Ventus VCT plc and Ventus 2 VCT plc - The Tax Shelter Report

Ventus VCT plc and Ventus 2 VCT plc - The Tax Shelter Report

Ventus VCT plc and Ventus 2 VCT plc - The Tax Shelter Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

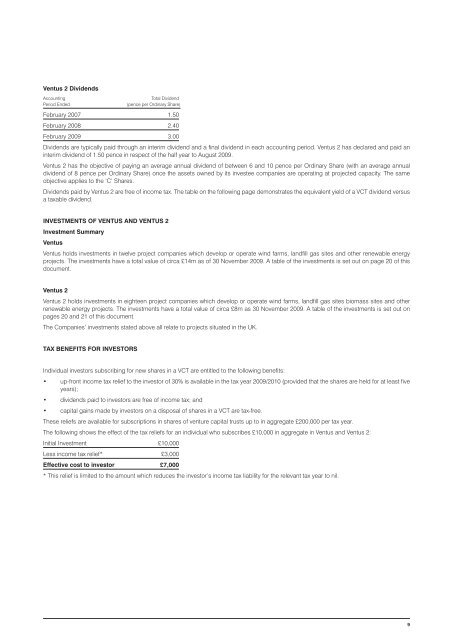

<strong>Ventus</strong> 2 Dividends<br />

Accounting<br />

Period Ended<br />

Total Dividend<br />

(pence per Ordinary Share)<br />

February 2007 1.50<br />

February 2008 2.40<br />

February 2009 3.00<br />

Dividends are typically paid through an interim dividend <strong>and</strong> a final dividend in each accounting period. <strong>Ventus</strong> 2 has declared <strong>and</strong> paid an<br />

interim dividend of 1.50 pence in respect of the half year to August 2009.<br />

<strong>Ventus</strong> 2 has the objective of paying an average annual dividend of between 6 <strong>and</strong> 10 pence per Ordinary Share (with an average annual<br />

dividend of 8 pence per Ordinary Share) once the assets owned by its investee companies are operating at projected capacity. <strong>The</strong> same<br />

objective applies to the ‘C’ Shares.<br />

Dividends paid by <strong>Ventus</strong> 2 are free of income tax. <strong>The</strong> table on the following page demonstrates the equivalent yield of a <strong>VCT</strong> dividend versus<br />

a taxable dividend.<br />

INVESTMENTS OF VENTUS AND VENTUS 2<br />

Investment Summary<br />

<strong>Ventus</strong><br />

<strong>Ventus</strong> holds investments in twelve project companies which develop or operate wind farms, l<strong>and</strong>fill gas sites <strong>and</strong> other renewable energy<br />

projects. <strong>The</strong> investments have a total value of circa £14m as of 30 November 2009. A table of the investments is set out on page 20of this<br />

document.<br />

<strong>Ventus</strong> 2<br />

<strong>Ventus</strong> 2 holds investments in eighteen project companies which develop or operate wind farms, l<strong>and</strong>fill gas sites biomass sites <strong>and</strong> other<br />

renewable energy projects. <strong>The</strong> investments have a total value of circa £8m as 30 November 2009. A table of the investments is set out on<br />

pages 20 <strong>and</strong> 21 of this document.<br />

<strong>The</strong> Companies’ investments stated above all relate to projects situated in the UK.<br />

TAX BENEFITS FOR INVESTORS<br />

Individual investors subscribing for new shares in a <strong>VCT</strong> are entitled to the following benefits:<br />

• up-front income tax relief to the investor of 30% is available in the tax year 2009/2010 (provided that the shares are held for at least five<br />

years);<br />

• dividends paid to investors are free of income tax; <strong>and</strong><br />

• capital gains made by investors on a disposal of shares in a <strong>VCT</strong> are tax-free.<br />

<strong>The</strong>se reliefs are available for subscriptions in shares of venture capital trusts up to in aggregate £200,000 per tax year.<br />

<strong>The</strong> following shows the effect of the tax reliefs for an individual who subscribes £10,000 in aggregate in <strong>Ventus</strong> <strong>and</strong> <strong>Ventus</strong> 2:<br />

Initial Investment £10,000<br />

Less income tax relief* £3,000<br />

Effective cost to investor £7,000<br />

* This relief is limited to the amount which reduces the investor’s income tax liability for the relevant tax year to nil.<br />

9