makes a ‘Good’ Password Manager Good? 44<br />

by Sean Comeau<br />

Bitcoin and <strong>Crypto</strong>currencies: Prospects for Development in Russia 46<br />

Bitcoin Suppression via the Patent System 48<br />

by Reed Jessen<br />

A Personal Journey Down the Bitcoin Rabbit Hole 50<br />

by Phoenix Olivia<br />

Bitcoin in the Beltway—Who, What, and Where Is Charlie? 52<br />

by Ben Isgur<br />

Github Bitcoin Glossary 58<br />

by Oleg Andreev

EXPERT ADVISORY BOARD<br />

BLAKE ANDERSON<br />

BLAKE ANDERSON is an MIT<br />

educated cryptographic<br />

economist and computer scientist.<br />

Having worked in Fortune 25<br />

finance as a math based security<br />

project manager he now works with Bitcoin<br />

derivatives, contracts and financial products.<br />

Working full time with BTC behind the scenes for<br />

years prior to IRS direction Blake is now happiest<br />

when speaking publicly about technology<br />

empowering the individual. More about Blake at:<br />

cointelegraph.com/post/blake_anderson<br />

KRISTOV ATLAS<br />

KRISTOV ATLAS is a network<br />

security and privacy researcher<br />

who studies crypto-currencies.<br />

He is the author of Anonymous<br />

Bitcoin: How to Keep Your Ƀ<br />

All to Yourself, a practical guide to maximizing<br />

financial privacy with Bitcoin. Kristov is also a<br />

correspondent for the World <strong>Crypto</strong> Network,<br />

appearing regularly on the weekly roundtable<br />

show The Bitcoin Group, and host of Dark News, a<br />

show about un-censorship technologies.<br />

LISA CHENG<br />

LISA CHENG is the co-founder of<br />

Distributed.buzz and the CEO<br />

of the Vanbex Group. She is the<br />

force behind the popular news<br />

aggregation site BitcoinRegime.<br />

com and a behind the scenes advocate of<br />

Bitcoin 2.0 and blockchain technology. She<br />

comes from an accomplished background after<br />

having worked at Fortune 500 companies and<br />

technology startups involved with Big Data,<br />

algorithmic trading, and enterprise systems.<br />

Lisa’s time is now focused on consulting and<br />

planning for new cryptocurrency projects after<br />

having worked for the Mastercoin Foundation in<br />

leading the Business Development effort. She is<br />

located in Vancouver, British Columbia, Canada<br />

and you can reach her via Twitter @lisacheng.<br />

SUSAN FOURTANÉ, BA<br />

SUSAN FOURTANÉ, Science &<br />

Technology Journalist—Susan’s<br />

articles on diverse technology<br />

topics have appeared in various<br />

UBM Tech and UBM Electronics<br />

online publications since 2009, and on Helsinki Times<br />

and other publications since 2006. In February <strong>2014</strong><br />

Susan joined CryptØMiners’ Board of Advisors as<br />

Media Advisor. Susan on Twitter: @SusanFourtane.<br />

BRANDEN PETERSEN<br />

BRANDEN PETERSEN is the<br />

founding Executive Director<br />

and Chairman of the Board of<br />

yesbitcoin. Along with this work, he<br />

serves on the Financial Standards<br />

Working Group at The Bitcoin Foundation. Elected<br />

to the Minnesota House of Representatives in 2010<br />

and the Minnesota State Senate in 2012, Petersen<br />

currently represents the people of Senate District<br />

35 in Northwest Anoka County. His legislative<br />

accomplishments in education policy reform as well<br />

as citizen data privacy protections are among the<br />

notable items in his body of work as the youngest<br />

member of the State Senate. Along with his work in<br />

the public sector, Petersen has also been delivering<br />

strategic communications solutions for an array of<br />

non-profit and corporate clients as a Senior Counselor<br />

at Ainsley Shea Communications in St. Paul, MN.<br />

PIOTR PIASECKI, BSc MSc<br />

PIOTR PIASECKI is a Chief<br />

Scientist at Provable Inc, a<br />

Vancouver-based software<br />

development startup. Since<br />

discovering Bitcoin in 2011, he<br />

became a reputable member of the Bitcoin<br />

community under the nickname “ThePiachu.”<br />

Piotr wrote his Master’s thesis on the subject of<br />

Bitcoin security in Technical University of Lodz,<br />

in Poland. He is also a moderator of Bitcoin.<br />

StackExchange.com, /r/Bitcoin subreddit, runs<br />

a number of Bitcoin-focused websites, such as<br />

Vanity Pool and TestNet Faucet, as well as writes<br />

a blog on various cryptocurrencies.<br />

July.<strong>2014</strong> Page.9 <strong>Crypto</strong> <strong>Biz</strong> Magazine

