You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

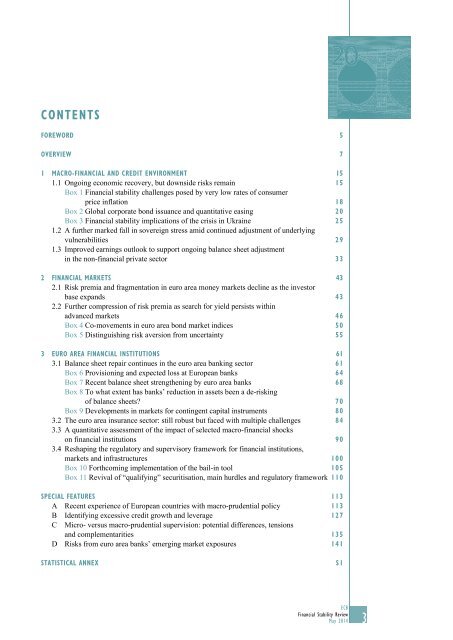

CONTENTS<br />

Foreword5<br />

Overview7<br />

1 Macro-Financial and credit Environment 15<br />

1.1 Ongoing economic recovery, but downside risks remain 15<br />

Box 1 Financial stability challenges posed by very low rates of consumer<br />

price inflation 18<br />

Box 2 Global corporate bond issuance and quantitative easing 20<br />

Box 3 Financial stability implications of the crisis in Ukraine 25<br />

1.2 A further marked fall in sovereign stress amid continued adjustment of underlying<br />

vulnerabilities 29<br />

1.3 Improved earnings outlook to support ongoing balance sheet adjustment<br />

in the non-financial private sector 33<br />

2 Financial markets 43<br />

2.1 Risk premia and fragmentation in euro area money markets decline as the investor<br />

base expands 43<br />

2.2 Further compression of risk premia as search for yield persists within<br />

advanced markets 46<br />

Box 4 Co-movements in euro area bond market indices 50<br />

Box 5 Distinguishing risk aversion from uncertainty 55<br />

3 Euro area Financial Institutions 61<br />

3.1 Balance sheet repair continues in the euro area banking sector 61<br />

Box 6 Provisioning and expected loss at European banks 64<br />

Box 7 Recent balance sheet strengthening by euro area banks 68<br />

Box 8 To what extent has banks’ reduction in assets been a de-risking<br />

of balance sheets? 70<br />

Box 9 Developments in markets for contingent capital instruments 80<br />

3.2 The euro area insurance sector: still robust but faced with multiple challenges 84<br />

3.3 A quantitative assessment of the impact of selected macro-financial shocks<br />

on financial institutions 90<br />

3.4 Reshaping the regulatory and supervisory framework for financial institutions,<br />

markets and infrastructures 100<br />

Box 10 Forthcoming implementation of the bail-in tool 105<br />

Box 11 Revival of “qualifying” securitisation, main hurdles and regulatory framework 110<br />

SPECIAL FEATURES 113<br />

A Recent experience of European countries with macro-prudential policy 113<br />

B Identifying excessive credit growth and leverage 127<br />

C Micro- versus macro-prudential supervision: potential differences, tensions<br />

and complementarities 135<br />

D Risks from euro area banks’ emerging market exposures 141<br />

STATISTICAL ANNEX<br />

S1<br />

ECB<br />

Financial Stability Review<br />

May 2014<br />

3