Success - ACRA

Success - ACRA

Success - ACRA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

22<br />

Advancing in Synergy<br />

Financial Highlights Financial Highlights <strong>ACRA</strong> Annual Report 2004/2005 23<br />

Financial<br />

Highlights<br />

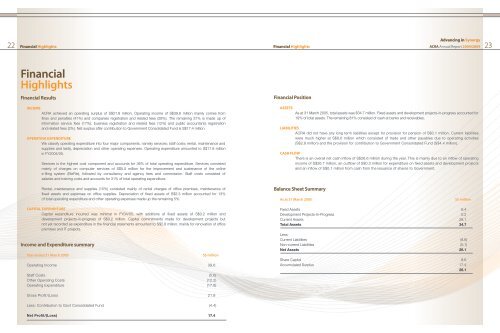

Financial Results<br />

INCOME<br />

<strong>ACRA</strong> achieved an operating surplus of S$21.8 million. Operating income of S$39.6 million mainly comes from<br />

fines and penalties (41%) and companies registration and related fees (28%). The remaining 31% is made up of<br />

information service fees (17%), business registration and related fees (12%) and public accountants registration<br />

and related fees (2%). Net surplus after contribution to Government Consolidated Fund is S$17.4 million.<br />

OPERATING EXPENDITURE<br />

We classify operating expenditure into four major components, namely services; staff costs; rental, maintenance and<br />

supplies and lastly, depreciation and other operating expenses. Operating expenditure amounted to S$17.8 million<br />

in FY2004/05.<br />

Services is the highest cost component and accounts for 36% of total operating expenditure. Services consisted<br />

mainly of charges on computer services of S$5.0 million for the improvement and sustenance of the online<br />

e-filing system (BizFile), followed by consultancy and agency fees and commission. Staff costs consisted of<br />

salaries and training costs and accounts for 31% of total operating expenditure.<br />

Financial Position<br />

ASSETS<br />

As at 31 March 2005, total assets was $34.7 million. Fixed assets and development projects-in-progress accounted for<br />

19% of total assets. The remaining 81% consisted of cash at banks and receivables.<br />

LIABILITIES<br />

<strong>ACRA</strong> did not have any long term liabilities except for provision for pension of S$0.1 million. Current liabilities<br />

were much higher at S$8.6 million which consisted of trade and other payables due to operating activities<br />

(S$2.8 million) and the provision for contribution to Government Consolidated Fund (S$4.4 million).<br />

CASH FLOW<br />

There is an overall net cash inflow of S$26.6 million during the year. This is mainly due to an inflow of operating<br />

income of S$26.7 million, an outflow of S$0.3 million for expenditure on fixed assets and development projects<br />

and an inflow of S$0.1 million from cash from the issuance of shares to Government.<br />

Rental, maintenance and supplies (15%) consisted mainly of rental charges of office premises, maintenance of<br />

fixed assets and expenses on office supplies. Depreciation of fixed assets of S$2.3 million accounted for 13%<br />

of total operating expenditure and other operating expenses made up the remaining 5%.<br />

Balance Sheet Summary<br />

As at 31 March 2005<br />

S$ million<br />

CAPITAL EXPENDITURE<br />

Capital expenditure incurred was minimal in FY04/05, with additions of fixed assets of S$0.2 million and<br />

development projects-in-progress of S$0.2 million. Capital commitments made for development projects but<br />

not yet recorded as expenditure in the financial statements amounted to S$2.8 million, mainly for renovation of office<br />

premises and IT projects.<br />

Income and Expenditure summary<br />

Year ended 31 March 2005<br />

S$ million<br />

Operating Income 39.6<br />

Staff Costs (5.6)<br />

Other Operating Costs (12.2)<br />

Operating Expenditure (17.8)<br />

Fixed Assets 6.4<br />

Development Projects-In-Progress 0.2<br />

Current Assets 28.1<br />

Total Assets 34.7<br />

Less:<br />

Current Liabilities (8.6)<br />

Non-current Liabilities (0.1)<br />

Net Assets 26.1<br />

Share Capital 8.6<br />

Accumulated Surplus 17.4<br />

26.1<br />

Gross Profit/(Loss) 21.8<br />

Less: Contribution to Govt Consolidated Fund (4.4)<br />

Net Profit/(Loss) 17.4