The Economic Cost of a Moratorium on Offshore Oil and Gas ...

The Economic Cost of a Moratorium on Offshore Oil and Gas ...

The Economic Cost of a Moratorium on Offshore Oil and Gas ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<str<strong>on</strong>g>Cost</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Moratorium</str<strong>on</strong>g> Report | 16<br />

companies. 87 ATP <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> Corp., for example,<br />

“expected to see its 2010 producti<strong>on</strong> double to at least<br />

12 milli<strong>on</strong> barrels <str<strong>on</strong>g>of</str<strong>on</strong>g> oil <strong>and</strong> gas but has now dropped<br />

its guidance to between 9 milli<strong>on</strong> <strong>and</strong> 10 milli<strong>on</strong>.” 88<br />

It is challenging, however, to quantify this effect<br />

coherently across the whole industry. Thus I have<br />

not included investment loss in my analysis. This<br />

means that I have under-reported the loss felt by<br />

communities in the Gulf <strong>and</strong> nati<strong>on</strong>wide.<br />

Third, if the end result <str<strong>on</strong>g>of</str<strong>on</strong>g> the moratorium is to place<br />

severe restricti<strong>on</strong>s <strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g>fshore drilling operati<strong>on</strong>s<br />

for the l<strong>on</strong>g-term, costs could increase to operators<br />

significantly. This could lead to decreased operati<strong>on</strong>s,<br />

increased oil <strong>and</strong> natural gas prices, <strong>and</strong> the movement<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> operati<strong>on</strong>s to cheaper locati<strong>on</strong>s. This would again<br />

impose significant ec<strong>on</strong>omic hardship <strong>on</strong> communities<br />

throughout the Gulf.<br />

Last, refining also has significant benefits to the<br />

ec<strong>on</strong>omies <str<strong>on</strong>g>of</str<strong>on</strong>g> the Gulf <strong>and</strong> the nati<strong>on</strong>. Again, it is<br />

difficult to determine the effect <str<strong>on</strong>g>of</str<strong>on</strong>g> the moratorium<br />

<strong>on</strong> refining capacity. It is reas<strong>on</strong>able to assume that<br />

some capacity will be reduced as a result <str<strong>on</strong>g>of</str<strong>on</strong>g> stagnant<br />

oil <strong>and</strong> gas extracti<strong>on</strong>, which would further add to the<br />

ec<strong>on</strong>omic hardship caused by the moratorium.<br />

G. Worst Case Scenario Analysis<br />

One potential outcome <str<strong>on</strong>g>of</str<strong>on</strong>g> the moratorium is that<br />

all producti<strong>on</strong> in the Gulf <str<strong>on</strong>g>of</str<strong>on</strong>g> Mexico stops because<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g>fshore drilling is deemed too dangerous. Although<br />

unlikely, repeating the analysis with this assumpti<strong>on</strong><br />

can be a useful exercise by providing an idea <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

total amount <str<strong>on</strong>g>of</str<strong>on</strong>g> output, employment, wages, <strong>and</strong> tax<br />

revenue at stake.<br />

This analysis uses data from the U.S. Department <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

Interior, U.S. Department <str<strong>on</strong>g>of</str<strong>on</strong>g> Energy, the U.S. Census<br />

Bureau, <strong>and</strong> the U.S. Treasury Department to estimate<br />

the total decrease in output, employment, wages, <strong>and</strong><br />

public revenues to the Gulf States <strong>and</strong> nati<strong>on</strong>wide.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> relevant <str<strong>on</strong>g>of</str<strong>on</strong>g>fshore oil <strong>and</strong> gas producti<strong>on</strong> data is<br />

again the starting point for the analysis. According to<br />

the U.S. Department <str<strong>on</strong>g>of</str<strong>on</strong>g> the Interior Office <str<strong>on</strong>g>of</str<strong>on</strong>g> <strong>Offshore</strong><br />

Energy & Minerals Management (MMS). 89 the average<br />

m<strong>on</strong>thly OCS <str<strong>on</strong>g>of</str<strong>on</strong>g>fshore producti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> oil <strong>and</strong> natural<br />

gas in the GOM from January 2001 through November<br />

2009 was over 42 milli<strong>on</strong> barrels <str<strong>on</strong>g>of</str<strong>on</strong>g> oil <strong>and</strong> 295 milli<strong>on</strong><br />

Mcf (Thous<strong>and</strong> Cubic Feet) <str<strong>on</strong>g>of</str<strong>on</strong>g> natural gas. According<br />

to a recent report, 80 percent <str<strong>on</strong>g>of</str<strong>on</strong>g> GOM oil producti<strong>on</strong><br />

