2013 - Maboneng Precinct

2013 - Maboneng Precinct

2013 - Maboneng Precinct

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INVESTING IN MABONENG<br />

10 11<br />

RELATIONSHIPS WITH BANKS<br />

AMOUNT<br />

Propertuity Management has developed<br />

strong relationships with the major banks in<br />

South Africa who have consistently funded<br />

acquisitions throughout developments in<br />

the <strong>Precinct</strong>. Depending on the financial<br />

position of a purchaser, bonds of up to<br />

100% have been granted.<br />

The tax incentive amounts to 30% of the<br />

purchase price of the property over a 5<br />

year period. For example, on a R500,000<br />

apartment, the tax incentive would be<br />

R150,000 over a 5 year period which<br />

equals R30,000 per year off set against<br />

taxable income.<br />

FOREIGN INVESTMENT<br />

Foreigners can own immovable property in<br />

South Africa without restriction. However,<br />

all foreign funds remitted to the country<br />

must be declared and documented to<br />

ensure repatriation. The property must<br />

also be endorsed ‘non-resident’, as a<br />

condition for repatriation.<br />

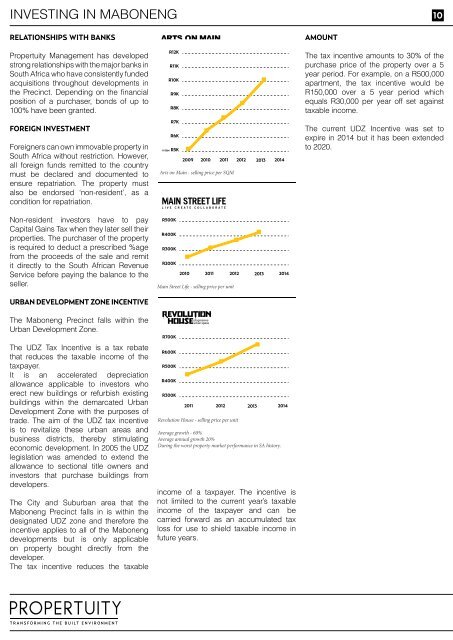

Arts on Main - selling price per SQM<br />

The current UDZ Incentive was set to<br />

expire in 2014 but it has been extended<br />

to 2020.<br />

Arts on Main 2009<br />

Arts on Main 2010<br />

Arts on Main interior<br />

Non-resident investors have to pay<br />

Capital Gains Tax when they later sell their<br />

properties. The purchaser of the property<br />

is required to deduct a prescribed %age<br />

from the proceeds of the sale and remit<br />

it directly to the South African Revenue<br />

Service before paying the balance to the<br />

seller.<br />

Main Street Life - selling price per unit<br />

URBAN DEVELOPMENT ZONE INCENTIVE<br />

Main Street Life - 2010<br />

Main Street Life - 2011<br />

Main Street Life - Interior<br />

The <strong>Maboneng</strong> <strong>Precinct</strong> falls within the<br />

Urban Development Zone.<br />

The UDZ Tax Incentive is a tax rebate<br />

that reduces the taxable income of the<br />

taxpayer.<br />

It is an accelerated depreciation<br />

allowance applicable to investors who<br />

erect new buildings or refurbish existing<br />

buildings within the demarcated Urban<br />

Development Zone with the purposes of<br />

trade. The aim of the UDZ tax incentive<br />

is to revitalize these urban areas and<br />

business districts, thereby stimulating<br />

economic development. In 2005 the UDZ<br />

legislation was amended to extend the<br />

allowance to sectional title owners and<br />

investors that purchase buildings from<br />

developers.<br />

The City and Suburban area that the<br />

<strong>Maboneng</strong> <strong>Precinct</strong> falls in is within the<br />

designated UDZ zone and therefore the<br />

incentive applies to all of the <strong>Maboneng</strong><br />

developments but is only applicable<br />

on property bought directly from the<br />

developer.<br />

The tax incentive reduces the taxable<br />

Revolution House - selling price per unit<br />

Average growth - 60%<br />

Average annual growth 20%<br />

During the worst property market performance in SA history.<br />

income of a taxpayer. The incentive is<br />

not limited to the current year’s taxable<br />

income of the taxpayer and can be<br />

carried forward as an accumulated tax<br />

loss for use to shield taxable income in<br />

future years.<br />

Revolution House - 2010<br />

Revolution House - 2011<br />

Revolution House - Interior<br />

Fox Street Studios - 2012<br />

Fox Street Studios - <strong>2013</strong><br />

Fox Street Studios - Interior<br />

<strong>2013</strong>