VISUAL CULTURE AND<br />

CRYPTOCURRENCY<br />

by NIKKI OLSON<br />

Imagine yourself designing a<br />

new cryptocurrency. You develop<br />

the protocol and other specific<br />

software attributes, and perhaps<br />

you’ve already settled on a name<br />

for your currency. Now you’re at<br />

the point where you have to create<br />

your cryptocurrency’s imagery…<br />

How do you decide how it will<br />

look, and why?<br />

Creating and decoding the significance<br />

of visual attributes is an<br />

exercise in visual culture.<br />

What is “visual culture”?<br />

Visual culture refers to aspects of<br />

culture that are communicated or<br />

evidenced in visual mediums.<br />

It can refer to anything from<br />

explicit art to fashion, from<br />

logos to typefaces—essentially,<br />

it’s anything that corresponds<br />

to a culture that is<br />

processed visually.<br />

and paper currency being a source<br />

of nationalism and national iconography.<br />

For over 2.5 millennia, currency<br />

around the world has been a way in<br />

which countries have made visual<br />

their self-image, ideals, aspirations,<br />

history, mythology and many other<br />

things. The most common images<br />

on money are of people (commonly,<br />

national heroes), but also popular<br />

are buildings, local flora and fauna,<br />

the common themes communicate;<br />

and can design in this space be<br />

categorized in any way?<br />

A survey of top crypto currencies<br />

reveals that the digital aspect of<br />

cryptocurrency is a consistently<br />

highlighted and/or central attribute<br />

in design. Binary digits and/<br />

or circuitry are common, as are<br />

aesthetics denoting a futuristic kind<br />

of elegance and sheen. Another<br />

thing to note is the frequent<br />

use of historic and even ancient<br />

language symbols. The “D”<br />

character on the Devcoin, for<br />

instance, which also appears on<br />

Dogecoin, is the historic character<br />

“eth,” which is used in numerous<br />

languages of the Middle Ages,<br />

including Old English.<br />

Others reach even<br />

further back.<br />

Zetacoin<br />

uses the<br />

Greek<br />

Page.10 July.<strong>2014</strong><br />

<strong>Crypto</strong> <strong>Biz</strong> Magazine<br />

While there are many interesting<br />

visual facets to the<br />

cryptocurrency culture itself,<br />

in this piece I’ll focus on<br />

cryptocoin logos, elucidating<br />

the contrast between nationstate<br />

currency and cryptocurrency<br />

from a visual standpoint, as well as<br />

explore the common symbolism<br />

used in cryptocurrency design (and<br />

the meaning it conveys).<br />

The visual aspects of nation-state<br />

currency have a rich history, dating<br />

back to approximately 600 B.C. in<br />

Lydia (present-day Turkey), which<br />

is where the first coins with artistic<br />

symbols and pictures etched into<br />

them appeared (Standish, p.15).<br />

The Greeks quickly followed, and<br />

in both instances the images on<br />

coins were symbolic logos, often<br />

representing the city-states that<br />

were producing them. What would<br />

ensue would be a 2,600-year history<br />

of a globally shared practice of met al<br />

Examples of ancient Greek<br />

coins, which followed the first<br />

coins from Lydia, (present-day<br />

Turkey) 600 B.C.<br />

and methods of transportation.<br />

In general, the visual<br />

aspect of nation-state currency<br />

can be thought of as<br />

a source of citizen education,<br />

artistic enjoyment, and of course,<br />

communication and propagation<br />

of national values.<br />

It should be quite clear that the<br />

visual aspects of cryptocurrency<br />

are of a vastly different orientation.<br />

<strong>Crypto</strong>currency imagery almost<br />

unanimously takes the form of<br />

circular logos, often of 2 or 3 solid<br />

colors. There are of course a few<br />

significant counter-examples, which<br />

I will turn to in a moment, but first,<br />

I pose the question: what are the<br />

common visual themes? What do<br />

alphabet’s “Zeta,” and Primecoin<br />

uses its “Psi.”<br />

What kind of meaning is conveyed<br />

by historic lettering? One could<br />

argue that the addition of historic<br />

lettering serves to give the logo<br />

an official feeling, as well as to<br />

emphasize positive attributes of<br />

stability and longevity. In addition,<br />

some instances of ancient letters

(such as “zeta,” and the written version of megacoin<br />

(MSC) which uses the summation symbol), have crossover<br />

use in mathematics and engineering, giving<br />

these logos, in addition, connotations of “precision,”<br />

“intelligence” and “reason.”<br />

One area of the market where design in this space is<br />

perhaps most interesting, and in many cases more<br />

similar in nature to traditional currency, is in instances<br />

where cryptocurrency is designed for a particular<br />

group of people, such as a nationality, or groups with<br />

common interests.<br />

“Ideological coins” (for example Anoncoin and Franko<br />

Coin,) and novelty coins such as Dogecoin, also tend<br />

to appeal to specific cultural groups more intentionally<br />

in the logo.<br />

What does the future hold in terms of<br />

cryptocurrency’s visual space?<br />

As the cryptocurrency movement unfolds, it will be<br />

interesting to see the aesthetic relationship communities<br />

have with cryptocurrencies grow in richness and<br />

complexity. Some visual customs of nation-state<br />

currency, such as the use of “official-looking” script<br />

and culturally significant images, having been<br />

carried through to cryptocurrency design<br />

and I wouldn’t expect that to change.<br />

However, as our relationship with<br />

cryptocurrency grows and unfolds,<br />

the meaning we associate<br />

with crytpocoin imagery will<br />

continue to change and intensify.<br />

References:<br />

1. Standish, D. (2001). The Art of Money:<br />

The History and Design of Paper<br />

Currency from Around the World. San<br />

Francisco: Chronicle Books. —S<br />

Take, for instance, Aurora Coin, a coin created for<br />

Icelandic citizens. Given the nation-state context,<br />

we find ourselves back in a familiar place in terms<br />

of design, where visual attributes (and the name, in<br />

this instance) are connected to local geography and<br />

the history of the region. The image is of the Aurora<br />

Borealis, a significant phenomenon of the sky in the<br />

far north, and the character on the coin is a Viking<br />

Rune, the first letter of the Runic alphabet. The<br />

character means “wealth” or “cattle,” but also bears<br />

resemblance to a coniferous tree, which is a tree of<br />

the North. Another example is MazaCoin, which is the<br />

official reserve currency of the Oglala Lakota Tribe.<br />

The MazaCoin logo incorporates the colors of the<br />

Lakota medicine wheel. You can see the evolution of<br />

the logo here.<br />

NIKKI OLSON is an entrepreneur,<br />

Transhumanist writer, and<br />

Affiliate Scholar at the Institute<br />

for Ethics and Emerging<br />

Technology. She has a BA in<br />

Sociology and Philosophy and<br />

is now a student of Computer<br />

Information Systems at the<br />

University of the Fraser Valley.<br />

Contact inikki3@gmail.com.<br />

Her Bitcoin address is:<br />

1GRxv7cuPU2P25kMR78qp6vrX5n71uCogD<br />

July.<strong>2014</strong> Page.11 <strong>Crypto</strong> <strong>Biz</strong> Magazine

