Sales Tax Statutes and Regulations - Louisiana Department of ...

Sales Tax Statutes and Regulations - Louisiana Department of ...

Sales Tax Statutes and Regulations - Louisiana Department of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

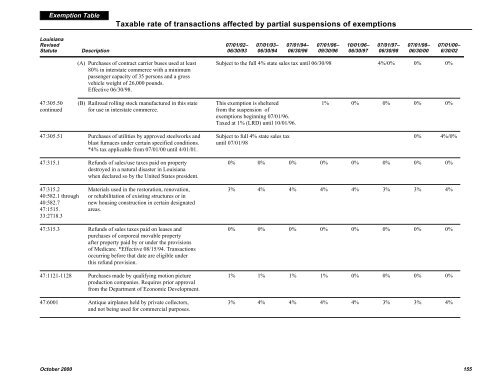

Exemption Table<br />

<strong>Tax</strong>able rate <strong>of</strong> transactions affected by partial suspensions <strong>of</strong> exemptions<br />

<strong>Louisiana</strong><br />

Revised 07/01/92– 07/01/93– 07/01/94– 07/01/96– 10/01/96– 07/01/97– 07/01/98– 07/01/00–<br />

Statute Description 06/30/93 06/30/94 06/30/96 09/30/96 06/30/97 06/30/98 06/30/00 6/30/02<br />

(A) Purchases <strong>of</strong> contract carrier buses used at least Subject to the full 4% state sales tax until 06/30/98 4%/0% 0% 0%<br />

80% in interstate commerce with a minimum<br />

passenger capacity <strong>of</strong> 35 persons <strong>and</strong> a gross<br />

vehicle weight <strong>of</strong> 26,000 pounds.<br />

Effective 06/30/98.<br />

47:305.50 (B) Railroad rolling stock manufactured in this state This exemption is sheltered 1% 0% 0% 0% 0%<br />

continued for use in interstate commerce. from the suspension <strong>of</strong><br />

exemptions beginning 07/01/96.<br />

<strong>Tax</strong>ed at 1% (LRD) until 10/01/96.<br />

47:305.51 Purchases <strong>of</strong> utilities by approved steelworks <strong>and</strong> Subject to full 4% state sales tax 0% 4%/0%<br />

blast furnaces under certain specified conditions. until 07/01/98<br />

*4% tax applicable from 07/01/00 until 4/01/01.<br />

47:315.1 Refunds <strong>of</strong> sales/use taxes paid on property 0% 0% 0% 0% 0% 0% 0% 0%<br />

destroyed in a natural disaster in <strong>Louisiana</strong><br />

when declared so by the United States president.<br />

47:315.2 Materials used in the restoration, renovation, 3% 4% 4% 4% 4% 3% 3% 4%<br />

40:582.1 through or rehabilitation <strong>of</strong> existing structures or in<br />

40:582.7 new housing construction in certain designated<br />

47:1515. areas.<br />

33:2718.3<br />

47:315.3 Refunds <strong>of</strong> sales taxes paid on leases <strong>and</strong> 0% 0% 0% 0% 0% 0% 0% 0%<br />

purchases <strong>of</strong> corporeal movable property<br />

after property paid by or under the provisions<br />

<strong>of</strong> Medicare. *Effective 08/15/94. Transactions<br />

occurring before that date are eligible under<br />

this refund provision.<br />

47:1121-1128 Purchases made by qualifying motion picture 1% 1% 1% 1% 0% 0% 0% 0%<br />

production companies. Requires prior approval<br />

from the <strong>Department</strong> <strong>of</strong> Economic Development.<br />

47:6001 Antique airplanes held by private collectors, 3% 4% 4% 4% 4% 3% 3% 4%<br />

<strong>and</strong> not being used for commercial purposes.<br />

October 2000 155