Miranjit Mukherjee - Actuarial Society of India

Miranjit Mukherjee - Actuarial Society of India

Miranjit Mukherjee - Actuarial Society of India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

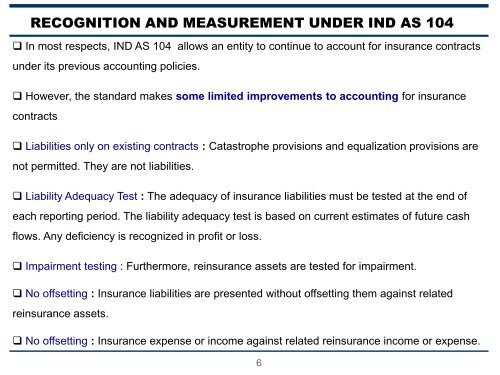

RECOGNITION AND MEASUREMENT UNDER IND AS 104<br />

In most respects, IND AS 104 allows an entity to continue to account for insurance contracts<br />

under its previous accounting policies.<br />

However, the standard makes some limited improvements to accounting for insurance<br />

contracts<br />

Liabilities only on existing contracts : Catastrophe provisions and equalization provisions are<br />

not permitted. They are not liabilities.<br />

Liability Adequacy Test : The adequacy <strong>of</strong> insurance liabilities must be tested at the end <strong>of</strong><br />

each reporting period. The liability adequacy test is based on current estimates <strong>of</strong> future cash<br />

flows. Any deficiency is recognized in pr<strong>of</strong>it or loss.<br />

Impairment testing : Furthermore, reinsurance assets are tested for impairment.<br />

No <strong>of</strong>fsetting : Insurance liabilities are presented without <strong>of</strong>fsetting them against related<br />

reinsurance assets.<br />

No <strong>of</strong>fsetting : Insurance expense or income against related reinsurance income or expense.<br />

6