YESBITCOIN<br />

by EXECUTIVE DIRECTOR BRANDEN PETERSEN<br />

Page.12 July.<strong>2014</strong><br />

<strong>Crypto</strong> <strong>Biz</strong> Magazine<br />

For five years, Bitcoin advocates have<br />

helped build an ecosystem that has<br />

caught the attention and interest of the<br />

world’s most powerful institutions. Yet<br />

today, less than five million people worldwide<br />

use Bitcoins in their everyday purchases.<br />

Bitcoin remains an enigma to the mainstream<br />

consumer marketplace despite exponential<br />

growth in venture capital and number of<br />

commercial business entities. Bitcoin investors,<br />

users and commercial interests are depending<br />

on the adoption of Bitcoin as a mainstream<br />

currency with upside value heavily dependent<br />

upon its use as a currency in the everyday<br />

marketplace. In order for this to happen, the<br />

broader community of diverse interests must<br />

communicate effectively to the marketplace<br />

at-large, as well as key constituents who have<br />

a stake in the successful adoption of Bitcoin as<br />

a global currency and technology.<br />

To address the challenges, a 501(c)(3) non-profit<br />

organization named yesbitcoin will launch as the<br />

world’s first strategic, consumer—and merchantfacing<br />

communications effort on behalf of the<br />

world’s most prominently accepted crypto<br />

currency. yesbitcoin will focus primarily on<br />

driving understanding and acceptance of Bitcoin<br />

as a mainstream consumer technology.<br />

As Co-Founder and CEO of Coinbase recently<br />

said in an interview with CNBC about Bitcoin’s<br />

mainstream adoption, “The biggest hurdle<br />

is education.” But educating the broader<br />

marketplace is a challenge when talking about<br />

something that is inherently decentralized.<br />

The decentralized and diverse nature of Bitcoin<br />

interests and core constituents makes large-scale,<br />

focused communications and<br />

public relations an overwhelming<br />

challenge for the community.<br />

Individual business entities or<br />

interest groups, no matter how<br />

successful, will likely be unable<br />

or reluctant to “carry the water”<br />

for the Bitcoin ecosystem<br />

because those organizations<br />

will not be the sole, direct<br />

beneficiaries of such an effort.<br />

Any investment they make in<br />

large-scale communications on<br />

their own behalf will benefit<br />

competitors and the ecosystem at large.<br />

Secondly, Bitcoin interests can’t scale<br />

communications efforts in a way that makes<br />

economic sense for their organizations and<br />

business objectives. Again, the decentralized<br />

nature of the Bitcoin ecosystem makes<br />

informational and advocacy work on behalf of<br />

bitcoin use problematic. Of course, given that most<br />

consumers are unaware of Bitcoin, this educational<br />

advocacy must be done before a brand can even<br />

begin to talk about their own value.<br />

Bitcoin needs a single, recognizable, central<br />

advocate that can help the entire ecosystem by<br />

communicating on behalf of all interests on an

appropriate, strategic scale without the conflicts<br />

presented by proprietary interests—with a single<br />

objective of driving understanding, acceptance<br />

and use.<br />

yesbitcoin is the world’s first global nonprofit<br />

organization committed to demystifying the<br />

Bitcoin economy and increasing understanding,<br />

acceptance and use of Bitcoin. The<br />

yesbitcoin mission is to immediately become<br />

the solution to the problem of decentralized<br />

interest and lack of focused, strategic advocacy.<br />

Consumers and merchants are accustomed to<br />

advertising communications from the financial<br />

service industry. Visa, MasterCard, American<br />

Express and other financial service providers<br />

have been selling the benefits of their products<br />

for decades, and have paved the path that<br />

Bitcoin must travel. We seek to serve in this<br />

capacity on behalf of Bitcoin, with “retail”<br />

communications efforts that can be easily<br />

understood by the marketplace at large.<br />

yesbitcoin will operate in a collaborative, nonterritorial<br />

and transparent manner. We seek<br />

to be a partner in propelling Bitcoin into the<br />

mainstream. We will continue in the tradition of<br />

the broader Bitcoin community, and work with<br />

all interests to advance our cause.<br />

We are an organization that is dependent on<br />

donations from the community.<br />

DONATE TO: 1DV9NsxTsaLMbDaduS49oKcAEcpER4aqJX<br />

or at www.coinbase.com/yesbitcoin<br />

WEB SITE: www.yesbitcoin.org<br />

CONTACT US: at branden@yesbitcoin.org or call<br />

1 (763) 227-5444<br />

BRANDEN PETERSEN is the<br />

founding Executive Director<br />

and Chairman of the Board<br />

of yesbitcoin. Along with this<br />

work, he serves on the Financial<br />

Standards Working Group at<br />

The Bitcoin Foundation. Elected<br />

to the Minnesota House of<br />

Representatives in 2010 and the<br />

Minnesota State Senate in 2012,<br />

Petersen currently represents<br />

the people of Senate District 35 in Northwest Anoka County.<br />

His legislative accomplishments in education policy reform as<br />

well as citizen data privacy protections are among the notable<br />

items in his body of work as the youngest member of the State<br />

Senate. Along with his work in the public sector, Petersen<br />

has also been delivering strategic communications solutions<br />

for an array of non-profit and corporate clients as a Senior<br />

Counselor at Ainsley Shea Communications in St. Paul, MN:<br />

1GRxv7cuPU2P25kMR78qp6vrX5n71uCogD<br />

July.<strong>2014</strong> Page.13 <strong>Crypto</strong> <strong>Biz</strong> Magazine

THE POWER OF THE BLOCKCHAIN:<br />

FUTURE DEVELOPMENTS AND APPLICATIONS<br />

by DOM STEIL<br />

“Talent hits a target others can’t hit,<br />

Genius hits a target others can’t see.”<br />

—Arthur Schopenhauer<br />

mechanism of transfer and record. It is the “third-party”<br />

that is needed in so many of our current trust base<br />

models for various services. It is the “universal balance<br />

sheet” used to record and verify the most recent state<br />

of various digital ownerships.<br />

Page.14 July.<strong>2014</strong><br />

<strong>Crypto</strong> <strong>Biz</strong> Magazine<br />

The sentiment surrounding Bitcoin has transformed.<br />

It has gone from being the anonymous payment<br />

mechanism to facilitate illegal transactions, to a<br />

speculative digital bubble with no intrinsic value, to<br />

what industry leaders are now calling the greatest<br />

and most disruptive technological breakthrough since<br />

the Internet.<br />

The paradigm has shifted; entrepreneurs and worldclass<br />

venture capital firms are teaming up to improve<br />

the efficiency and effectiveness of this new payment<br />

ecosystem through:<br />

online exchanges<br />

single-signature wallets<br />

multi-signature wallets<br />

merchant integration services<br />

B2B enterprise solutions<br />

mobile user applications<br />

So far, what has been built is a secure and effective<br />

means to “pay” someone else without the need for a third<br />

party. It is simply a global transfer of ownership mechanism<br />

using a mathematically distributed digital asset<br />

that is growing in scarcity because of an increase in<br />

the awareness of its namespace and purposiveness.<br />

It is a decentralized peer-to-peer (P2P) transfer of<br />

ownership protocol using a time-stamping mechanism,<br />

and ultimately, it works.<br />

The underlying technology that facilitates the transfer<br />

of bitcoins, the blockchain, the namespace not in the<br />

headlines, is what will transform almost every domestic<br />

and international vertical market. The blockchain is<br />

intrinsically powerful in that it is the backbone of<br />

this new type of open source, verifiable, distributed<br />

The blockchain is the foundation for so much more<br />

than just a payment network in the same way the<br />

Internet is the foundation for so much more than just<br />

e-mail. If the blockchain is what’s important, then<br />

“Bitcoin” is simply the global onloading mechanism.<br />

It is the first tier, an introduction to a new age of<br />

what is possible through decentralized networking<br />

and computing.<br />

Tier 1: A Decentralized Digital Currency and Payment<br />

Network<br />

Why is Bitcoin being developed in the form of<br />

multiple online exchanges and wallets based on<br />

geographical location and currency?<br />

What if there was one was global exchange that<br />

allowed anyone to buy and sell any form of digital<br />

or physical asset regardless of location in world?<br />

How could a global asset exchange such as this<br />

increase the security, transparency, and efficiency<br />

of global finance and trade?<br />

Tier 2: Decentralized Networks and Development<br />

Platforms<br />

Why are digital currencies the only things being<br />

built up on top of this blockchain technology?<br />

What if anything that could logically be expressed<br />

in code could be implemented on a blockchain?<br />

How could this type of network and platform be<br />

adopted by the global economy?<br />

This concept has the namespace of “Ethereum,” “Eris”<br />

(on Ethereum), “Colored Coins,” “Smart Contracts,”<br />

“Bitcoin 2.0,” and “Sidechains.”<br />

The crux of this whole phenomenon is that “Bitcoin” is<br />

a currency application to the blockchain.<br />

Ethereum wants to make it so ANY type of deal,<br />

organization, service, or system, can be decentralized. It<br />

just requires the parties involved to set the parameters<br />

expressed in code. So what will be built on top of the<br />

Ethereum network for consensus verification?

