presidents message - SwissThai Chamber of Commerce

presidents message - SwissThai Chamber of Commerce

presidents message - SwissThai Chamber of Commerce

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FEBRUARY 2011 | SWISS THAI CHAMBER OF COMMERCE | 05<br />

meet conditions that are a bit more onerous<br />

or stringent.<br />

Basically, in order for an ROH company to<br />

be entitled to the enhanced tax concessions<br />

under the Model 2 regime, an ROH<br />

company is going to have to put a higher<br />

level <strong>of</strong> commitment into its ROH operations<br />

in Thailand.<br />

It should also be noted that companies<br />

wishing to claim the tax concessions<br />

under the Model 2 ROH regime, must do<br />

so within 5 years <strong>of</strong> the issue date <strong>of</strong> the<br />

Revenue Department’s rules, i.e. within<br />

15 November 2015.<br />

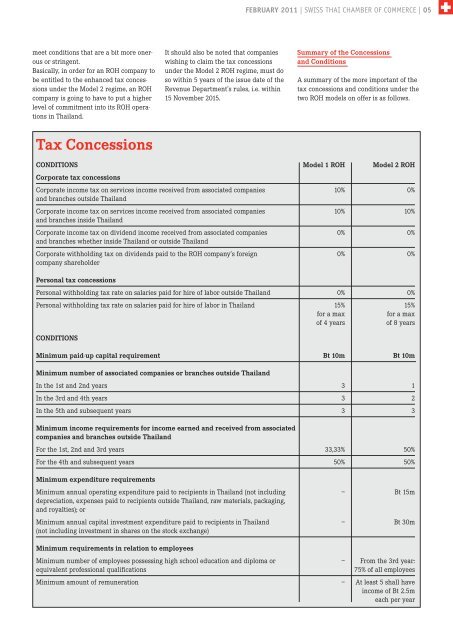

Summary <strong>of</strong> the Concessions<br />

and Conditions<br />

A summary <strong>of</strong> the more important <strong>of</strong> the<br />

tax concessions and conditions under the<br />

two ROH models on <strong>of</strong>fer is as follows.<br />

Tax Concessions<br />

CONDITIONS Model 1 ROH Model 2 ROH<br />

Corporate tax concessions<br />

Corporate income tax on services income received from associated companies 10% 0%<br />

and branches outside Thailand<br />

Corporate income tax on services income received from associated companies 10% 10%<br />

and branches inside Thailand<br />

Corporate income tax on dividend income received from associated companies 0% 0%<br />

and branches whether inside Thailand or outside Thailand<br />

Corporate withholding tax on dividends paid to the ROH company’s foreign 0% 0%<br />

company shareholder<br />

Personal tax concessions<br />

Personal withholding tax rate on salaries paid for hire <strong>of</strong> labor outside Thailand 0% 0%<br />

Personal withholding tax rate on salaries paid for hire <strong>of</strong> labor in Thailand 15% 15%<br />

for a max<br />

for a max<br />

<strong>of</strong> 4 years<br />

<strong>of</strong> 8 years<br />

CONDITIONS<br />

Minimum paid-up capital requirement Bt 10m Bt 10m<br />

Minimum number <strong>of</strong> associated companies or branches outside Thailand<br />

In the 1st and 2nd years 3 1<br />

In the 3rd and 4th years 3 2<br />

In the 5th and subsequent years 3 3<br />

Minimum income requirements for income earned and received from associated<br />

companies and branches outside Thailand<br />

For the 1st, 2nd and 3rd years 33,33% 50%<br />

For the 4th and subsequent years 50% 50%<br />

Minimum expenditure requirements<br />

Minimum annual operating expenditure paid to recipients in Thailand (not including – Bt 15m<br />

depreciation, expenses paid to recipients outside Thailand, raw materials, packaging,<br />

and royalties); or<br />

Minimum annual capital investment expenditure paid to recipients in Thailand – Bt 30m<br />

(not including investment in shares on the stock exchange)<br />

Minimum requirements in relation to employees<br />

Minimum number <strong>of</strong> employees possessing high school education and diploma or – From the 3rd year:<br />

equivalent pr<strong>of</strong>essional qualifications<br />

75% <strong>of</strong> all employees<br />

Minimum amount <strong>of</strong> remuneration – At least 5 shall have<br />

income <strong>of</strong> Bt 2.5m<br />

each per year