listing rules - The Nigerian Stock Exchange

listing rules - The Nigerian Stock Exchange

listing rules - The Nigerian Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

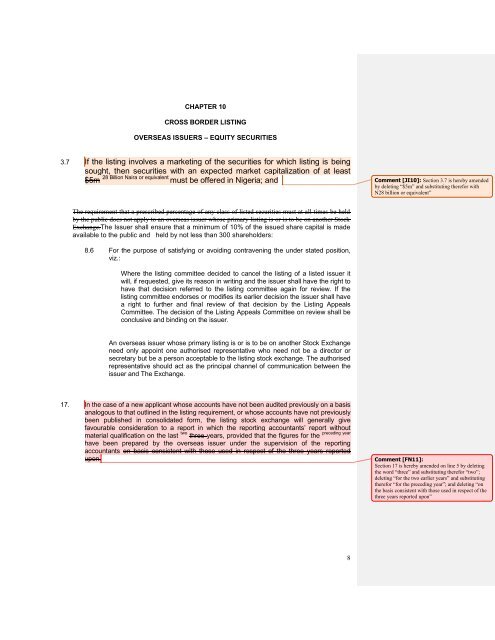

CHAPTER 10<br />

CROSS BORDER LISTING<br />

OVERSEAS ISSUERS – EQUITY SECURITIES<br />

3.7 If the <strong>listing</strong> involves a marketing of the securities for which <strong>listing</strong> is being<br />

sought, then securities with an expected market capitalization of at least<br />

$5m 28 Billion Naira or equivalent must be offered in Nigeria; and<br />

Comment [JI10]: Section 3.7 is hereby amended<br />

by deleting “$5m” and substituting therefor with<br />

N28 billion or equivalent”<br />

<strong>The</strong> requirement that a prescribed percentage of any class of listed securities must at all times be held<br />

by the public does not apply to an overseas issuer whose primary <strong>listing</strong> is or is to be on another <strong>Stock</strong><br />

<strong>Exchange</strong>.<strong>The</strong> Issuer shall ensure that a minimum of 10% of the issued share capital is made<br />

available to the public and held by not less than 300 shareholders:<br />

8.6 For the purpose of satisfying or avoiding contravening the under stated position,<br />

viz.:<br />

Where the <strong>listing</strong> committee decided to cancel the <strong>listing</strong> of a listed issuer it<br />

will, if requested, give its reason in writing and the issuer shall have the right to<br />

have that decision referred to the <strong>listing</strong> committee again for review. If the<br />

<strong>listing</strong> committee endorses or modifies its earlier decision the issuer shall have<br />

a right to further and final review of that decision by the Listing Appeals<br />

Committee. <strong>The</strong> decision of the Listing Appeals Committee on review shall be<br />

conclusive and binding on the issuer.<br />

An overseas issuer whose primary <strong>listing</strong> is or is to be on another <strong>Stock</strong> <strong>Exchange</strong><br />

need only appoint one authorised representative who need not be a director or<br />

secretary but be a person acceptable to the <strong>listing</strong> stock exchange. <strong>The</strong> authorised<br />

representative should act as the principal channel of communication between the<br />

issuer and <strong>The</strong> <strong>Exchange</strong>.<br />

17. In the case of a new applicant whose accounts have not been audited previously on a basis<br />

analogous to that outlined in the <strong>listing</strong> requirement, or whose accounts have not previously<br />

been published in consolidated form, the <strong>listing</strong> stock exchange will generally give<br />

favourable consideration to a report in which the reporting accountants’ report without<br />

material qualification on the last two preceding year<br />

three years, provided that the figures for the<br />

have been prepared by the overseas issuer under the supervision of the reporting<br />

accountants on basis consistent with those used in respect of the three years reported<br />

upon.<br />

Comment [FN11]:<br />

Section 17 is hereby amended on line 5 by deleting<br />

the word “three” and substituting therefor “two”;<br />

deleting “for the two earlier years” and substituting<br />

therefor “for the preceding year”; and deleting “on<br />

the basis consistent with those used in respect of the<br />

three years reported upon”<br />

8