Third-party Trust Models<br />

Real Estate escrow between parties can be<br />

implemented using multi-signature contracts<br />

Insurance Policies can be engrained<br />

in the blockchain<br />

Digital Commodity Pricing<br />

Commodities pegged at consensus-aggre gated<br />

value<br />

Weather Based Contracts<br />

Contract premiums based on seasonal conditions<br />

A Farmer makes an insurance agreement based<br />

upon rainfall data<br />

File and Data Storage<br />

Proof of Existence on Bitcoin Blockchain<br />

Dropbox/Box-type cloud storage<br />

Enterprise storage, buy space from others on<br />

the network<br />

Smart Contracts and Escrow<br />

Hedging accountability<br />

No option of default<br />

Signatures<br />

Docusign<br />

Multi-signature to set proportional abilities on<br />

access to assets given a certain number of keys<br />

Private Keys to Share Economy Assets<br />

Home and Apartment Leases<br />

Home and Apartment Keys<br />

Hotel Keys<br />

Airbnb<br />

Car and Ride Leases<br />

Car and Ride Keys<br />

Autonomous Vehicles<br />

Safety Deposit Box Keys<br />

Package Delivery Keys<br />

Permits to Controlled Assets<br />

Guns<br />

Prescriptions<br />

Timestamped verifiable access<br />

Audit and Financial Services<br />

Taxes<br />

Returns<br />

Gambling and Betting<br />

Proof of a Bet<br />

Indisputable<br />

APIs with Global Mobile Banking<br />

MPesa<br />

WeChat<br />

Alipay<br />

Non-Disclosure Agreements<br />

Timestamped Verification<br />

Patents, Copyrights, and Trademarks<br />

Timestamped Intellectual Property Rights<br />

Payment Processors<br />

DAOs (Decentralized Autonomous Organizations)<br />

An organization run and bound by code<br />

Domain Names<br />

Namecoin<br />

First to exist<br />

ICANN Replacement<br />

Governance<br />

Opt-In<br />

Laws consensus driven<br />

Voting Systems and Records<br />

Reputation Systems<br />

Online Identification Systems and Records<br />

Medical Records<br />

Incentivized Truth Consensus Crowdsourcing<br />

Range of n inputs for a sought after accurate condition<br />

or state of n, correct answers are rewarded x<br />

What is actually enabling individuals to trade any<br />

amount of bitcoin, regardless of their location in the<br />

world? “Mining.”<br />

The cryptographic time-stamping mechanism that<br />

replaces centralized authority with community<br />

consensus. The blockchain needs miners to survive.<br />

It needs nodes to verify valid blocks with valid<br />

transactions.<br />

What if the mining becomes centralized, thus Bitcoin<br />

becomes centralized? It is now self-evident to anyone<br />

who has been following the development of this<br />

cryptocurrency that the “mining” and “the blockchain”<br />

are what really matter.<br />

July.<strong>2014</strong> Page.15 <strong>Crypto</strong> <strong>Biz</strong> Magazine

Page.16 July.<strong>2014</strong><br />

<strong>Crypto</strong> <strong>Biz</strong> Magazine<br />

The incentivized mining mechanism is what should make<br />

this ecosystem thrive, not the companies building a new<br />

type of wallet or security feature.<br />

User adoption isn’t people buying up, holding and<br />

dumping after a price increase, it’s about people<br />

mining, becoming another node, therefore increasing<br />

the security and transaction volume capacity of the<br />

network. It’s those people realizing they can be part of<br />

a truly empowering decentralized global network. The<br />

network effect is what makes this technology powerful,<br />

its functionality as a type of distributed consensus<br />

technology increases over time.<br />

So the Bitcoin blockchain is being “mined” for a<br />

currency because it’s catching on, people are starting<br />

to accept it, online and offline. There is incentive.<br />

For all of these other future blockchain applications<br />

to work, you need people to mine “ether” from the<br />

Ethereum blockchain. I don’t know if I will be able to<br />

spend “ether” anytime soon, but the important thing is<br />

that if given the right incentives, a blockchain has the<br />

potential to become very powerful.<br />

Create an incentive for people to decentralize a type<br />

of process:<br />

Bitcoin<br />

Create a platform that allows people to decentralize<br />

any type of process:<br />

Ethereum<br />

Additional Reading on this:<br />

Tomorrow’s Apps Will Come From Brilliant<br />

(And Risky) Bitcoin Code<br />

By PRIMAVERA DE FILIPPI<br />

Wired<br />

The coming digital anarchy<br />

By MATTHEW SPARKES<br />

Deputy Head of Technology<br />

The Telegraph<br />

Think the Internet’s disruptive? Hold tight for<br />

blockchain<br />

DOM STEIL is an entrepreneur from<br />

the Silicon Valley. He is well-versed in<br />

a variety of technological fields and<br />

has experience as a business analyst<br />

at the international enterprise level.<br />

For more information, visit his blog at<br />

www.dominicsteil.wordpress.com.<br />

Dom also accepts Bitcoin tips to:<br />

1FiYresjQP7GV9EUxr9fudWm3Xz7WC2VMC<br />

By PHIL WAINEWRIGHT<br />

diginomica<br />

—S

VeriCoin<br />

50% of the Multi-pool fees will go to the VeriFund,<br />

services for VeriCoin will be paid from the VeriFund.<br />

Proof-of-Stake Verified.<br />

Proof-of-Work Distributed.<br />

Network-Stake-Dependent Interest.<br />

www.vericoin.info/verifund.html<br />

Donate:<br />

VRC: VTHZfUg11wEJmSgBLUcmCKGYekuqFcGHQq<br />

BTC: 1LRWAyE3WKwTzXszEmtqKXzikQvoq7NJBa<br />

www.vericoin.info

CAN BITCOIN<br />

DISPLACE GOLD AS<br />

A STORE OF VALUE?<br />

by ARIEL DESCHAPPEL<br />

Page.18 July.<strong>2014</strong><br />

<strong>Crypto</strong> <strong>Biz</strong> Magazine<br />

After several high profile arrests, the<br />

collapse of its once biggest exchange,<br />

and many other setbacks and<br />

scandals, Bitcoin is still around… and<br />

kicking as hard as ever. The price of a bitcoin<br />

has rebounded over 70% since April, and<br />

venture capital continues to be injected into<br />

the ecosystem.<br />

In May, the Bitcoin payment processor BitPay<br />

raised $30 million in a funding round that included<br />

major players such as billionaire investor Sir<br />

Richard Branson.<br />

Also in May, the leading Bitcoin mining hardware<br />

manufacturer, BitFury, closed its own additional<br />

funding round of $20 million.<br />

Circle Financial, another Bitcoin startup, has<br />

raised $26 million to-date and recently just<br />

unveiled its first consumer service, aimed at<br />

making it as easy as possible for the mainstream<br />

to use Bitcoin.<br />

Perhaps most interestingly, Euro Pacific<br />

Precious Metals—one of the world’s largest<br />

gold and silver dealers by volume—has started<br />

accepting Bitcoin payments. Euro Pacific<br />

Precious Metals was founded by Peter Schiff,<br />

gold bug, and since early 2013, one of the<br />

leading vocal critics of Bitcoin.<br />

So why this seemingly sudden development?<br />

Has Peter Schiff altered his opinion on Bitcoin<br />

and “crypto currencies”?

