2010 - 11 - Dabur India Limited

2010 - 11 - Dabur India Limited

2010 - 11 - Dabur India Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Dabur</strong> <strong>India</strong> <strong>Limited</strong> // Half Yearly Report <strong>2010</strong>-<strong>11</strong><br />

Schedules to Consolidated Financials<br />

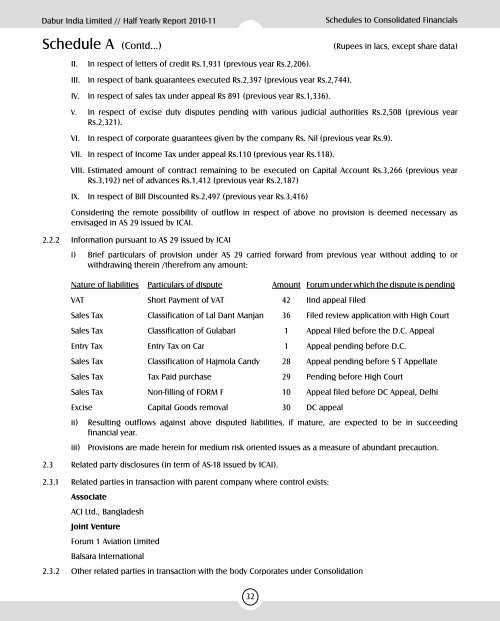

Schedule A (Contd...)<br />

II.<br />

In respect of letters of credit Rs.1,931 (previous year Rs.2,206).<br />

III. In respect of bank guarantees executed Rs.2,397 (previous year Rs.2,744).<br />

IV. In respect of sales tax under appeal Rs 891 (previous year Rs.1,336).<br />

V. In respect of excise duty disputes pending with various judicial authorities Rs.2,508 (previous year<br />

Rs.2,321).<br />

VI. In respect of corporate guarantees given by the company Rs. Nil (previous year Rs.9).<br />

VII. In respect of Income Tax under appeal Rs.<strong>11</strong>0 (previous year Rs.<strong>11</strong>8).<br />

VIII. Estimated amount of contract remaining to be executed on Capital Account Rs.3,266 (previous year<br />

Rs.3,192) net of advances Rs.1,412 (previous year Rs.2,187)<br />

IX. In respect of Bill Discounted Rs.2,497 (previous year Rs.3,416)<br />

Considering the remote possibility of outflow in respect of above no provision is deemed necessary as<br />

envisaged in AS 29 issued by ICAI.<br />

2.2.2 Information pursuant to AS 29 issued by ICAI<br />

i) Brief particulars of provision under AS 29 carried forward from previous year without adding to or<br />

withdrawing therein /therefrom any amount:<br />

Nature of liabilities Particulars of dispute Amount Forum under which the dispute is pending<br />

VAT Short Payment of VAT 42 IInd appeal Filed<br />

Sales Tax Classification of Lal Dant Manjan 36 Filed review application with High Court<br />

Sales Tax Classification of Gulabari 1 Appeal Filed before the D.C. Appeal<br />

Entry Tax Entry Tax on Car 1 Appeal pending before D.C.<br />

Sales Tax Classification of Hajmola Candy 28 Appeal pending before S T Appellate<br />

Sales Tax Tax Paid purchase 29 Pending before High Court<br />

Sales Tax Non-filling of FORM F 10 Appeal filed before DC Appeal, Delhi<br />

Excise Capital Goods removal 30 DC appeal<br />

ii)<br />

Resulting outflows against above disputed liabilities, if mature, are expected to be in succeeding<br />

financial year.<br />

iii) Provisions are made herein for medium risk oriented issues as a measure of abundant precaution.<br />

2.3 Related party disclosures (in term of AS-18 issued by ICAI).<br />

2.3.1 Related parties in transaction with parent company where control exists:<br />

Associate<br />

ACI Ltd., Bangladesh<br />

Joint Venture<br />

Forum 1 Aviation <strong>Limited</strong><br />

Balsara International<br />

2.3.2 Other related parties in transaction with the body Corporates under Consolidation<br />

(Rupees in lacs, except share data)<br />

32