Annual Report on Form 20-F - CRH

Annual Report on Form 20-F - CRH

Annual Report on Form 20-F - CRH

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BUSINESS REVIEW — Current Year<br />

Outlook – Europe Distributi<strong>on</strong><br />

After a difficult <strong>20</strong>12 we believe that market c<strong>on</strong>diti<strong>on</strong>s will remain weak in <strong>20</strong>13, albeit at different levels in the various markets we operate<br />

in. Our expectati<strong>on</strong>s for the German, Austrian, Swiss and Belgian markets are more favourable than our outlook for the markets in the<br />

Netherlands and France. We therefore expect <strong>20</strong>13 to be challenging, due mainly to the difficult outlook for the Dutch ec<strong>on</strong>omy, and we<br />

remain focussed <strong>on</strong> delivering further savings from our operati<strong>on</strong>al excellence programmes.<br />

Americas Distributi<strong>on</strong><br />

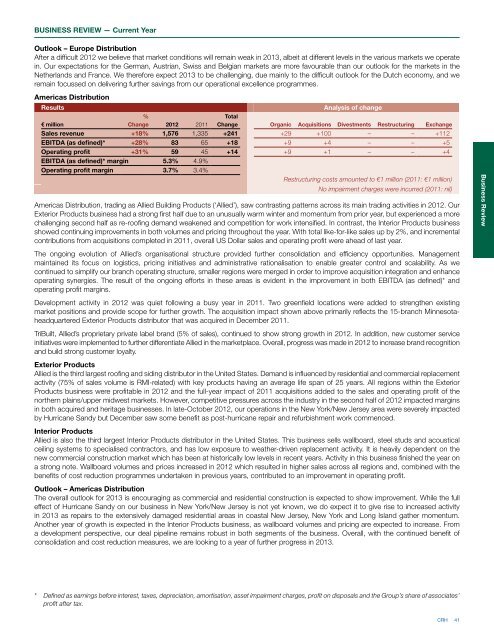

Results<br />

€ milli<strong>on</strong><br />

%<br />

Change <strong>20</strong>12 <strong>20</strong>11<br />

Analysis of change<br />

Total<br />

Change Organic Acquisiti<strong>on</strong>s Divestments Restructuring Exchange<br />

Sales revenue +18% 1,576 1,335 +241 +29 +100 – – +112<br />

EBITDA (as defined)* +28% 83 65 +18 +9 +4 – – +5<br />

Operating profit +31% 59 45 +14 +9 +1 – – +4<br />

EBITDA (as defined)* margin 5.3% 4.9%<br />

Operating profit margin 3.7% 3.4%<br />

Restructuring costs amounted to €1 milli<strong>on</strong> (<strong>20</strong>11: €1 milli<strong>on</strong>)<br />

No impairment charges were incurred (<strong>20</strong>11: nil)<br />

Americas Distributi<strong>on</strong>, trading as Allied Building Products (‘Allied’), saw c<strong>on</strong>trasting patterns across its main trading activities in <strong>20</strong>12. Our<br />

Exterior Products business had a str<strong>on</strong>g first half due to an unusually warm winter and momentum from prior year, but experienced a more<br />

challenging sec<strong>on</strong>d half as re-roofing demand weakened and competiti<strong>on</strong> for work intensified. In c<strong>on</strong>trast, the Interior Products business<br />

showed c<strong>on</strong>tinuing improvements in both volumes and pricing throughout the year. With total like-for-like sales up by 2%, and incremental<br />

c<strong>on</strong>tributi<strong>on</strong>s from acquisiti<strong>on</strong>s completed in <strong>20</strong>11, overall US Dollar sales and operating profit were ahead of last year.<br />