Not according to his brief<br />

interview with CoinDesk,<br />

where he states that this is<br />

simply a strategic move, and<br />

proceeds to reiterate some<br />

of his previous objections<br />

to Bitcoin. Ultimately, Schiff<br />

still believes gold is better<br />

than Bitcoin.<br />

Oddly enough, extreme<br />

skepticism of Bitcoin is<br />

quite possibly the only<br />

thing Peter Schiff and<br />

Paul Krugman—the New<br />

York Times writer who<br />

penned ‘Bitcoin is Evil’—<br />

truly have in common. For<br />

Krugman this makes<br />

sense given his traditional<br />

background in favor of<br />

large government spending,<br />

regulation, Federal stimulus<br />

programs, etc. All policy<br />

recommendations whose principles stand in stark<br />

contrast to Bitcoin. Yet Schiff is another matter,<br />

and may simply be too beholden of gold to let<br />

it go so easily. So how do gold and Bitcoin really<br />

match up?<br />

Mr. Schiff has several objections to Bitcoin, all I<br />

believe stem from a lack of appreciation for its<br />

many technical intricacies. For starters, Mr. Schiff<br />

is perturbed by the fact that Bitcoin is backed by<br />

nothing. Critics like Schiff claim its value can go<br />

from thousands of dollars to zero at any time,<br />

leaving owners holding the bag. Gold, on the<br />

other hand, can always be melted down into<br />

jewelry, and used in many industrial applications.<br />

However, the large bulk of the demand for gold<br />

comes from its value as a hedge against inflation<br />

and as an investment. These two uses make up<br />

the vast majority of its demand.<br />

Now it’s important to realize that thinking of Bitcoin<br />

as “not real” is a silly mistake. It may only exist in the<br />

digital realm, but Bitcoin is cryptographically hardwired<br />

to have a limited supply of only 21 million<br />

units. This scarcity is very real, and even more<br />

transparent and assured than gold. Further, these<br />

limited units have utility. They can be transferred<br />

all over the world almost instantaneously and at<br />

practically no cost. Bitcoins have utility because<br />

they are the only unit of value on the planet that<br />

can boast such global efficiency.<br />

It’s an extremely powerful means of transferring<br />

value in the digital world, at the same speed we<br />

can transfer information, something that had<br />

eluded us until Satoshi’s original white paper.<br />

If Bitcoin is not “backed” by anything in the<br />

traditional sense, it’s because bitcoins are already<br />

“something” themselves. Each bitcoin is a unique,<br />

unreplicable unit—much like gold. But where<br />

gold first gained value from its aesthetic appeal,<br />

Bitcoin gains its value from its built-in global<br />

payments network, and technological advantages.<br />

Once you realize that Bitcoin is as “real” as<br />

any other limited good with value, you realize<br />

both Bitcoin and gold play by the same market<br />

rules. If, for whatever reason, everyone decided<br />

tomorrow that gold wasn’t pretty anymore, and<br />

Bitcoin became useless as a means of exchange,<br />

then both would indeed collapse in price. In<br />

that situation the fact that gold holders have<br />

something physical left over is a moot point if it<br />

isn’t worth much. The only advantage gold really<br />

has in this respect is a multi-millennia track record<br />

of holding value, while Bitcoin is admittedly far<br />

newer and therefore carries inherently more risk.<br />

However these risks are easily identifiable, so to<br />

render Bitcoin useless or totally insecure as a<br />

means of exchange (and thus worthless) would<br />

require either a catastrophic internal bug, or<br />

some other mass loss of confidence in favor of a<br />

superior “cryptocurrency.”<br />

The odds of a catastrophic glitch being discovered<br />

at this point is practically zero, as Bitcoin is open<br />

source software that has been scrutinized, tested,<br />

and tweaked by legions of programmers and<br />

computer scientists over the past 5 years. While<br />

there are a number of smaller internal issues<br />

July.<strong>2014</strong> Page.19 <strong>Crypto</strong> <strong>Biz</strong> Magazine

