The best way to start. BDO Rewards

The best way to start. BDO Rewards

The best way to start. BDO Rewards

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

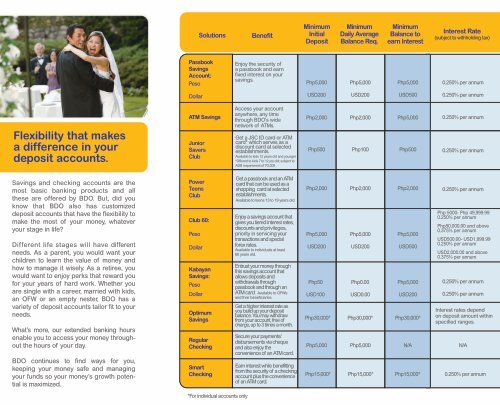

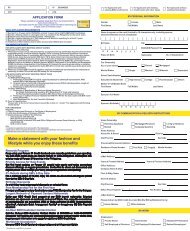

Solutions<br />

Benefit<br />

Minimum<br />

Initial<br />

Deposit<br />

Minimum<br />

Daily Average<br />

Balance Req.<br />

Minimum<br />

Balance <strong>to</strong><br />

earn Interest<br />

Interest Rate<br />

(subject <strong>to</strong> withholding tax)<br />

Passbook<br />

Savings<br />

Account:<br />

Peso<br />

Enjoy the security of<br />

a passbook and earn<br />

fixed interest on your<br />

savings.<br />

Php5,000<br />

Php5,000<br />

Php5,000<br />

0.250% per annum<br />

Dollar<br />

USD200<br />

USD200<br />

USD500<br />

0.250% per annum<br />

Flexibility that makes<br />

a difference in your<br />

deposit accounts.<br />

ATM Savings<br />

Junior<br />

Savers<br />

Club<br />

Access your account<br />

anywhere, any time<br />

through <strong>BDO</strong>’s wide<br />

network of ATMs.<br />

Get a JSC ID card or ATM<br />

card* which serves as a<br />

discount card at selected<br />

establishments.<br />

Available <strong>to</strong> kids 12 years old and younger<br />

*Offered <strong>to</strong> kids 7 <strong>to</strong> 12 yrs old; subject <strong>to</strong><br />

ADB requirement of P2,000.<br />

Php2,000 Php2,000<br />

Php5,000<br />

Php500 Php100 Php500<br />

0.250% per annum<br />

0.250% per annum<br />

Savings and checking accounts are the<br />

most basic banking products and all<br />

these are offered by <strong>BDO</strong>. But, did you<br />

know that <strong>BDO</strong> also has cus<strong>to</strong>mized<br />

deposit accounts that have the flexibility <strong>to</strong><br />

make the most of your money, whatever<br />

your stage in life?<br />

Different life stages will have different<br />

needs. As a parent, you would want your<br />

children <strong>to</strong> learn the value of money and<br />

how <strong>to</strong> manage it wisely. As a retiree, you<br />

would want <strong>to</strong> enjoy perks that reward you<br />

for your years of hard work. Whether you<br />

are single with a career, married with kids,<br />

an OFW or an empty nester, <strong>BDO</strong> has a<br />

variety of deposit accounts tailor fit <strong>to</strong> your<br />

needs.<br />

What’s more, our extended banking hours<br />

enable you <strong>to</strong> access your money throughout<br />

the hours of your day.<br />

<strong>BDO</strong> continues <strong>to</strong> find <strong>way</strong>s for you,<br />

keeping your money safe and managing<br />

your funds so your money’s growth potential<br />

is maximized.<br />

Power<br />

Teens<br />

Club<br />

Club 60:<br />

Peso<br />

Dollar<br />

Kabayan<br />

Savings:<br />

Peso<br />

Dollar<br />

Optimum<br />

Savings<br />

Regular<br />

Checking<br />

Smart<br />

Checking<br />

Get a passbook and an ATM<br />

card that can be used as a<br />

shopping card at selected<br />

establishments.<br />

Available <strong>to</strong> teens 13 <strong>to</strong> 19 years old.<br />

Enjoy a savings account that<br />

gives you tiered interest rates,<br />

discounts and privileges,<br />

priority in servicing your<br />

transactions and special<br />

forex rates.<br />

Available <strong>to</strong> individuals at least<br />

60 years old.<br />

Entrust your money through<br />

this savings account that<br />

allows deposits and<br />

withdrawals through<br />

passbook and through an<br />

ATM card. Available <strong>to</strong> OFWs<br />

and their beneficiaries.<br />

Get a higher interest rate as<br />

you build up your deposit<br />

balance. You may withdraw<br />

from your account, free of<br />

charge, up <strong>to</strong> 3 times a month.<br />

Secure your payments/<br />

disbursements via cheque<br />

and also enjoy the<br />

convenience of an ATM card.<br />

Earn interest while benefitting<br />

from the security of a checking<br />

account plus the convenience<br />

of an ATM card.<br />

Php2,000 Php2,000 Php2,000 0.250% per annum<br />

Php5,000<br />

USD200<br />

Php50<br />

USD100<br />

Php30,000*<br />

Php5,000<br />

Php5,000<br />

USD200<br />

Php0.00<br />

USD0.00<br />

Php30,000*<br />

Php5,000<br />

USD500<br />

Php5,000<br />

USD200<br />

Php30,000*<br />

Php 5000- Php 49,999.99<br />

0.250% per annum<br />

Php50,000.00 and above<br />

0.375% per annum<br />

USD500.00- USD1,999.99<br />

0.250% per annum<br />

USD2,000.00 and above<br />

0.375% per annum<br />

0.250% per annum<br />

0.250% per annum<br />

Interest rates depend<br />

on deposit amount within<br />

specified ranges.<br />

Php5,000 N/A N/A<br />

Php15,000* Php15,000* Php15,000* 0.250% per annum<br />

*For individual accounts only