Business Review<br />

The <strong>on</strong>going evoluti<strong>on</strong> of Allied’s organisati<strong>on</strong>al structure provided further c<strong>on</strong>solidati<strong>on</strong> and efficiency opportunities. Management<br />

maintained its focus <strong>on</strong> logistics, pricing initiatives and administrative rati<strong>on</strong>alisati<strong>on</strong> to enable greater c<strong>on</strong>trol and scalability. As we<br />

c<strong>on</strong>tinued to simplify our branch operating structure, smaller regi<strong>on</strong>s were merged in order to improve acquisiti<strong>on</strong> integrati<strong>on</strong> and enhance<br />

operating synergies. The result of the <strong>on</strong>going efforts in these areas is evident in the improvement in both EBITDA (as defined)* and<br />

operating profit margins.<br />

Development activity in <strong>20</strong>12 was quiet following a busy year in <strong>20</strong>11. Two greenfield locati<strong>on</strong>s were added to strengthen existing<br />

market positi<strong>on</strong>s and provide scope for further growth. The acquisiti<strong>on</strong> impact shown above primarily reflects the 15-branch Minnesotaheadquartered<br />

Exterior Products distributor that was acquired in December <strong>20</strong>11.<br />

TriBuilt, Allied’s proprietary private label brand (5% of sales), c<strong>on</strong>tinued to show str<strong>on</strong>g growth in <strong>20</strong>12. In additi<strong>on</strong>, new customer service<br />

initiatives were implemented to further differentiate Allied in the marketplace. Overall, progress was made in <strong>20</strong>12 to increase brand recogniti<strong>on</strong><br />

and build str<strong>on</strong>g customer loyalty.<br />

Exterior Products<br />

Allied is the third largest roofing and siding distributor in the United States. Demand is influenced by residential and commercial replacement<br />

activity (75% of sales volume is RMI-related) with key products having an average life span of 25 years. All regi<strong>on</strong>s within the Exterior<br />

Products business were profitable in <strong>20</strong>12 and the full-year impact of <strong>20</strong>11 acquisiti<strong>on</strong>s added to the sales and operating profit of the<br />

northern plains/upper midwest markets. However, competitive pressures across the industry in the sec<strong>on</strong>d half of <strong>20</strong>12 impacted margins<br />

in both acquired and heritage businesses. In late-October <strong>20</strong>12, our operati<strong>on</strong>s in the New York/New Jersey area were severely impacted<br />

by Hurricane Sandy but December saw some benefit as post-hurricane repair and refurbishment work commenced.<br />

Interior Products<br />

Allied is also the third largest Interior Products distributor in the United States. This business sells wallboard, steel studs and acoustical<br />

ceiling systems to specialised c<strong>on</strong>tractors, and has low exposure to weather-driven replacement activity. It is heavily dependent <strong>on</strong> the<br />

new commercial c<strong>on</strong>structi<strong>on</strong> market which has been at historically low levels in recent years. Activity in this business finished the year <strong>on</strong><br />

a str<strong>on</strong>g note. Wallboard volumes and prices increased in <strong>20</strong>12 which resulted in higher sales across all regi<strong>on</strong>s and, combined with the<br />

benefits of cost reducti<strong>on</strong> programmes undertaken in previous years, c<strong>on</strong>tributed to an improvement in operating profit.<br />

Outlook – Americas Distributi<strong>on</strong><br />

The overall outlook for <strong>20</strong>13 is encouraging as commercial and residential c<strong>on</strong>structi<strong>on</strong> is expected to show improvement. While the full<br />

effect of Hurricane Sandy <strong>on</strong> our business in New York/New Jersey is not yet known, we do expect it to give rise to increased activity<br />

in <strong>20</strong>13 as repairs to the extensively damaged residential areas in coastal New Jersey, New York and L<strong>on</strong>g Island gather momentum.<br />

Another year of growth is expected in the Interior Products business, as wallboard volumes and pricing are expected to increase. From<br />

a development perspective, our deal pipeline remains robust in both segments of the business. Overall, with the c<strong>on</strong>tinued benefit of<br />

c<strong>on</strong>solidati<strong>on</strong> and cost reducti<strong>on</strong> measures, we are looking to a year of further progress in <strong>20</strong>13.<br />

* Defined as earnings before interest, taxes, depreciati<strong>on</strong>, amortisati<strong>on</strong>, asset impairment charges, profit <strong>on</strong> disposals and the Group’s share of associates’<br />

profit after tax.<br />

<strong>CRH</strong> 41