Page.20 July.<strong>2014</strong><br />

<strong>Crypto</strong> <strong>Biz</strong> Magazine<br />

and debates that you can spend weeks reading<br />

into, none of them spell the doom of Bitcoin. As<br />

for a mass exodus to another digital currency,<br />

in order to supplant the massive first mover<br />

and networking advantage<br />

Bitcoin has, it better have<br />

features that far surpass it,<br />

and it’s hard to beat instant,<br />

and virtually free. More likely<br />

Bitcoin will be the “Facebook”<br />

of digital currencies, with<br />

newer ones with specialized<br />

features appealing to<br />

niches that may be sizable<br />

in themselves but won’t<br />

threaten the incumbent. Gold<br />

originally became soughtafter<br />

because of its luster,<br />

and will always retain some<br />

kind of value because of this<br />

property. Similarly a Bitcoin<br />

will always have value as long<br />

as the network continues to<br />

function, something that its<br />

decentralized architecture ensures as there is no<br />

one point of failure.<br />

In a debate with Stefan Molyneux of Freedomain<br />

Radio, Mr. Schiff commented, in regards to<br />

Bitcoin, “A currency backed by something is<br />

always better than a currency backed by nothing.”<br />

To be fair, in a world of precious metals and fiat<br />

cur rencies, this is an accurate statement. Modern<br />

day fiat currency is merely a tool leveraged by<br />

governments to help finance unsustainable<br />

spending and debt. In the United States the<br />

dollar has lost 97% of its purchasing power since<br />

the abolition of Bretton Woods in 1971, deficit<br />

spending continues to spiral out of control,<br />

and as of 2011 the largest holder of US debt is<br />

the Federal Reserve. Contrary to the delusions<br />

of some, like Paul Krugman, there is no reality<br />

where this ends well. All of these developments<br />

have only been made possible by fiat currency,<br />

and the power of the printing press. The opposite<br />

of this monetary system was the Classical Gold<br />

Standard, which tied currencies to the supply<br />

of gold. That is the primary purpose of any<br />

commodity-based currency: to prevent the<br />

unlimited, unsustainable, and arbitrary printing of<br />

currency by a central authority.<br />

While there is certainly a certain allure to a tangible<br />

and physical store of value like gold, this should<br />

not be confused as a superior monetary property<br />

in regards to Bitcoin. In fact the physical nature of<br />

gold has a number of major disadvantages in that<br />

regard. Let’s use a hypothetical example Mr. Schiff<br />

presents on a number of occasions to illustrate<br />

this point: A gold-backed digital currency. Actually<br />

it’s not a hypothetical, as it has been attempted a<br />

number of times and failed. There are a number<br />

of problems with a gold- or commodity-backed<br />

currency today, and the simple way to sum them<br />

up is centralization. To back a digital currency<br />

with gold requires a place to hold all this gold, be<br />

it a Swiss bank or Fort Knox, and the capital to<br />

support all of that storage and overhead. This all<br />

requires trust in the party holding the gold, in the<br />

infrastructure running the digital currency to be<br />

maintained properly, etc.<br />

At the end of the day, this is not only massively<br />

expensive but it’s pointless. What this system<br />

ultimately tries to accomplish is a modern form<br />

of the classical gold standard. A digital currency<br />

that can indeed be traded and transferred<br />

instantly but is fundamentally limited in supply.<br />

However if the ultimate goal of tying a currency<br />

to a commodity is to create scarcity, and therefore<br />

ensure its sustained value, then why bother with<br />

these shenanigans at all? The technology behind<br />

Bitcoin fundamentally allows for hard-coded<br />

scarcity, doing away with the need to be tied<br />

down to a commodity to keep supply limited. In<br />

fact the most important quality gold has in terms<br />

of securing its value is its scarcity. If it rained from<br />

the sky, or a massive super reserve was discovered<br />

and mined, for all its aesthetic appeal it would<br />

still be worthless. Bitcoin perfectly employs the<br />

great attribute of scarcity that has allowed gold<br />

to exist as a standard of value in countless world<br />

civilizations for thousands of years.<br />

But having that scarcity be physical can actually be a<br />

downside. Gold-backed digital currencies all had one<br />

major reason for failure due to their centralization:<br />

government shutdown. You see, governments aren’t

fond of the idea of losing their monopoly on money.<br />

A central location with hoarded gold backing up a<br />

digital currency is easy to put pressure on, or in<br />

extreme cases, confiscate—an event that actually<br />

has precedence in the United States. Bitcoin, on the<br />

other hand, exists over the Internet with no central<br />

point of control. Short of Armageddon, it can never<br />

be shut down, and can<br />

never be confiscated.<br />

You may correctly think<br />

that a gold-backed di gital<br />

currency would have a<br />

price stability advantage,<br />

which is certainly true<br />

today. That is because<br />

gold, having existed for<br />

thousands of years, has<br />

already experienced repeated<br />

price discovery,<br />

while Bitcoin is still up<br />

in the air. Fortunately,<br />

fundamental logic would<br />

suggest that the higher the Bitcoin market cap<br />

and daily volume rises, the more stable the price<br />

will be. Take the dollar, which—like Bitcoin—<br />

is backed by nothing and has value that is<br />

determined entirely by supply and demand. The<br />

dollar, however, is used every day by hundreds of<br />

millions of people, and, as a result, its day-to-day<br />

value is very stable. Theoretically, the dollar at the<br />

market size of Bitcoin would be just as volatile, and<br />

Bitcoin used at the level of the dollar would be just<br />

as stable. Of course the difference is that bitcoins<br />

are limited in supply while dollars are not.<br />

The question is, can Bitcoin crawl up to levels of<br />

greater usage and thus stability? It’s actually a bit<br />

of a paradox, as greater amounts of people would<br />

only be confident using Bitcoin if it was more<br />

stable, and it won’t get more stable until greater<br />

amounts of people use it. This makes it an uphill<br />

battle for adoption, one that is unprecedented as<br />

far as technological advancements go. However,<br />

the potential benefits of Bitcoin, if widely<br />

adopted, are clear, even if it could take a while.<br />

Goldman Sachs estimates $210 billion could be<br />

saved a year globally by Bitcoin, and that’s only<br />

the economic benefit that’s easily measurable.<br />

It’s impossible to even contemplate how<br />

much economic damage is done in the form<br />

of artificially inflated bubbles from rampant<br />

and irresponsible government money printing,<br />

not to mention the theft of the purchasing<br />

power of citizens to fund what would otherwise<br />

meet violent opposition if it required increased<br />

taxes. Finally, Bitcoin is an open platform that<br />

allows for permissionless innovation, much like<br />

the Internet, allowing for an untold number of<br />

applications and useful subsystems to be added<br />

to it in the future. Gold doesn’t have even a<br />

medi ocre chance of matching any of these<br />

technological achievements.<br />

In ancient times, gold used as a ubiquitous<br />

means of exchange was a revolution in trade<br />

and com merce. It<br />

was, and remains,<br />

easily di visible, limited<br />

in supply, durable<br />

and impossible to<br />

counterfeit. However,<br />

Bitcoin represents a<br />

similar revolution in<br />

money, combining the<br />

fundamental values<br />

of gold as money and<br />

implementing it in a worldwide decentralized system<br />

with no borders, no artificial barriers, and<br />

with total monetary freedom. It instills the ability<br />

in all owners, whether wealthy venture capitalists,<br />

or a merchant in Zimbabwe with a cell phone, to<br />

send money instantaneously around the world<br />

without any middlemen, at close to no cost.<br />

Bitcoin is the embodiment of both sound money,<br />

and a new age of unprecedented global trade<br />

and economic freedom. Gold will always have its<br />

historic past, but the future belongs to Bitcoin. —S<br />

ARIEL DESCHAPELL<br />

is an enthusiastic Bitcoin<br />

community organizer, analyst,<br />

writer, and entrepreneur. Since<br />

first hearing about Bitcoin<br />

he has been on a mission to<br />

correct the vast amount of<br />

misinformation circulating<br />

about Bitcoin online, article<br />

by article. He is a Miami born<br />

Cuban-American, and attends<br />

Florida International University<br />

for finance. In his spare time he enjoys reading, eating, playing<br />

Halo, and mountain climbing. Ariel accepts Bitcoin tips:<br />

1D9P94wkZNvaDVei4q8iYS9zKKkHgbRjLG<br />

July.<strong>2014</strong> Page.21 <strong>Crypto</strong> <strong>Biz</strong> Magazine

