Winter 2012 - Ensuring the Future of Dance - San Francisco Ballet

Winter 2012 - Ensuring the Future of Dance - San Francisco Ballet

Winter 2012 - Ensuring the Future of Dance - San Francisco Ballet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The asset allocation <strong>of</strong> <strong>the</strong> endowment changed slightly<br />

during <strong>the</strong> fiscal year in order to minimize risk and fur<strong>the</strong>r<br />

diversify <strong>the</strong> portfolio, as noted in <strong>the</strong> following table.<br />

Alternative assets include limited partnership investments<br />

in hedge funds. Global equity includes funds that are<br />

invested in both domestic and foreign assets. The <strong>Ballet</strong>’s<br />

investment performance was comparable to that <strong>of</strong><br />

benchmark indices.<br />

Beginning <strong>of</strong> FY2011 End <strong>of</strong> FY2011<br />

Real Assets 0% 2.4%<br />

Alternative Assets 33.2% 30.8%<br />

Equity – Foreign 12.2% 13.9%<br />

Equity – Domestic 15.7% 17.1%<br />

Equity – Global 12.4% 9.6%<br />

Fixed Income 23.7% 22.6%<br />

Balanced (Equity<br />

and Fixed Income) 1.2% 1.3%<br />

Cash and<br />

Equivalents 1.5% 2.3%<br />

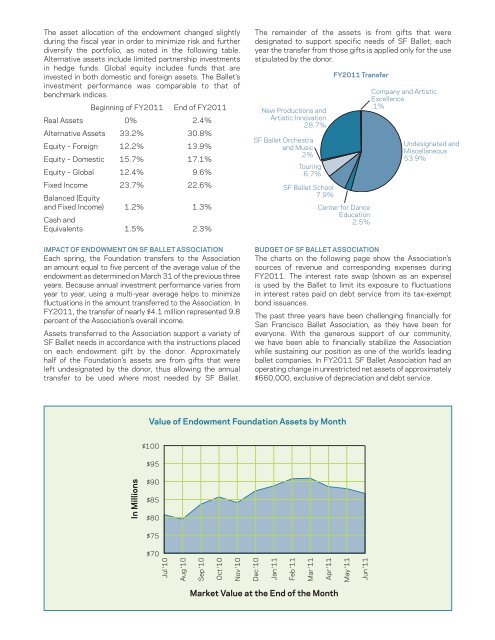

The remainder <strong>of</strong> <strong>the</strong> assets is from gifts that were<br />

designated to support specific needs <strong>of</strong> SF <strong>Ballet</strong>; each<br />

year <strong>the</strong> transfer from those gifts is applied only for <strong>the</strong> use<br />

stipulated by <strong>the</strong> donor.<br />

New Productions and<br />

Artistic Innovation<br />

28.7%<br />

SF <strong>Ballet</strong> Orchestra<br />

and Music<br />

.2%<br />

Touring<br />

6.7%<br />

SF <strong>Ballet</strong> School<br />

7.9%<br />

FY2011 Transfer<br />

Center for <strong>Dance</strong><br />

Education<br />

2.5%<br />

Company and Artistic<br />

Excellence<br />

.1%<br />

Undesignated and<br />

Miscellaneous<br />

53.9%<br />

Impact <strong>of</strong> Endowment on SF <strong>Ballet</strong> Association<br />

Each spring, <strong>the</strong> Foundation transfers to <strong>the</strong> Association<br />

an amount equal to five percent <strong>of</strong> <strong>the</strong> average value <strong>of</strong> <strong>the</strong><br />

endowment as determined on March 31 <strong>of</strong> <strong>the</strong> previous three<br />

years. Because annual investment performance varies from<br />

year to year, using a multi-year average helps to minimize<br />

fluctuations in <strong>the</strong> amount transferred to <strong>the</strong> Association. In<br />

FY2011, <strong>the</strong> transfer <strong>of</strong> nearly $4.1 million represented 9.8<br />

percent <strong>of</strong> <strong>the</strong> Association’s overall income.<br />

Assets transferred to <strong>the</strong> Association support a variety <strong>of</strong><br />

SF <strong>Ballet</strong> needs in accordance with <strong>the</strong> instructions placed<br />

on each endowment gift by <strong>the</strong> donor. Approximately<br />

half <strong>of</strong> <strong>the</strong> Foundation’s assets are from gifts that were<br />

left undesignated by <strong>the</strong> donor, thus allowing <strong>the</strong> annual<br />

transfer to be used where most needed by SF <strong>Ballet</strong>.<br />

Budget <strong>of</strong> SF <strong>Ballet</strong> Association<br />

The charts on <strong>the</strong> following page show <strong>the</strong> Association’s<br />

sources <strong>of</strong> revenue and corresponding expenses during<br />

FY2011. The interest rate swap (shown as an expense)<br />

is used by <strong>the</strong> <strong>Ballet</strong> to limit its exposure to fluctuations<br />

in interest rates paid on debt service from its tax-exempt<br />

bond issuances.<br />

The past three years have been challenging financially for<br />

<strong>San</strong> <strong>Francisco</strong> <strong>Ballet</strong> Association, as <strong>the</strong>y have been for<br />

everyone. With <strong>the</strong> generous support <strong>of</strong> our community,<br />

we have been able to financially stabilize <strong>the</strong> Association<br />

while sustaining our position as one <strong>of</strong> <strong>the</strong> world’s leading<br />

ballet companies. In FY2011 SF <strong>Ballet</strong> Association had an<br />

operating change in unrestricted net assets <strong>of</strong> approximately<br />

$660,000, exclusive <strong>of</strong> depreciation and debt service.<br />

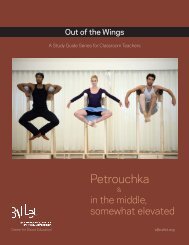

Value <strong>of</strong> Endowment Foundation Assets by Month<br />

$100<br />

$95<br />

In Millions<br />

$90<br />

$85<br />

$80<br />

$75<br />

$70<br />

Jul ‘10<br />

Aug ‘10<br />

Sep ‘10<br />

Oct ‘10<br />

Nov ‘10<br />

Dec ‘10<br />

Jan ‘11<br />

Feb ‘11<br />

Mar ‘11<br />

Apr ‘11<br />

May ‘11<br />

Jun ‘11<br />

Market Value at <strong>the</strong> End <strong>of</strong> <strong>the</strong> Month