<strong>and</strong> 45 percent <str<strong>on</strong>g>of</str<strong>on</strong>g> natural gas producti<strong>on</strong> comes from<br />

deepwater operati<strong>on</strong>s, <strong>and</strong> is therefore affected by the<br />

moratorium. 90 Applying these percentages to the total<br />

producti<strong>on</strong> figures, 34 milli<strong>on</strong> barrels <str<strong>on</strong>g>of</str<strong>on</strong>g> oil <strong>and</strong> 133<br />

milli<strong>on</strong> Mcf <str<strong>on</strong>g>of</str<strong>on</strong>g> natural gas a m<strong>on</strong>th are at risk from<br />

the moratorium in the entire GOM regi<strong>on</strong>. Thus the<br />

total annual producti<strong>on</strong> at risk from the moratorium is<br />

around 410 milli<strong>on</strong> barrels <str<strong>on</strong>g>of</str<strong>on</strong>g> oil <strong>and</strong> 1.6 billi<strong>on</strong> Mcf <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

natural gas.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g>se figures are apporti<strong>on</strong>ed to the Gulf States in<br />

the same manner as before. Dollar values are also<br />

calculated similarly, using the EIA’s latest inflati<strong>on</strong>adjusted<br />

energy price forecasts from the Short Term<br />

Energy Outlook July 2010. <str<strong>on</strong>g>The</str<strong>on</strong>g> report indicates that<br />

for the sec<strong>on</strong>d half <str<strong>on</strong>g>of</str<strong>on</strong>g> 2010 the average prices <str<strong>on</strong>g>of</str<strong>on</strong>g> oil<br />

will $79.00 per barrel <strong>and</strong> the average price <str<strong>on</strong>g>of</str<strong>on</strong>g> natural<br />

gas is $4.68 per MMBtu. 91 <str<strong>on</strong>g>The</str<strong>on</strong>g> value <str<strong>on</strong>g>of</str<strong>on</strong>g> each state’s<br />

producti<strong>on</strong> is calculated as the sum <str<strong>on</strong>g>of</str<strong>on</strong>g> (1) its share <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

available GOM <str<strong>on</strong>g>of</str<strong>on</strong>g>fshore oil producti<strong>on</strong> times $79.00<br />

per barrel <strong>and</strong> (2) its share <str<strong>on</strong>g>of</str<strong>on</strong>g> available GOM natural<br />

gas producti<strong>on</strong> times $4.68 per thous<strong>and</strong> cubic feet.<br />

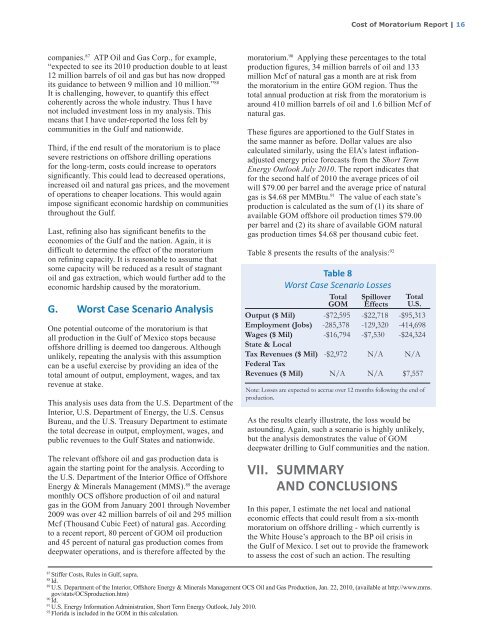

Table 8 presents the results <str<strong>on</strong>g>of</str<strong>on</strong>g> the analysis: 92<br />

Table 8<br />

Worst Case Scenario Losses<br />

Total<br />

GOM<br />

Spillover<br />

Effects<br />

Total<br />

U.S.<br />

Output ($ Mil) -$72,595 -$22,718 -$95,313<br />

Employment (Jobs) -285,378 -129,320 -414,698<br />

Wages ($ Mil) -$16,794 -$7,530 -$24,324<br />

State & Local<br />

Tax Revenues ($ Mil) -$2,972 N/A N/A<br />

Federal Tax<br />

Revenues ($ Mil) N/A N/A $7,557<br />

Note: Losses are expected to accrue over 12 m<strong>on</strong>ths following the end <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

producti<strong>on</strong>.<br />

As the results clearly illustrate, the loss would be<br />

astounding. Again, such a scenario is highly unlikely,<br />

but the analysis dem<strong>on</strong>strates the value <str<strong>on</strong>g>of</str<strong>on</strong>g> GOM<br />

deepwater drilling to Gulf communities <strong>and</strong> the nati<strong>on</strong>.<br />

VII. SUMMARY<br />

AND CONCLUSIONS<br />

In this paper, I estimate the net local <strong>and</strong> nati<strong>on</strong>al<br />

ec<strong>on</strong>omic effects that could result from a six-m<strong>on</strong>th<br />

moratorium <strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g>fshore drilling - which currently is<br />

the White House’s approach to the BP oil crisis in<br />

the Gulf <str<strong>on</strong>g>of</str<strong>on</strong>g> Mexico. I set out to provide the framework<br />

to assess the cost <str<strong>on</strong>g>of</str<strong>on</strong>g> such an acti<strong>on</strong>. <str<strong>on</strong>g>The</str<strong>on</strong>g> resulting<br />

87<br />

Stiffer <str<strong>on</strong>g>Cost</str<strong>on</strong>g>s, Rules in Gulf, supra.<br />

88<br />

Id.<br />

89 <br />

U.S. Department <str<strong>on</strong>g>of</str<strong>on</strong>g> the Interior, <strong>Offshore</strong> Energy & Minerals Management OCS <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> Producti<strong>on</strong>, Jan. 22, 2010, (available at http://www.mms.<br />

gov/stats/OCSproducti<strong>on</strong>.htm)<br />

90<br />

Id.<br />

91<br />

U.S. Energy Informati<strong>on</strong> Administrati<strong>on</strong>, Short Term Energy Outlook, July 2010.<br />

92<br />

Florida is included in the GOM in this calculati<strong>on</strong>.