BITCOIN FOR<br />

CHARITIES<br />

by PIOTR PIASECKI<br />

Page.22 July.<strong>2014</strong><br />

<strong>Crypto</strong> <strong>Biz</strong> Magazine<br />

The Bitcoin technology has a lot to offer to the<br />

non-profit sector. This message permeated the<br />

Bitcoin in the Beltway conference. It doesn’t<br />

matter whether you’re feeding the homeless like<br />

Sean’s Outpost, building water wells through The<br />

Water Project, or mapping the asteroids floating<br />

in our solar system with B612 Foundation, the<br />

Bitcoin community wants to give you money,<br />

and it will go out of its way to make sure you<br />

can accept it.<br />

Using Bitcoin can be a challenge in itself, let<br />

alone using it in your business. However, there are<br />

many great services that take care of everything<br />

for you. For example, BitPay will accept Bitcoin<br />

payments and donations on your behalf, convert<br />

the money into your local currency of choice and<br />

deposit it into your account in a matter of days.<br />

Moreover, if you are a registered charity or nonprofit,<br />

they will do it for free, end-to-end. No<br />

setup fees, no transaction fees, no withdrawal<br />

fees, nothing. All a non-profit needs to do is set<br />

up with the service, put a widget or a QR code<br />

on their website and it’s done.<br />

If that still sounds too complicated, or like<br />

too much of a hassle for your charity, another<br />

organization by the name of Bitcoin 100 will<br />

gladly help you go through the process. In<br />

addition, once you start accepting funds on your<br />

website, they’ll give you the equivalent to $1000<br />

in Bitcoin for your trouble. No strings attached.<br />

While this amount might just pay for the effort<br />

of setting everything up in the West, that can be<br />

a sizable contribution in developing countries.<br />

And that’s only a start…

The Bitcoin community loves to support<br />

charities in its space. The Celebrity of Bitcoin<br />

non-profits is by far Sean’s Outpost, a homeless<br />

outreach from Pensacola, FL. In their first year<br />

of operation (they recently celebrated their oneyear<br />

anniversary) they fed over 60,000 meals to<br />

the homeless, handed out 1,000 blankets, got<br />

nine people off the street permanently, created<br />

a Satoshi Forest homeless sanctuary, and much<br />

more. They raised about 733 bitcoins in total<br />

for their cause and are going so strong they<br />

are planning on setting up new charters all over<br />

the US and in Canada. The message couldn’t be<br />

clearer—Bitcoiners love nonprofits.<br />

Another important thing to remember is that<br />

Bitcoin can thrive under oppression. Women’s<br />

Annex Foundation is a charity aiming to bring<br />

digital literacy to women in Afghanistan and other<br />

countries. While in the Western world one takes<br />

access to banks for granted, it is a struggle in devel -<br />

oping countries. Traveling long distances to a bank,<br />

the danger of robbery when carrying a lot of money,<br />

women unable to open bank accounts without<br />

their husband’s consent—a reality for many people.<br />

Bitcoin changes all of that. One can easily use<br />

Bitcoin with SMS through 37Coins, or a number<br />

of online wallets on a smartphone. Transactions<br />

are cheap, Bitcoin does not discriminate against<br />

anyone and you can use it everywhere. Not only<br />

can Bitcoin technology help charities, it might be<br />

the only way for some people to receive money.<br />

When you’re talking about money,<br />

you also have to keep in mind how<br />

difficult and expensive it is to send<br />

money to some places in the world.<br />

PayPal doesn’t support many coun -<br />

tries (complete list of unsupported<br />

countries), countries such as Haiti,<br />

Iran or Pakistan. Sending $100 to<br />

these countries through Western<br />

Union can cost as much as $12, and<br />

the ratio gets worse with smaller<br />

amounts. With Bitcoin, no amount<br />

is too small. It’s actually economically<br />

feasible to donate one<br />

dollar or less to a charity half a<br />

world away, and know they’ll<br />

receive that money instantly.<br />

A charity in a third world country<br />

can solicit direct donations from<br />

anyone on the Internet without<br />

having to rely on third par ties<br />

or having to pay an arm and a leg<br />

for the privilege.<br />

Lastly, Bitcoin protects the<br />

charities from fraudulent “donors” and charge -<br />

backs. You hear those stories every now and<br />

then about someone who steals credit<br />

card information and decides to be a<br />

“generous” Robin Hood and donate some<br />

of the stolen money to a charity. A few weeks or<br />

months down the line that charity receives a massive<br />

chargeback on their account, for money they’ve<br />

already spent, because it came from a fraudulent<br />

source. Despite accepting the money in good faith,<br />

the charity suffers. Bitcoin donations are like cash,<br />

once they’re given, that’s it—there is no taking<br />

it back.<br />

Not only do Bitcoin enthusiasts love charities,<br />

they go out of their way to support them. The<br />

Bitcoin technology boosts existing charities<br />

and enables new non-profits to form where<br />

they couldn’t before. So if you’re donating<br />

to a charity, let them know about Bitcoin and<br />

why they should accept it. If you are a charity<br />

or a non-profit, give Bitcoin a go—it costs you<br />

nothing to try and who know how many people<br />

will shower you with their coins and affection. —S<br />

PIOTR PIASECKI is a Chief Scientist at Provable Inc, a<br />

Vancouver-based software development startup. Since discovering<br />

Bitcoin in 2011, he became a reputable member of the Bitcoin<br />

community under the nickname “ThePiachu.” Piotr wrote his<br />

Master’s thesis on the subject of Bitcoin security in Technical<br />

University of Lodz, in Poland. He is also a moderator of Bitcoin.<br />

StackExchange.com, /r/Bitcoin subreddit, runs a number of<br />

Bitcoin-focused websites, such as Vanity Pool and TestNet Faucet,<br />

as well as writes a blog on various cryptocurrencies.<br />

July.<strong>2014</strong> Page.23 <strong>Crypto</strong> <strong>Biz</strong> Magazine

CRYPTOCOIN SOCIAL<br />

@MaxKeiser<br />

Page.24 July.<strong>2014</strong><br />

@<strong>Crypto</strong>genicBull<br />

<strong>Crypto</strong> <strong>Biz</strong> Magazine

CRYPTOCOIN SOCIAL<br />

@BitcoinReporter<br />

@BitcoinPrice<br />

July.<strong>2014</strong> Page.25 <strong>Crypto</strong> <strong>Biz</strong> Magazine

WHY YOU SHOULD PROBABLY BE<br />

USING A MULTISIG BITCOIN WALLET<br />

by ARIANNA SIMPSON<br />

If you’re like most people,<br />

you probably like things to be<br />

simple. Many users simply don’t<br />

want the headache of thinking<br />

about security, which is the<br />

appeal of a full-service solution<br />

that stores your private keys<br />

for you. These full-service solutions<br />

become problematic for<br />

more advanced or tech-savvy<br />

users, who generally want a<br />

heightened degree of security<br />

while maintaining control over<br />

their assets.<br />

Page.26 July.<strong>2014</strong><br />

<strong>Crypto</strong> <strong>Biz</strong> Magazine<br />

I WOULD SAY I’M GENERALLY<br />

a jovial person, but if I woke up<br />

and realized I had lost 7500<br />

bitcoins, I would encourage<br />

the rest of the world to back<br />

away from me… very slowly and<br />

without making any sudden<br />

movements. Fortunately, this<br />

hasn’t happened to me, but it<br />

did happen, unfortunately, to<br />

Jeremy Howells, who became<br />

infamous in the Bitcoin community<br />

for accidentally disposing<br />

of his hard drive with the keys<br />

to all of his bitcoins on it.<br />

At this point in time, we’re still<br />

in the early stages of Bitcoin’s<br />

life cycle, and five years is like<br />

the blink of an eye in currency<br />

years. Although there is a strong<br />

trend toward mass adoption<br />

(5 million wallets, growing 8x<br />

year-over-year, according to<br />

Mary Meeker’s annual report),<br />

we’re not there yet. As things<br />

currently stand, there’s a<br />

fundamental disconnect<br />

between usability and control.<br />

You can choose to keep your<br />

private keys yourself in what is<br />

known as a client-side wallet,<br />

or you can hand them over to<br />

a third party that stores them<br />

for you in a web wallet. When<br />

you do the latter, you’re trusting<br />

that the third party is taking<br />

appropriate security measures,<br />

which includes keeping at least<br />

the majority of your bitcoins in<br />

cold storage. As we’ve learned<br />

from Mt. Gox and other similar<br />

fiascos, this isn’t always the<br />

case, which is why the safest<br />

thing to do is to diversify your<br />

holdings by using a variety of<br />

wallets so if one gets hacked,<br />

you don’t lose everything.<br />

Conveniently enough, the<br />

Bitcoin protocol can accommodate<br />

such a tall order. Pay<br />

to Script Hash (P2SH) is a type<br />

of Bitcoin address that was<br />

introduced as part of Bitcoin<br />

Improvement Proposal 16<br />

(also known as BIP 16), early in<br />

2012. P2SH addresses can be<br />

secured using a more complex<br />

algorithm than standard addresses,<br />

and involve the use of<br />

multiple Elliptic Curve Digital<br />

Signature Algorithm (more<br />

commonly known as ECDSA)<br />

keys, rather than only one.<br />

Multi-signature (M of N) wallets<br />

allow users to maintain<br />

direct control over their<br />

bitcoins while also removing<br />

some of the security burden<br />

from them. In the event that<br />

one of their private keys is lost<br />

or stolen, it no longer means<br />

lost access to your bitcoins,<br />

as they can still be accessed<br />

using the backup keys.<br />

The concept of m-of-n signature<br />

schemes is fairly simple,<br />

at least at an abstract level:<br />

In order to complete a transaction,<br />

more than one private key<br />

(m) is needed out of a total<br />

number generated (n). In a<br />

2-of-3 scenario, you would need

two out of a<br />

total of three<br />

keys to withdraw<br />

money, but the process for deposits is the same<br />

as it would be for a standard address.<br />

You can then approach distributing and storing the<br />

keys in various ways. You could hold one key, you<br />

could give another key (the backup) to a trusted<br />

friend or relative—or even store it yourself in a<br />

different location from the “main” key, and the<br />

third key would be held by another party, such<br />

as a company offering the service. BitGo, which<br />

I recommend checking out, is a company at the<br />

forefront of implementing m-of-n addresses.<br />

Since it’s significantly harder for someone to<br />

steal two private keys than one, this adds an<br />

additional safety net against both physical<br />

and digital theft. The benefit of multi-signature<br />

wallets is that they’re more secure than a<br />

traditional digital signature setup, and also<br />

offer more protection from human error. In the<br />

event that I accidentally go into spring-cleaning<br />

overdrive and toss out my hard drive with my<br />

private keys on it, I can still access my bitcoins<br />

using the backup key.<br />

The reason I like multi-signature addresses and<br />

wallets is that, unlike having a vault that is simply<br />

insured, they use technology to secure the coins.<br />

What’s most exciting about multisig is that it’s an<br />

actual advancement in the protocol that permits<br />

this type of address to be created and used.<br />

While insurance has its place, it does not actually<br />

solve or get rid of the problem of loss or theft—it<br />

merely corrects the wrong after the fact. Insurance<br />

does not offer an advancement in technology, and<br />

the onus still falls on the insurance company to make<br />

things right again.<br />

I have no doubt that insurance covering Bitcoin assets<br />

will become industry-standard in the next few years,<br />

but if Bitcoin ends up requiring all the same cumbersome<br />

financial infrastructure as the current<br />

system, we will have gone full circle while making little<br />

real progress.<br />

I’ve only examined the application of multisignature<br />

transactions and wallets for security<br />

purposes here, but it can also be applied to escrow,<br />

and to transactions involving digital payment for<br />

physical goods. Multi-signature transactions can<br />

also be used in institutional or corporate settings,<br />

where more than one person is needed to sign<br />

off on something before funds can be released,<br />

for example. These applications of multi-signature<br />

transactions deserve their own examination, which<br />

I’ll address in an upcoming issue. —S<br />

As a Bitcoin enthusiast and investor,<br />

ARIANNA SIMPSON is<br />

particularly passionate about<br />

helping women get involved in the<br />

Bitcoin community. She is now at<br />

Facebook, working out of the New<br />

York office, where she organizes<br />

the Bitcoin meetup group. In her<br />

previous lives, Arianna did ecology<br />

research for the National Science<br />

Foundation in South Africa, cofounded<br />

Tigervine, lead sales &<br />

boutique operations at Shoptiques.com, and spent several months<br />

backpacking through Southern Africa. Her Bitcoin address is:<br />

1DLBeB2NxcGNsCAFyLa6ateQqtBc1o1LJh.<br />

July.<strong>2014</strong> Page.27 <strong>Crypto</strong> <strong>Biz</strong> Magazine

Q&A WITH SWARM<br />

CEO JOEL DIETZ<br />

Page.28 July.<strong>2014</strong><br />

<strong>Crypto</strong> <strong>Biz</strong> Magazine<br />

<strong>Crypto</strong> <strong>Biz</strong> Magazine’s Editor-in-Chief Soshi sits down<br />

with Swarm Corp’s CEO Joel Dietz. On the weekend<br />

we covered their pre-launch party, which took place in<br />

Berlin, Germany, as they counted down to their (June<br />

17th, <strong>2014</strong>) launch, and to keep the momentum going we<br />

decided to also include a Q&A.<br />

SOSHI: Thank you for joining us for an interview, Joel!<br />

Our team is honoured to have the pleasure to sit down<br />

with such an important innovator from within our fastgrowing<br />

crypto-community.<br />

DIETZ: Super excited to be with you guys! Been very<br />

impressed with <strong>Crypto</strong> <strong>Biz</strong> Magazine so far.<br />

SOSHI: Please tell our readers a little a bit about<br />